On the Determination of Capital Charges in a Discounted Cash Flow - PowerPoint PPT Presentation

On the Determination of Capital Charges in a Discounted Cash Flow Model Eric R. Ulm Georgia State University Motivation Solvency II Required Assets determined on a consolidated basis Assets allocated to the lines of business on a

On the Determination of Capital Charges in a Discounted Cash Flow Model Eric R. Ulm Georgia State University

Motivation • Solvency II – Required Assets determined on a consolidated basis – Assets allocated to the lines of business on a marginal basis – Division into “Reserves” and “Capital” is line by line – Do Capital Charges on capital and change in reserves cancel for performance analysis of line managers?

Motivation • Multiple Candidates for Reserves: – U.S. Statutory Reserves; – U.S. GAAP Reserves; – U.S. Tax Reserves; – Fair Value of Liabilities; – Assets at a somewhat conservative solvency standard (Solvency II uses 75%); – Expected Loss under the realistic measure discounted at the risk-free rate.

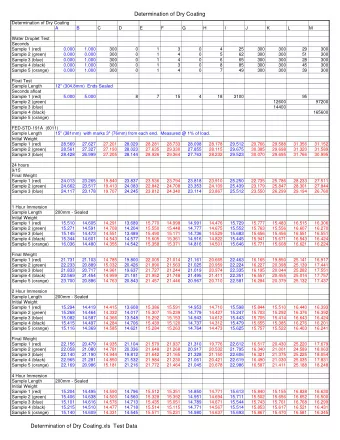

Performance Evaluation 200,000 Income less Capital 150,000 Tax Reserves Charges 100,000 Evaluation Reserves 50,000 0 0 20 40 60 80 (50,000) Year

Discounted Cash Flow Model • Myers and Cohn (1987) • Cummins (1990) • Taylor (1994) – Assumes reserves are “technical reserves”, i.e. discounted value of expected losses – Free parameter is “capital”, i.e. assets = capital + technical reserves. • Overview in Cummins and Phillips (2000)

Examples Single Premium / Single Loss CF CF CF CF CF 0 1 1 i T T 0 1 i T-1 T CF P A 0 0 , T ( ) ( 1 ) CF A A P A r V 1 0 , 1 , 0 , 1 , T T T f T ( ) ( ) ( 1 ) CF A A A r V V 1 , , 1 , , 1 , i i T i T i T f i T i T ( ) ( 1 ) ( 1 ) CF A L A r V 1 , 1 , 1 , T T T T T T f T T

Examples Single Premium / Single Loss ( ) A y r T 1 T 1 E L y , i T f ( ) T P V , i T 1 T i i ( 1 )( 1 ) ( 1 )( 1 ) ( 1 )( 1 ) y x y x y x 0 1 i i x y 1 – Equivalently ( ) ( ) 1 A y r 1 T T V y E L , i T f , i T T P T i i ( 1 ) ( 1 )( 1 ) ( 1 )( 1 ) r y x y x 0 1 i i f [ ] E L [ ] E L ( ) ( ) T V V T A A , , i T i T T i i , T i , T ( 1 ) r T i ( 1 ) r f f

Examples Single Premium / Single Loss ( ) • Evaluation Reserves and capital e V ( ) e A V , i T , , i T i T ( e ) ( ) ( e ) [ ]( 1 ) ( 1 ) ( ) 0 E L A r V V A V x 1 , 1 , 1 , 1 , 1 , T t t f t t t t t t t t ( ) ( ) ( ) ( ) ( ) e e e ( 1 ) ( ) 0 A r V V V V A V x i , T f i , T i 1 , T i , T i 1 , T i , T i , T • solves for (by induction) ( ) [ ( 1 )] A x r ( [ ] ) E L V [ ] E L T 1 , T f 1 , ( ) T T T e T V 1 , T T ( 1 ) 1 1 x x x ( ) ( ) [ ( 1 )] ( ) 1 A x r 1 V V [ ] T T E L , 1 , , j T f j T j T ( ) e T V , i T T i j i 1 j i 1 ( 1 ) ( 1 ) ( 1 ) x x x j i j i ( ) V e P 0 , T

