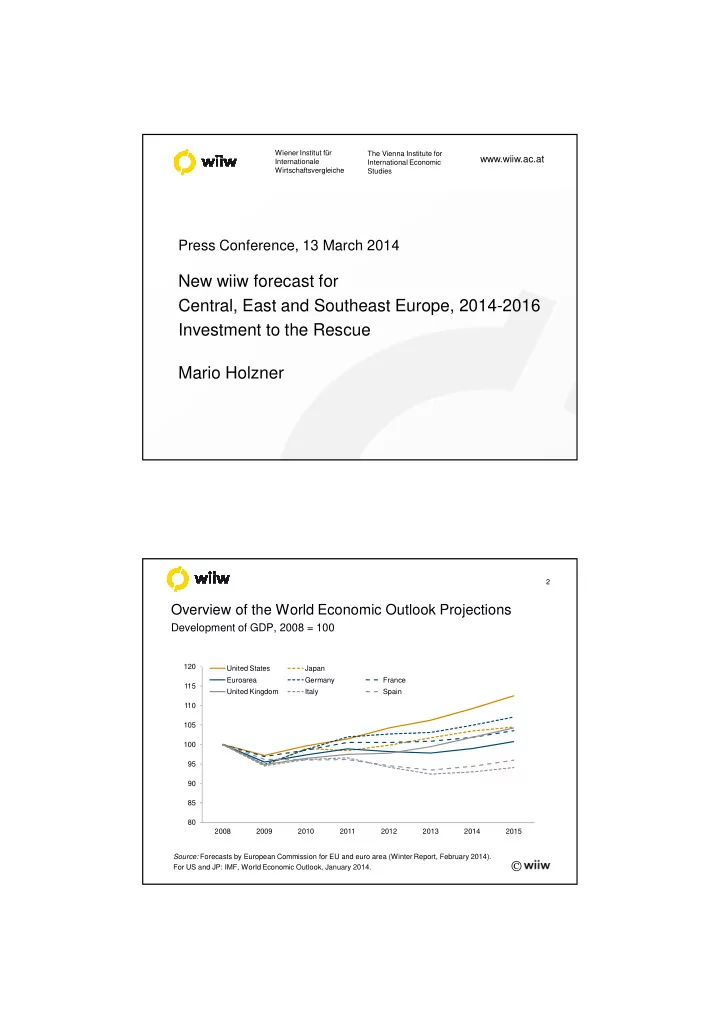

Wiener Institut für The Vienna Institute for www.wiiw.ac.at Internationale International Economic Wirtschaftsvergleiche Studies Press Conference, 13 March 2014 New wiiw forecast for Central, East and Southeast Europe, 2014-2016 Investment to the Rescue Mario Holzner 2 Overview of the World Economic Outlook Projections Development of GDP, 2008 = 100 120 United States Japan Euroarea Germany France 115 United Kingdom Italy Spain 110 105 100 95 90 85 80 2008 2009 2010 2011 2012 2013 2014 2015 Source: Forecasts by European Commission for EU and euro area (Winter Report, February 2014). For US and JP: IMF, World Economic Outlook, January 2014.

3 Development of quarterly GDP real change in % against preceding year 14 RO KZ 12 UA LT 10 LV TR 8 AL HU PL 6 RS MK 4 SI ME 2 SK RU 0 BA BG -2 CZ EE HR -4 test -6 1q 2q 3q 4q 1q 2q 3q 4q 1q 2q 3q 4q 4q 2011 2011 2011 2011 2012 2012 2012 2012 2013 2013 2013 2013 2013 ranking Remark: Highlighted lines represent top 3 and bottom 3 countries referring to growth of 4th quarter 2013. Source: National and Eurostat statistics. 4 Consumer prices change in % against preceding year 14 12 Serbia 10 Turkey 8 Russia 6 Kazakhstan 4 Range for other CESEE 2 Average 0 -2 Jan-13 Feb-13 Mar-13 Apr-13 May-13 Jun-13 Jul-13 Aug-13 Sep-13 Oct-13 Nov-13 Dec-13 Source: wiiw Monthly Database incorporating national and Eurostat statistics.

