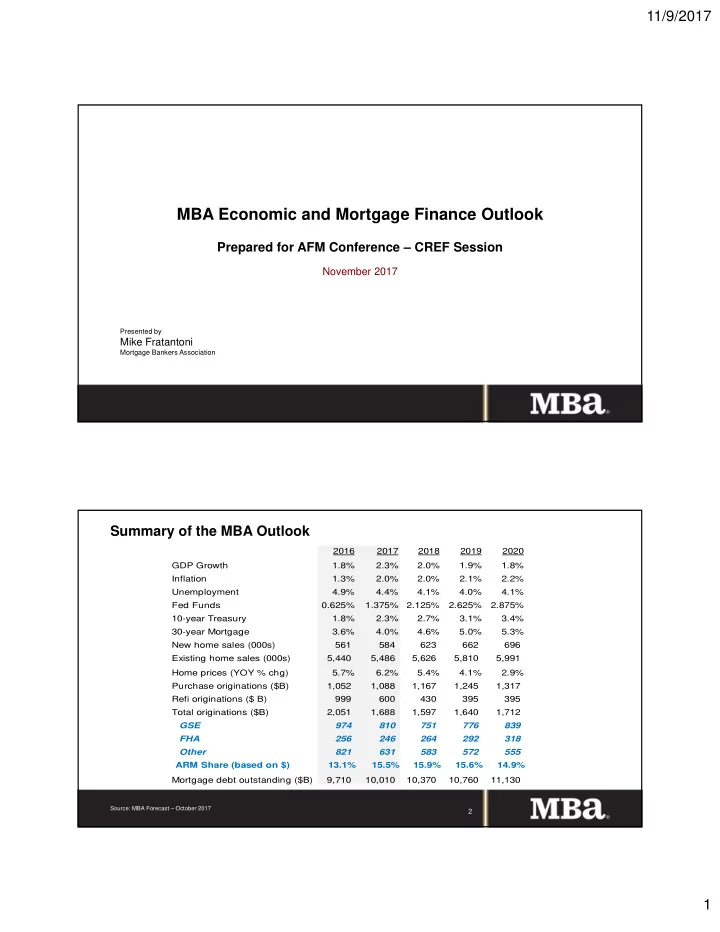

11/9/2017 MBA Economic and Mortgage Finance Outlook Prepared for AFM Conference – CREF Session November 2017 Presented by Mike Fratantoni Mortgage Bankers Association Summary of the MBA Outlook 2016 2017 2018 2019 2020 GDP Growth 1.8% 2.3% 2.0% 1.9% 1.8% Inflation 1.3% 2.0% 2.0% 2.1% 2.2% Unemployment 4.9% 4.4% 4.1% 4.0% 4.1% Fed Funds 0.625% 1.375% 2.125% 2.625% 2.875% 10-year Treasury 1.8% 2.3% 2.7% 3.1% 3.4% 30-year Mortgage 3.6% 4.0% 4.6% 5.0% 5.3% New home sales (000s) 561 584 623 662 696 Existing home sales (000s) 5,440 5,486 5,626 5,810 5,991 Home prices (YOY % chg) 5.7% 6.2% 5.4% 4.1% 2.9% Purchase originations ($B) 1,052 1,088 1,167 1,245 1,317 Refi originations ($ B) 999 600 430 395 395 Total originations ($B) 2,051 1,688 1,597 1,640 1,712 GSE 974 810 751 776 839 FHA 256 246 264 292 318 Other 821 631 583 572 555 ARM Share (based on $) 13.1% 15.5% 15.9% 15.6% 14.9% Mortgage debt outstanding ($B) 9,710 10,010 10,370 10,760 11,130 Source: MBA Forecast – October 2017 2 1

11/9/2017 Job Growth Still Strong in 2017 Average Monthly Payroll Growth 400 284 300 254 265 261 250 235 216 232 226 210 210 208 207 174 179 192 187 174 200 170 163 145 138 96 88 100 50 Thousands of jobs 18 10 - (42) (100) (144) (200) (300) (297) (400) (422) (500) Source: BLS 3 Companies Increasingly Having Difficulties Filling Open Positions Firms Reporting Hard to Fill Openings and Plans to Raise Compensation 40.0 35.0 30.0 Percent of firms with hard to 25.0 fill job openings, (%, SA) 20.0 Net percent of firms planning 15.0 to raise compensation, (%, SA) 10.0 5.0 ‐ (5.0) Jan ‐ 86 Dec ‐ 86 Nov ‐ 87 Oct ‐ 88 Sep ‐ 89 Aug ‐ 90 Jul ‐ 91 Jun ‐ 92 May ‐ 93 Apr ‐ 94 Mar ‐ 95 Feb ‐ 96 Jan ‐ 97 Dec ‐ 97 Nov ‐ 98 Oct ‐ 99 Sep ‐ 00 Aug ‐ 01 Jul ‐ 02 Jun ‐ 03 May ‐ 04 Apr ‐ 05 Mar ‐ 06 Feb ‐ 07 Jan ‐ 08 Dec ‐ 08 Nov ‐ 09 Oct ‐ 10 Sep ‐ 11 Aug ‐ 12 Jul ‐ 13 Jun ‐ 14 May ‐ 15 Apr ‐ 16 Mar ‐ 17 Source: NFIB 4 2

