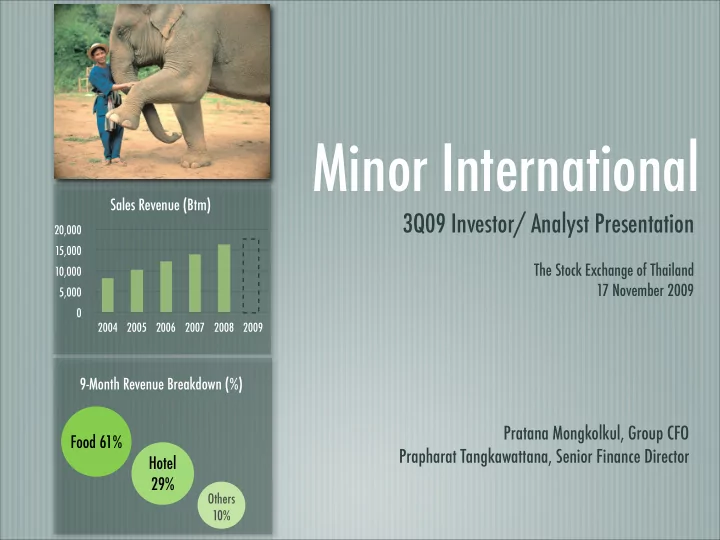

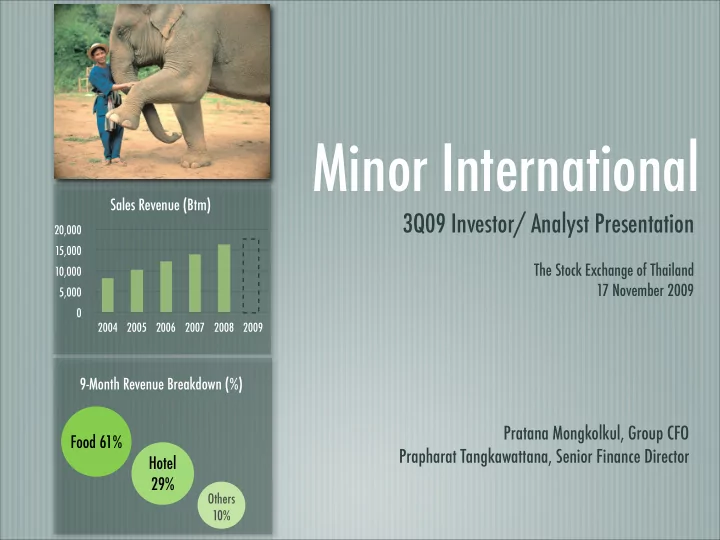

Minor International Sales Revenue (Btm) 3Q09 Investor/ Analyst Presentation 20,000 15,000 The Stock Exchange of Thailand 10,000 17 November 2009 5,000 0 2004 2005 2006 2007 2008 2009 9-Month Revenue Breakdown (%) Pratana Mongkolkul, Group CFO Food 61% Prapharat Tangkawattana, Senior Finance Director Hotel 29% Others 10%

Today’s Agenda I. Recent Developments II. Financial Results III. MINT’s Strategic Growth IV. Pipeline Expansion & Financial Outlook

I. Recent Developments

Key Business Developments in 3Q09 ‣ Successful placement of Bt 2,000m debentures in July; 4-year term with coupon rate of 4.65%. It is MINT’s first debenture issued to retail investors ‣ MINT’s total food outlets reached 1,097 with current international coverage in 14 countries ‣ Opened purely-managed hotels, Anantara Qasr Al Sarab - Abu Dhabi and Anantara Lawana - Koh Samui , in late October 2009. MINT currently operates 30 hotels in 8 countries ‣ Completed an extension of 12 pool villas at Four Seasons Hotel in Chiang Mai & opened 2 new spa under management contracts in Turkey and China ‣ Signed an agreement with GAP Inc. as the exclusive distributor in Thailand. First stores in Bangkok to be opened in 1Q10 4

MINT’s Revenue Breakdown by Business 3rd Quarter 2009: Bt 4,152 m 9 Months 2009: Bt 12,184 m Plaza & Entertain 3% Hotel & Spa Hotel & Spa 24% 29% Plaza & Entertain Retail Trading 3% 14% Retail Trading 6% Food Food Share of Profit Share of Profit 1% 57% 61% 1% ‣ Strategically, MINT’s revenue structure is balanced with 50% from food and 40% from hotel, while the remaining comes from other complimentary businesses 5