5 Imports of goods change in % against preceding year, 2H2013 vs. 2H2012, current EUR 8 6 4 2 0 -2 -4 -6 -8 -10 -12 UA RU AL LV BA HR TR MK ME EE KZ CZ HU SI PL SK BG RO LT RS Source: wiiw Monthly Database incorporating national and Eurostat statistics. 6 Current account (net), in % of GDP 2011 2012 2013 10 5 0 -5 -10 BG HR CZ EE HU LV LT PL RO SK SI 2011 2012 2013 10 5 0 -5 -10 -15 -20 AL BA XK MK ME RS TR KZ RU UA Remark: HR, CZ, HU, SK, AL, BA, XK, MK, ME, RS: 2013 data for 3 quarters. BA, KZ and RU: already reporting according to IMF BOP Manual 6th edition. Source: wiiw Databases incorporating national statistics and Eurostat.

7 General government social expenditure vs. capital investment austerity Social exp. austerity, ∆ in pp. of GDP, 2012 vs. 2007 2 HU 0 RS PL HR LT -2 LV AL CZ SK BG EE RO SI -4 -6 0 1 2 3 Capital investment austerity, ∆ in pp. of GDP, 2012 vs. 2007 Note: Positive values of expenditures, expressed in actual 2012 GDP percentage point differences between counterfactual ‘potential’ and actual shares, hint at fiscal austerity and reduced national income. Diamonds represent countries with fixed exchange rate regimes as opposed to flexible ones. Source: wiiw Annual database incorporating national and Eurostat statistics, own calculation. 8 Public and private GFCF growth in 15 CESEE countries, (2000-2008) 40 Private sector GFCF real change in % 20 0 -20 private = 9.4 - 0.0 * public + u R² = 0% -40 -50 0 50 100 150 Public sector GFCF real change in % Source: National and Eurostat statistics, own calculations.

9 Public and private GFCF growth in 15 CESEE countries, (2009-2012) 50 Private sector GFCF real change in % private = - 3.2 + 0.6 * public + u R² = 26% 0 -50 -60 -40 -20 0 20 40 Public sector GFCF real change in % Source: National and Eurostat statistics, own calculation. 10 (Public) Investment leads the way out of the slump � Motorways, thermal and nuclear power plant projects in the pipeline � Intensive use of the remaining disbursement period 2014-2015 of the EU MFF 2007-2013 & national co-financing � More public capital investment has the potential to spur subsequent private investment � Improving growth prospects in the euro area are likely to encourage CESEE export industries’ investment activity

11 CESEE gross industrial production and industrial confidence indicator production change in % against preceding year / industrial confidence in pp. 15 5 10 0 5 -5 0 -10 -5 -15 -10 -20 -15 -25 -20 industrial production (lhs) -30 -25 industrial confidence indicator (rhs) -30 -35 Jan-08 Jan-09 Jan-10 Jan-11 Jan-12 Jan-13 Jan-14 Remark: Average over available countries. Source: wiiw Monthly Database incorporating national and Eurostat statistics for industrial production. Eurostat and national statistics for industrial confidence. 12 GDP growth in 2013 & 2014 in % and contribution of individual demand components in percentage points, flat household consumption countries GFCF investment Household final consumption Net exports GDP (growth in %) 10 8 6 4 2 0 -2 -4 Serbia Bulgaria Hungary Czech Albania Bosnia Montenegro Romania Poland Slovakia Republic & Herzegovina Remark: Ordered by 2014 growth rates. Source: For 2013 wiiw and national statistics as of March 2014. Forecast 2014 by wiiw.

13 GDP growth in 2013 & 2014 in % and contribution of individual demand components in percentage points, dynamic household consumption countries 10 GFCF investment Household final consumption Net exports GDP (growth in %) 8 6 4 2 0 -2 -4 Ukraine Slovenia Croatia Russia Turkey Macedonia Estonia Lithuania Latvia Kazakhstan Remark: Ordered by 2014 growth rates. Source: For 2013 wiiw and national statistics as of March 2014. Forecast 2014 by wiiw. 14 Non-performing loans in % of total loans (Sept. 2013) and stock of loans to the non-financial sector change in % against preceding year (avg. Dec. 2012 – Nov. 2013) 40 40 NPL - Non-financial corporations NPL - Households Bank loans - Non-financial corporations (RHS) Bank loans - Households (RHS) 35 30 30 20 25 20 10 15 0 10 -10 5 0 -20 UA SI HR KZ HU* BG MK LT CZ LV SK PL RU TR EE *Non-performing loans data for Hungary are for June 2013. Source: National Bank and Eurostat statistics, wiiw own calculations.