Examples Single Premium / Single Loss • More intuitively ... ( ) ( ) [ ( 1 )] ( ) 1 A x r 1 V V [ ] T T E L , 1 , , j T f j T j T ( ) e T V , i T 1 1 T i j i j i ( 1 ) ( 1 ) ( 1 ) r x x j i j i f

Examples Multiple Premium / Multiple Loss • Nonstochastic P and A (i.e. losses are uncorrelated and premiums paid with certainty ... ( ) 1 1 A y r 1 T T T T P E L y i f ( ) i i V i i i 1 i i ( 1 ) ( 1 )( 1 ) ( 1 )( 1 ) ( 1 )( 1 ) x y x y x y x i 0 i 1 i 0 i 1 • Otherwise replace with in the [ ] E A A i i premium equations, and with in A [ | ] E A j j i the reserve equation. Make similar P substitutions for i

Examples Multiple Premium / Multiple Loss • More intuitively ... ( ) ( ) 1 1 A y r 1 T T T T P E L V y i f i i i i i i i ( 1 ) ( 1 ) ( 1 )( 1 ) ( 1 )( 1 ) r r y x y x 0 1 0 1 i i i i f f • Defining [ ] T E L T 1 P j j A A i i j i j i ( 1 ) ( 1 ) r r 1 1 j i j i f f [ ] E L 1 P T T ( ) j j ( ) V V i i j i j i ( 1 ) ( 1 ) r r 1 j i j i f f • Practically, the and often depend on ( ) V A i i the premiums.

Examples Multiple Premium / Multiple Loss ( 1 ) [ ]( 1 ) ( 1 ) P E L A r 1 i i i f ( ) ( ) ( ) ( ) ( ) e e e ( ) 0 V V V V A V P x 1 1 i i i i i i i [ ] E L 1 P T T j j ( ) e V i j i j i ( 1 ) ( 1 ) x x 1 j i j i ( ) ( ) [ ( 1 )] [( [ ]) [ ] 1 A x r 1 V E L V P T T 1 1 j f j j j j 1 1 j i j i ( 1 ) ( 1 ) x x j i j i ( ) ( ) [ ( 1 )] ( ) 1 A x r 1 V V T T [ ] E L 1 P T T 1 j f j j j j ( ) e V 1 1 j i j i ( 1 ) ( 1 ) i x x j i j i ( 1 ) ( 1 ) r r j i j i 1 j i j i f f

Solvency II Context One Period • In one year assets are [ 1 ( 1 )] ( 1 ) A r L P 0 , 1 1 f and liabilities are 0. Solve Pr [ 1 ( 1 )] ( 1 ) 0 0 . 995 A r L P 0 , 1 1 f • to find 0 . 995 ( 1 ) P L A 1 0 , 1 [ 1 ( 1 )] r f 0 . 995 [ ] ( [ ]) E L E L R • Premium is with 1 1 L P 1 ( 1 ) r f ( 1 ) x r f R 1 x

Solvency II Context Multiple Period 0 . 995 ( ) ( 1 ) V • Last period is similar: 1 , L T T T A T 1 , T [ 1 ( 1 )] r f • Other periods require the determination of [ ] [ ] MV L MV L 0 [ ] T i i T ~ • Key insight: , the premium which would be P , i T charged at time i to cover the loss at time t, must be and this premium can be [ ] MV i L T found from the previous analysis. • Find the market values recursively.