11/9/2017 Wages Growing Slowly Atlanta Fed Wage Growth Tracker Percent 6.0 5.0 4.0 3.0 2.0 1.0 Overall Prime-age 0.0 Source: Federal Reserve Bank of Atlanta 5 Inflation Flirting with 2 Percent CPI and Selected Components Year over year percent change 4.0 40.0 3.0 30.0 2.0 20.0 1.0 10.0 ‐ ‐ (1.0) (10.0) (2.0) (20.0) (3.0) (30.0) (4.0) (40.0) Jan ‐ 14 Feb ‐ 14 Mar ‐ 14 Apr ‐ 14 May ‐ 14 Jun ‐ 14 Jul ‐ 14 Aug ‐ 14 Sep ‐ 14 Oct ‐ 14 Nov ‐ 14 Dec ‐ 14 Jan ‐ 15 Feb ‐ 15 Mar ‐ 15 Apr ‐ 15 May ‐ 15 Jun ‐ 15 Jul ‐ 15 Aug ‐ 15 Sep ‐ 15 Oct ‐ 15 Nov ‐ 15 Dec ‐ 15 Jan ‐ 16 Feb ‐ 16 Mar ‐ 16 Apr ‐ 16 May ‐ 16 Jun ‐ 16 Jul ‐ 16 Aug ‐ 16 Sep ‐ 16 Oct ‐ 16 Nov ‐ 16 Dec ‐ 16 Jan ‐ 17 Feb ‐ 17 Mar ‐ 17 Apr ‐ 17 May ‐ 17 Jun ‐ 17 Jul ‐ 17 Aug ‐ 17 Sep ‐ 17 Motor Fuel (right axis) All Items (left axis) All Items exc Food & Energy (left axis) Shelter (left axis) Source: BLS 6 3

11/9/2017 New Leadership at the Fed: Increased Uncertainty • Yellen -> Powell • Fischer -> ?? • 3 other governor spots open • Dudley -> ?? • Richmond Fed?? 7 Changes to Fed’s Balance Sheet Are Coming… Chart of the Week ‐ June 16, 2017 US Treasuries and Agency MBS on Fed's Balance Sheet 4.5 $ Trllions 4.0 3.5 Hypothetical 3.0 path 2.5 2.0 1.5 1.0 0.5 0.0 2002 ‐ Q4 2003 ‐ Q2 2003 ‐ Q4 2004 ‐ Q2 2004 ‐ Q4 2005 ‐ Q2 2005 ‐ Q4 2006 ‐ Q2 2006 ‐ Q4 2007 ‐ Q2 2007 ‐ Q4 2008 ‐ Q2 2008 ‐ Q4 2009 ‐ Q2 2009 ‐ Q4 2010 ‐ Q2 2010 ‐ Q4 2011 ‐ Q2 2011 ‐ Q4 2012 ‐ Q2 2012 ‐ Q4 2013 ‐ Q2 2013 ‐ Q4 2014 ‐ Q2 2014 ‐ Q4 2015 ‐ Q2 2015 ‐ Q4 2016 ‐ Q2 2016 ‐ Q4 2017 ‐ Q2 2017 ‐ Q4 2018 ‐ Q2 2018 ‐ Q4 2019 ‐ Q2 2019 ‐ Q4 MBS US Treasuries Source: FRED, FOMC Statement 8 4

11/9/2017 10 5

11/9/2017 11 FRBNY Bonis, Brian, Jane Ihrig, and Min Wei (2017). "Projected Evolution of the SOMA Portfolio and the 10-year Treasury Term Premium Effect," FEDS Notes. Washington: Board of Governors of the Federal Reserve System, September 22, 2017, https://doi.org/10.17016/2380- 7172.2081. Data: https://www.federalreserve.gov/econres/notes/feds-notes/projected-evolution-of-the-soma-portfolio-and-the-10-year-treasury-term- premium-effect-accessible-20170922.htm#fig1 6

