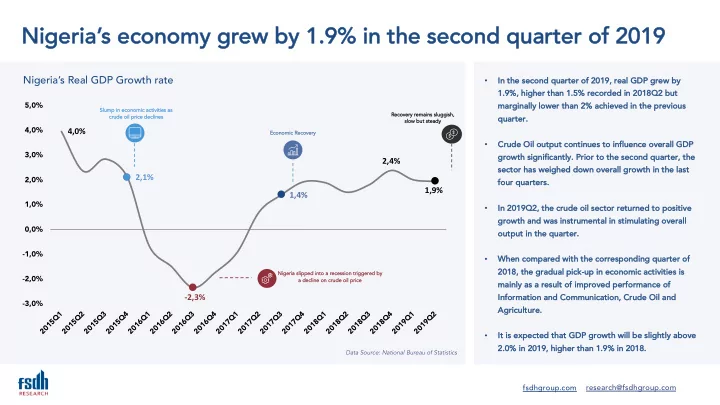

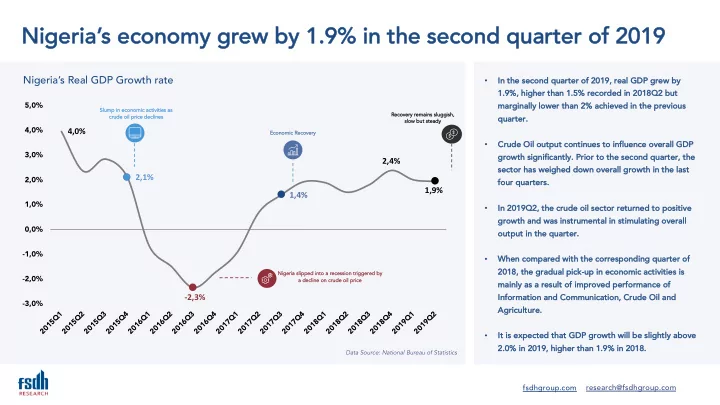

Nigeria’s economy y grew by y 1.9% in the second quarter of 2019 Nigeria’s Real GDP Growth rate In the second quarter of 2019, real GDP grew by y • 1. 1.9% 9%, hi higher her tha han n 1. 1.5% 5% rec ecorded ed in n 2018Q 2018Q2 2 but ut 5,0% marginally y lower than 2% achieve ved in the previ vious Sl Slum ump in n ec econo nomic activities es as Re Recov overy remains sluggi ggish, crude oil price cr ce decl clines quarter. qu slow but st sl steady 4,0% 4,0% Ec Econ onom omic Re Recov overy Crude Oil output continues to influence ove verall GDP • 3,0% growth significantly. y. Prior to the second quarter, the 2,4% sector has weighed down ove verall growth in the last 2,1% 2,0% four quarters. fou 1,9% 1,4% 1,0% In 2019Q2, the crude oil sector returned to positive ve • growth and was instrumental in stimulating ove verall 0,0% ou output in the quarter. -1,0% Wh When compar ared with the corresponding quar arter of • 2018, 2018, the he gradua ual pick-up in economic activi vities is Ni Nigeri ria s slipped i into to a a re recession tri triggere red b by -2,0% a a decline on crude oil price mainly y as a result of improve ved performance of -2,3% In Information a and C Communication, C , Crude O Oil a and -3,0% Ag Agricul ultur ure. e. 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 Q Q Q Q Q Q Q Q Q Q Q Q Q Q Q Q Q Q 5 5 5 5 6 6 6 6 7 7 7 7 8 8 8 8 9 9 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 2 2 2 2 2 2 2 2 2 2 2 2 2 2 2 2 2 2 It is expected that GDP growth will be slightly y above ve • 2. 2.0% 0% in n 2019, 2019, hi higher her tha han n 1. 1.9% 9% in n 2018. 2018. Data Source: National Bureau of Statistics fsdhgroup.com research@fsdhgroup.com