Food Business in This Quarter ‣ Facing challenges from the outbreak of H1N1 flu since July ‣ Cautious consumer spending driving marketing strategies; variety and value promotion ‣ Strengthening profitability from successful implementation of Supply Chain Management Business ‣ SSS growth declined in-line with GDP and Consumer Confidence, however, TSS grew due to shop expansion ‣ Strong improvement in Thai franchised outlets due to expansion in under- penetrated markets especially in upcountry ‣ Business synergy with local bank to strengthen domestic franchising business 6

Improvement of Consumer Confidence ‣ We have seen the gradual improvement in consumer sentiment in the past few months which we believe has driven private consumption and manufacturing orders and we expected that this will strengthen our domestic QSR business Pressure from Global Economic 85 Downturn and Intensified Political Tension 80 75 70 Jan 08 Mar 08 May 08 Jul 08 Sep 08 Nov 08 Jan 09 Mar 09 May 09 Jul 09 Sep 09 7

Thailand’s Modern Trade Growth in Late 2009 Expected Growth of Hypermarkets Economic slowdown forced a slower ‣ growth in hypermarkets in Thailand in Existing Store New Store the first half of 2009 +5 90 Pent-up demand expected to accelerate ‣ +3 domestic hypermarkets in the latter of 60 the year +7 Industry experts indicated 5% growth ‣ 30 on average in 2010. This will be one of key drivers for the new openings 0 especially for those under-penetrated Tesco Lotus Big C Carrefour markets Source: Public News Based on Management Interview 8

Promising Growth of Delivery Business & Upcountry Franchising Capturing Under-penetrated Market Number of Franchised Outlets 3Q08 3Q09 ‣ Delivery dockets for local TPC franchised 222 stores grew 5% y-y, especially in under- penetrated markets ‣ Local SW franchised outlets reported the 111 docket growth of 21% y-y, thanks to value promotions ‣ Newly opened stores of TCC achieved 0 higher sales/ store compared to the TPC SW TCC existing ones 9

Food Business: Key Performance - 3Q09 SSS (%) TSS (%) Brand 3Q09 3Q08 3Q09 3Q08 The Pizza Company -8.9 5.1 0.5 15.9 Swensen’s 3.4 3.6 8.8 18.9 Sizzler -3.3 15.3 10.9 14.6 Dairy Queen -9.7 13.0 -6.3 25.3 Burger King -7.0 -0.8 4.1 19.4 The Coffee Club 0.2 1.2 19.6 15.2 Thai Express -17.7 3.6 33.0 71.7 Average -4.2 4.2 9.9 19.5 10

Food Business: Key Performance -- 9M09 SSS (%) TSS (%) Brand 9M09 9M08 9M09 9M08 The Pizza Company -4.6 2.1 7.0 10.4 Swensen’s -1.5 0.9 8.1 12.8 Sizzler -0.3 18.9 11.3 17.4 Dairy Queen 0.1 5.7 3.8 15.8 Burger King -9.1 0.9 5.9 16.9 The Coffee Club 1.6 2.7 18.3 19.1 Thai Express -14.9 6.7 50.4 62.1 Average -2.5 4.1 12.9 17.7 11

Key Issues in Hospitality Business ‣ Despite H1N1 challenge at the beginning of 3Q, hotel business poor sentiment has shown the occupancy rate bottom-out in June ‣ Overall room rate remained an issue giving a modest rebound of tourist arrivals compared to strong growth last year ‣ International tourist arrivals to Thailand posted a significant y-y decline, however, a strong improvement is seen in the South beach provinces and oversea markets. September was the first month to report number of tourist arrivals climbing back at the same level of normal years. ‣ Continuous introduction of premium properties; Anantara Kihavah, Maldives and St. Regis Hotel & Residence, Bangkok 12

Thai Tourism Sentiments in Past 18 Months Foreign Tourists & Thai hotels Occupancy The industry was severely hit in late 2008 by political unrest Number of Tourist Occupancy (%) and further in 2009 due to the (Million Persons) slowdown of the global 68 5.00 economy and the H1N1 virus 55 53 53 50 outbreak 47 3.75 42 The government has launched 2.50 several tourism recovery programs including massive 1.25 budget and policy measures in order to restore business and 0 1Q08 2Q08 3Q08 4Q08 1Q09 2Q09 3Q09 consumer confidence Source: BOT 13