11/9/2017 13 Growing Federal Debt Looming Source: CBO 14 7

11/9/2017 Rates Expected to Increase Source: Federal Reserve, Freddie Mac, MBA 15 Impact of Rate Hikes Source: S&P 16 8

11/9/2017 Tax Reform • Corporate • Business • Individual • Rates • Distributional impacts • Housing provisions • Geographic impacts 17 Demand Strong but Household Formation Facing Headwinds Alternate Data Sources Provide Different Views of Household Formation 1,600 1,350 1,344 1,400 1,295 1,177 1,156 1,200 1,100 1,036 970 971 950 1,000 871 Thousands 800 750 650 600 540 538 400 200 0 2014 2015 2016 2017 ACS Adjusted CPS Res. USPS Res. Elect. Srvc Housing Completions Source: Census, USPS, EIA 18 9

11/9/2017 A Decade of Unusual (for the US) Housing Growth Is Binding Markets Net Change in Households, by Structure Type and Tenure (millions) 14 Millions 12 Rented Owner‐Occupied 10 8 11.2 6 8.1 4 1.4 5.7 0.9 2 1.6 3.0 1.8 1.0 1.2 0.8 0 ‐0.8 ‐2 Single Family Multifamily Single Family Multifamily Single Family Multifamily 1987‐1997 1997‐2007 2007‐2017 Source: Adjusted CPS, MBA 19 Declining Inventories for Sale Constraining Existing Home Sales Existing Home Sales, Inventory and Months Supply 12 8000 7000 10 6000 8 5000 Thousands Months 6 4000 3000 4 2000 2 1000 0 0 1999 1999 2000 2000 2001 2001 2002 2002 2003 2003 2004 2004 2005 2005 2006 2006 2007 2007 2008 2008 2009 2009 2010 2010 2011 2011 2012 2012 2013 2013 2014 2014 2015 2015 2016 2016 2017 2017 2018 2018 2019 2019 2020 2020 Months supply of existing homes on market (Months, SA, left axis) Existing Home Sales (Ths., SAAR, right axis) Number of homes available for sale (Ths., SA, right axis) EHS Forecast (right axis) Source: NAR, MBA 20 10

11/9/2017 Decelerating Growth in New Home Market, Despite Demand Chart of the Week ‐ October 13, 2017 Year over Year Change in Builder Applications Survey Index (%) 30% 250 25% 200 20% 15% 150 10% 100 5% 0% 50 ‐5% ‐10% 0 2014 2015 2016 2017 BAS Index (right axis) Source: MBA Builder Applications Survey 21 Single Family Starts Still Gathering Steam; MF Steady Single and Multifamily Housing Starts (Seasonally adjusted annualized rate) 2200 2000 1800 1600 1400 Thousands 1200 1000 800 600 400 200 0 Single Family Starts (SAAR) MF Starts (SAAR) Total Completions (SAAR) Source: Census, MBA 22 11

11/9/2017 Lack of Labor Holding Back Single Family Housing Starts Construction Labor 8.0 7.0 6.0 5.0 4.0 3.0 2.0 1.0 0.0 Jan‐02 Sep‐02 May‐03 Jan‐04 Sep‐04 May‐05 Jan‐06 Sep‐06 May‐07 Jan‐08 Sep‐08 May‐09 Jan‐10 Sep‐10 May‐11 Jan‐12 Sep‐12 May‐13 Jan‐14 Sep‐14 May‐15 Jan‐16 Sep‐16 May‐17 Layoffs and Discharges Rate (12 mo. moving avg., %) Hires Rate (12 mo. moving avg., %) Job Openings Rate (12 mo. moving avg., %) Source: BLS, NAHB 23 House Price Growth Outpacing Income Growth; Price Gains to Slow Year over Year Growth of Wages and House Prices 15.0% 10.0% 6.4% 5.0% 2.3% 2.4% 0.0% ‐5.0% ‐10.0% Q1‐83 Q1‐85 Q1‐87 Q1‐89 Q1‐91 Q1‐93 Q1‐95 Q1‐97 Q1‐99 Q1‐01 Q1‐03 Q1‐05 Q1‐07 Q1‐09 Q1‐11 Q1‐13 Q1‐15 Q1‐17 Q1‐19 ECI: Wages & Salaries: Civilian Workers (SA, Dec‐05=100) FHFA House Price Index, United States (NSA, Q1‐80=100) Source: FHFA, BLS 24 12

11/9/2017 MBA Research Sign-Ups and Services 25 Contact Information and MBA Resources Mike Fratantoni, Ph.D. Chief Economist & Senior Vice President | Research and Industry Technology 202-557-2935 mfratantoni@mba.org MBA Research: RIHA: www.housingamerica.org www.mba.org/research 26 13

Recommend

More recommend