Oil GDP move vement explains Nigeria’s economic vu vulnerability Nigeria’s Oil and Non-Oil GDP Growth rate 1. 1. In the second quarter of 2019, oil GDP returned to a positive ve growt gr wth of 5.2% for the first time since the first qu quarter of 2018. 30,0% This is largely y as a result of increased crude oil output which 25,0% ave veraged 1.98 million barrels per day y in the quarter. 20,0% 15,0% 2. 2. In In a addition t to o oil o output, t , the b base e effect w was r responsible f for 10,0% this increase, especially y give ven that oil GDP had the largest 5,0% decline of -4% de 4% in n 2018Q 2018Q2. 2. 0,0% -5,0% 3. 3. The decline in Oil GDP was instrumental in pulling the economy y into a recession in 2016. Howeve ver, its return to positive ve growth -10,0% presents a glimmer of hope and strengthens ove verall growth -15,0% Oil GDP growth has remained in the prospects of the economy. y. -20,0% negative since 2018 Q2, but returned to positive growth in 2019Q2. -25,0% 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 4. 4. Non-oi No oil GDP has remained resilient but has experienced weak Q Q Q Q Q Q Q Q Q Q Q Q Q Q Q Q Q Q 5 5 5 5 6 6 6 6 7 7 7 7 8 8 8 8 9 9 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 growth. It grew by y 1.6% in the second quarter of 2019. This is 2 2 2 2 2 2 2 2 2 2 2 2 2 2 2 2 2 2 th the lowest t gro rowth th re record rded since 2018Q2. Oil GDP Non-Oil GDP Data Source: National Bureau of Statistics fsdhgroup.com research@fsdhgroup.com

Which sectors will drive ve growth in coming quarters? Sectoral GDP Growth in 2019Q2 Contribution to GDP - 2019Q2 Water Supply, Sewage, Waste Mgmt 14,4% Information & Communication 23% 9,0% Transportation & Storage 8,0% Mining & Quarrying 5,0% Agriculture Accommodation & Food Services 2,9% Industries Other Services 2,5% 54% Administrative & Support Services 2,0% Services Overall Growth 1,9% 23% Agriculture 1,8% Profession, Sci. & Technical Services 1,2% Human Health & Social Services 1,1% Education 1,0% Arts, Entertainment & Recreation 0,8% Servi vices remained the drive ver of GDP growth in 2018 and 2019Q2, led by y • Construction 0,7% Transportation & Storage and Information & Communication, although Water Tr Electricity, Gas, Steam, & AC Supply 0,4% Supply/ y/Waste Management had the highest growth of 14.4% in 2019Q2. Manufacturing -0,1% In 2019Q2, of the 19 major sectors, 5 recorded negative ve growth, down from 6 • Trade -0,2% sectors in the previ vious quarter. Manufacturing recorded a negative ve growth for the Finance & Insurance -2,2% fi first time since the third quarter of f 2017. Public Administration -3,4% Ag Agriculture and construction recorded modest growth in 2019Q2. • Trade is expected to bounce back to the positive ve region in 2019. Real Estate • -3,8% Recent data show slow economic recove very y amidst positive ve expectations. • Data Source: National Bureau of Statistics fsdhgroup.com research@fsdhgroup.com

The economy y is expanding- slowly y but steadily Gr Growth w will c continue t to b be driven by dr by the Services sector- Ni Nigeri ria’ a’s GD GDP Pr Prices es are e ex expec ected ed to Te Telecoms s and Tr Transp sport wi will gr grow owth is expe pected d pl play a major role in dr driving g remain stable in the re gr growth. Similarly, Oil GDP will to to b be s slightl tly a above remaining part of the re be be instrumental in shapi ping g 2% 2% in n 2019, 2019, lower er ov overa rall GDP DP perf rform ormance in ye year owing to exch xchange 2019. Agricul 2019. ultur ure e will rem emain n than th th the E ERGP GP ta target t ra rate te s sta tability ty a and s sta table resilient, re t, how owever, r, poor oor weath ther r of of 4.5%. co conditions and lower ag agricultural al o output. . pr produ ductivity are major ch challenges that co could limit gr growth. FPI are FPI e set et to be e Government policies, Go hi higher her tha han n the he re reforms and expenditure re Ba Banking, Manufacturing, Ex Exchange ge Ra Rate is pl plans will have sign gnificant US$12.2 billio US illion Mining and Quarrying, Mi expec ex ected ed to rem emain n po positive impa pact on the re record rded in 2018. an and t the T Technology st stable largely due to econo ec nomy. Howev ever er, we e Mo Money market se sectors s are expected to st stable oil prices s and may continue to ma instruments will in will ac account fo for t the l lar argest exper ex erienc ence e reg egul ulatory foreign i fo investm tment t co continue to acco ccount share of FDI inflows sh s in “tightness” “t ” from fiscal al an and in inflo lows ws. fo for an r an i increas asing 2019. 2019. monetary authorities, mo sh share of inflows. s. wh which may limit growt wth. fsdhgroup.com research@fsdhgroup.com

Recommend

More recommend