Solvency II Context Multiple Period ( ) [ ] [ ] 1 MV L MV L V x y 1 1 1 , j T j T j t 1 r [ ] MV L r j t ( 1 )( 1 ) 1 x x ( 1 ) ( 1 ) r r f f 0 . 995 ( ) [ ] ( [ ]) E L E L R 1 V T T L T 1 , T i T 1 T [ ] 1 ( 1 ) P MV L t r r r 0 T T i ( 1 ) ( 1 ) r r 1 i f f • Assets from 0 . 995 [ ] ( [ ]) E L E L R T L T 2 T i ( ) ( ) Pr [ 1 ( 1 )] ( ) 1 t A r V V r , 1 , , i T f i T i T 1 T i ( 1 ) r f ( ) 1 V T j , t 2 j i ( 1 ) 0 0 . 995 r r 1 j i ( 1 ) r 2 j i f

Solvency II Context Multiple Period • Assets 0 . 995 [ ] ( [ ]) E L E L R T L T t 1 T i ( ) ( ) ( 1 ) r ( ) V V f T i 2 1 , , i T i T 1 A r i , t [ 1 ( 1 )] [ 1 ( 1 )] r r f f ( ) 1 V T , j T 2 j i ( 1 ) r r 1 j i ( 1 ) r 2 j i f [ 1 ( 1 )] r f

Solvency II Context Multiple Period • Evaluation Reserves r [ ] E L f ( ) e T 1 ( 1 ) V r R r R s i , T T i 2 2 | T i r ( 1 ) [ 1 ( 1 )]( 1 ) 1 x x r r ann f f 0 . 995 ( [ ]) E L R L T 1 t R s 2 T i 2 | T i r ( 1 ) [ 1 ( 1 )]( 1 ) 1 x r r x ann f f ( ) ( ) ( ) V R s ( ) 1 V V 1 T T , j T 1 | 1 , , j i r i T i T r ann 1 j i j i [ 1 ( 1 )]( 1 ) ( 1 ) [ 1 ( 1 )]( 1 ) r x x r r 2 j i j i f f ( 1 )( 1 ) r x 1 y 1 1 r ann ( 1 ) 1 r r f f

Examples Two Period Loss 0 . 995 500 [ ] 400 E L L 1 1 0 . 995 [ ] 500 E L 700 2 L 2 10 % 6 % x r f • Tax Reserves are Eq. Principle reserves at 7%. • Guess P P 0 1 0 . 995 ( ) ( ) ( 1 ) V V P MVL • Assets are 1 1 L i i i i 1 A i i 1 ( 1 ) r f

Examples Two Period Loss • Market Value of Liabilities are ( ) E L 1 A y r T T j j f MVL i 1 j i j i ( 1 )( 1 ) ( 1 )( 1 ) y x y x j i 1 j i 1 1 P T T y j ( ) V j j i j i ( 1 )( 1 ) ( 1 ) y x x 1 j i j i 0 • MVL sets 430.910689 5 0

Examples Two Period Loss Balance Sheet Items for Two Premium Two Loss Example ( ) ( ) ( e ) V A MVL V A V i i Time i i i Capital i i 0 0.00 0.00 491.69 75.85 0.00 60.78 0.00 1 48.31 7.52 601.13 129.43 50.22 120.00 51.07 Income Statement Items for Two Premium Two Loss Example Cash Flow Change in Cash Capital i ( e ) CF Income V Charges i i 0 (60.78) 1 (53.15) 56.30 (50.22) (6.08) 2 132.00 (38.22) 50.22 (12.00)

Examples Two Year Term Life • $100,000 face, 1000 identical individuals 0 . 020 0 . 025 q q 1 x x [ 1 ] 980 1000 E P P 0 0 . 995 ( 1 ) N | 1 L N ( ) 2 1 A N 1 1 [ 1 ( 1 )] r f • is binomial with probability 0.025 2 | N L 1 • is binomial with probability 0.02 N 1 [ ] 2 , 412 , 312 . 05 320 . 5078876 E A 1

Examples Two Year Term Life [ 1 ( 1 )] 1000 100 , 000 * ( 1000 )( 1 ) MVA A r N 1 0 1 f [ ]( ) A N y r [ | ] E L N 1 1 f 2 1 MVL N 1 1 ( 1 ) ( 1 ) y y • 99.5% solvency at N 1 = 968 4 , 237 , 501 . 48 579 . 87683598 A 0 • Determine 2 , 185 . 20 ( ) e [ ] 161 , 338 . 82 E V 1

Recommend

More recommend

Explore More Topics

Stay informed with curated content and fresh updates.