15 Indices of foreign bank claims of Western European banks to CEE on ultimate risk basis, January 2008 = 100 110 Czech Republic Poland Slovakia Slovenia Hungary 100 90 80 70 60 50 Jun-08 Dec-08 Jun-09 Dec-09 Jun-10 Dec-10 Jun-11 Dec-11 Jun-12 Dec-12 Jun-13 Dec-13 Source: BIS. 16 Youth unemployment rate for age group 25-29, %, avg. 1-3q 2013 Source: wiiw calculation incorporating national and Eurostat statistics.

17 Summary � Upward reversal of public investment has potential to spur private � Motorways, thermal and nuclear power plant projects in the pipeline � Intensive use of remaining disbursement period 2014-2015 of EU MFF � euro area growth likely to encourage export industries’ investments � CESEE GDP to pick up speed and grow on average 2-3% 2014-2016 18 GDP growth, current wiiw forecast for 2014-2016 2014 2015 2016 2014 2015 2016 Kazakhstan 6.0 6.5 5.5 Bosnia and Herzegovina 1.9 3.0 3.0 Kosovo 5.0 4.0 4.0 Albania 1.7 1.5 1.0 Latvia 4.2 4.1 3.9 Russia 1.6 2.3 3.0 Lithuania 3.6 3.8 4.0 Bulgaria 1.5 2.3 2.7 Macedonia 3.0 3.0 3.0 Czech Republic 1.4 2.4 3.0 Estonia 2.6 3.0 3.2 Hungary 1.4 2.1 2.0 Poland 2.4 3.2 3.1 Croatia 0.0 1.0 1.5 Romania 2.4 2.7 3.0 Slovenia -0.5 0.5 1.4 Slovakia 2.4 3.0 3.2 Serbia -0.5 1.0 1.9 Turkey 2.2 3.5 4.5 Ukraine -1.1 0.9 1.8 Montenegro 2.1 2.9 3.0 Source: wiiw forecast, March 2014.

19 Exchange rate development RUB/USD, UAH/USD 31.5 7.5 8.0 32.5 8.5 33.5 9.0 34.5 Euromaidan start, 21.11.2013 9.5 Argentine peso 35.5 crisis, 22.01.2014 10.0 RUB/USD (lhs) Hryvnia peg 36.5 abandoning, UAH/USD (rhs) Russian 10.5 07.02.2014 aggression Crimea, 27.02.2014 Source : National central banks. 20 Ukraine: budget austerity on the agenda � Large external financing needs (approx. USD 35 bn, 2014-2015) � Russian credits agreed in Dec 2013 (USD 15 bn) have stalled � EU (USD 15 bn), USA (USD 1 bn), WB (USD 3 bn) promises � Ongoing negotiations over an IMF ‘rescue package’ � But: IMF requires budget consolidation � Public expenditures to be cut by up to 17% in 2014 � Energy tariff hikes for households � Pensions of working pensioners to be cut by 50% � Likely consequences: economic recession and rising social tensions

21 Possible Crimea crisis effects � Annexation without shooting: most likely scenario, limited UA/RU trade disruptions, little effects on CESEE, except maybe on ‘south stream’ countries (BG, RS, HU) � Annexation with shooting: less likely scenario, major UA/RU trade disruptions, substantial effects on CESEE in terms of energy supply, trade, investment, interest rates � Super autonomy: less likely scenario, hardly any effects � Extensive EU trade and finance sanctions against Russia unlikely � Long-term effects: further energy diversification in CESEE, further EU integration boost (e.g. PL & euro) Wiener Institut für The Vienna Institute for www.wiiw.ac.at Internationale International Economic Wirtschaftsvergleiche Studies Press Conference, 13 March 2014 New wiiw forecast for Central, East and Southeast Europe, 2014-2016 Investment to the Rescue Mario Holzner

Recommend

More recommend