Midterm 1 Financial Econometrics University of Notre Dame Fall - PDF document

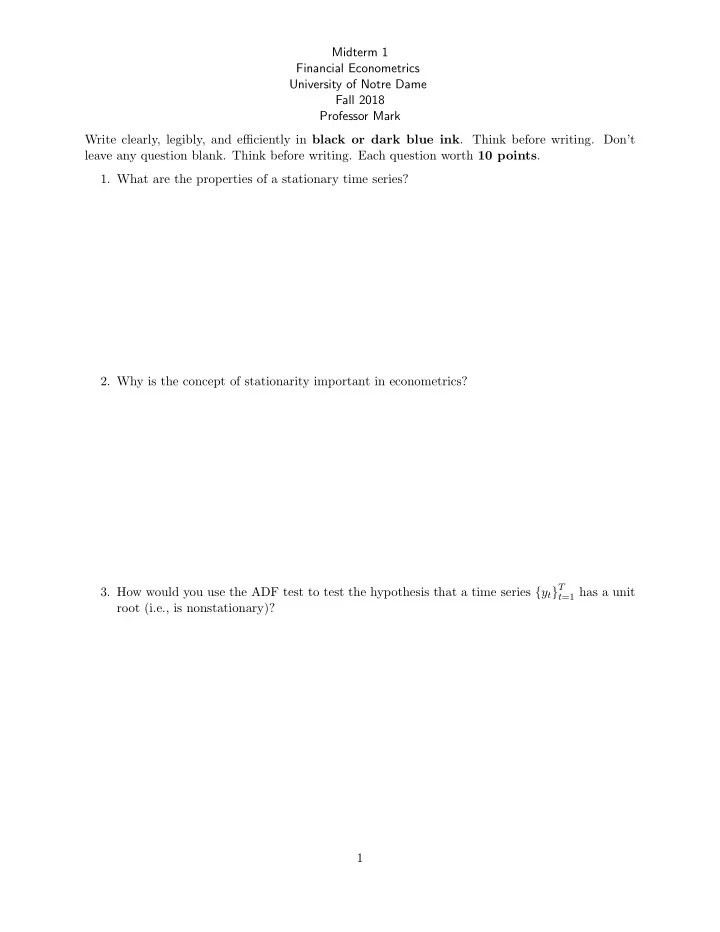

Midterm 1 Financial Econometrics University of Notre Dame Fall 2018 Professor Mark Write clearly, legibly, and efficiently in black or dark blue ink . Think before writing. Dont leave any question blank. Think before writing. Each question

Midterm 1 Financial Econometrics University of Notre Dame Fall 2018 Professor Mark Write clearly, legibly, and efficiently in black or dark blue ink . Think before writing. Don’t leave any question blank. Think before writing. Each question worth 10 points . 1. What are the properties of a stationary time series? 2. Why is the concept of stationarity important in econometrics? 3. How would you use the ADF test to test the hypothesis that a time series { y t } T t =1 has a unit root (i.e., is nonstationary)? 1

4. Let ǫ t be i.i.d. with mean 0 and variance σ 2 ǫ , and | ρ 1 + ρ 2 | < 1 in the AR(2) model, , y t = ρ 1 y t − 1 + ρ 2 y t − 2 + ǫ t (a) What is the optimal (best) forecast of y t +1 conditional on information known at t ? (b) What is the optimal (best) forecast of y t +2 conditional on information known at t ? (c) Assume y 0 = y − 1 = 0 . What is the impulse response for y 1 , y 2 , and y 3 for a one-time shock ǫ 1 = 1? 2

5. Suppose you are trying to choose between an AR(1) model and an MA(1) model. How can you use AIC, BIC, and HQIC to help? 6. Let x t = ρx t − 1 + u t iid � 0 , σ 2 � where u t ˜ , and 0 < ρ < 1 . Assume the truth is, u r t +1 = βx t + ǫ t +1 iid � 0 , σ 2 � where ǫ t ˜ , where r t is the one-period return on some asset. You ask if x t helps predict ǫ the 2-period return, r t +1 + r t +2 by running the regression r t +1 + r t +2 = γx t + v t +2 (a) Show that the population slope γ is bigger than the population slope β. 3

(b) Express the regression error v t +2 in terms of ǫ t +1 , ǫ t +2 and u t +1 , and show that v t +2 is correlated with v t +1 . 7. Let p t be the log dividend-adjusted price of a stock, where p t = p t − 1 + ǫ t iid � 0 , σ 2 � where ǫ t ˜ . What is the optimal (best) predictor of p t +20 , conditional on information ǫ available at t ? 4

Recommend

More recommend

Explore More Topics

Stay informed with curated content and fresh updates.