Regional Occupancy Rate % Change in Market (YTD Jul 2009) Occupancy % Change in ADR % Change in RevPar Occupancy Hong Kong - 5 Star (HKD) 56% (24%) (16%) (36%) Hong Kong - 4 Star (HKD) 74% (10%) (20%) (28%) Bangkok - 5 Star (THB) 47% (32%) (11%) (40%) Bangkok - 4 Star (THB) 51% (29%) (12%) (37%) Singapore - 5 Star (SGD) 65% (12%) (21%) (30%) Singapore - 4 Star (SGD) 72% (12%) (23%) (32%) Manila - City (PHP) 68% (10%) (2%) (12%) Phuket - City (THB) 59% (16%) (13%) (27%) Maldives - City (USD) 60% (21%) 8% (15%) Bali - City (USD) 70% (9%) 3% (6%) Jakarta - City (USD) 61% (11%) (7%) (17%) Hanoi - City (USD) 54% (16%) (17%) (31%) Ho Chi Minh - City (USD) 53% (27%) (10%) (35%) Source: The Brief (Oct 2009)STR Global 2009, Jones Lang LaSalle Hotels 14

Feeder Markets to Thailand vs. MINT’s Thailand MINT Hotels - 9M09 Thailand Oceania 12% EU 5% South Asia 28% Others Others 6% EU 3% 7% 38% Oceania 4% South East Asia The Americas 6% 6% South East Asia 28% East Asia East Asia The Americas 21% 22% 12% Change in % Share of Total Tourist Arrivals (y-y) Europe 2% East Asia (5%) The Americas - South East Asia 2% South Asia 1% Oceania and Others - Source: 9M09 Office of Tourism Development, MINT 15

MINT’s Hotel Occupancy Hit Bottom in Jun 09 (Million) First 8 months 2008 were outstanding 2.0 period for MINT’s hotel business 85% 81% 79% 75% Airport 1.5 72% 67% Closure 66% 66% April 63% H1N1 61% 60% 60% 60% Riot 56% 56% Outbreak 50% 49% 48% 48% 1.0 43% 43% 39% 0.5 0 8 8 8 8 8 8 8 8 8 8 8 8 9 9 9 9 9 9 9 9 9 9 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 - - - - - - - - - - - - - - - - - - - - - - r r n b r y n l g p t v c n b r y n l g p t u c u c a p e a p o a e a u u e a e a u u e O O J J M A D M A F S N F S J M J A J M J A No. of Foreign Visitors (Pending info of Oct-09) MINT’s Thai Hotels’ Average Occupancy (%) 16

MINT’s RevPar from Past to Present ‣ In our opinion, the excess supply was not a major concern compared to demand situation Airport ‣ MINT’s hotel RevPar is about to show a decline for the Sub-prime Closure Global Economic Crisis first time in 5 year mainly caused by global economic crisis BKK Bomb, London Political Turmoil Coup turmoil 4,156 Bomb H1N1 Outbreak 3,951 Tsunami, Bird Flu 3,339 c. 3,200 3,200 3,023 5-Yr CAGR 14% SARS 911 2,555 Financial 2,175 2,158 2,151 Crisis 1,997 1,806 1,740 1,401 (Baht/Night) 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009F 17

Hotel Supply Situation Upscale Hotel Rooms in Bangkok Upscale Hotel Rooms in Phuket 15,000 7,000 5,250 10,000 3,500 5,000 1,750 0 0 2008 2009E 2010F 2011F 2008 2009E 2010F 2011F Upscale Hotel Rooms in Maldives Upscale Hotel Rooms in Samui 2,000 24,000 1,500 18,000 1,000 12,000 500 6,000 0 0 2008 2009E 2010F 2011F 2008 2009E 2010F 2011F Source: HVS Asia Pacific Hotel Watch 2009, MINT Existing Supply Additional Supply 18

Hotel Business: Key Performance - 3Q09 Occupancy (%) ADR (Bt/night) RevPar (Bt/night) Hotel 3Q09 3Q08 3Q09 %Chg 3Q09 %Chg Four Seasons 45% 54% 7,157 -22% 3,215 -35% Anantara 47% 64% 6,247 -9% 2,915 -34% Marriott 60% 71% 2,948 -21% 1,761 -34% Others 28% 37% 7,139 15% 1,985 -14% Average-Thai 51% 66% 3,906 -19% 1,975 -38 Average 51% 64% 4,765 -13% 2,429 -31% 19

Recommend

More recommend