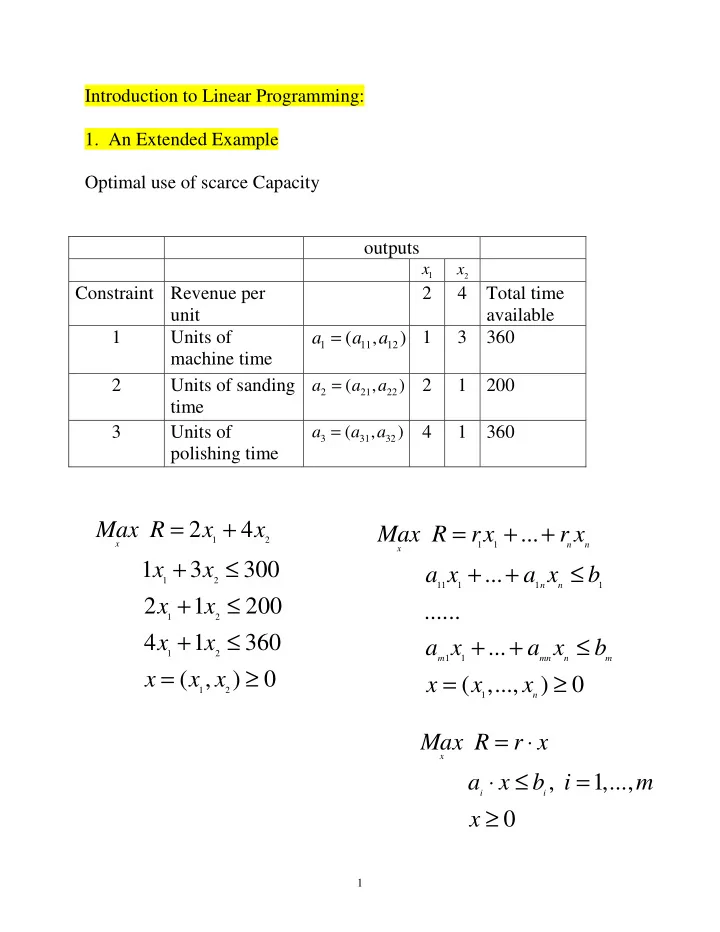

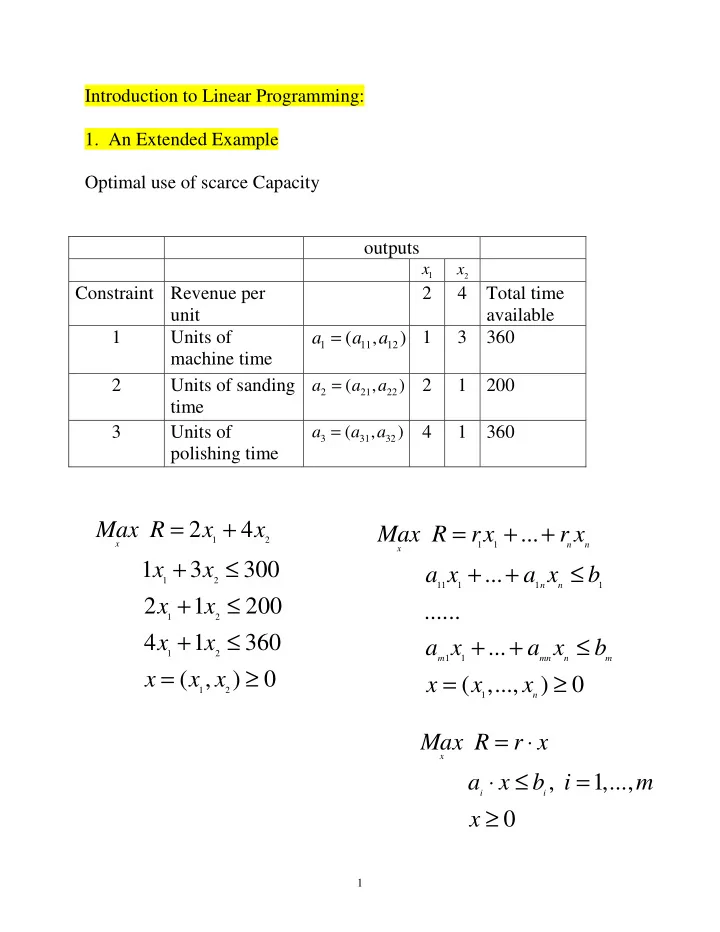

Introduction to Linear Programming: 1. An Extended Example Optimal use of scarce Capacity outputs x x 1 2 Constraint Revenue per 2 4 Total time unit available = 1 Units of ( , ) 1 3 360 a a a 1 11 12 machine time = 2 Units of sanding a ( a , a ) 2 1 200 2 21 22 time = 3 Units of a ( a , a ) 4 1 360 3 31 32 polishing time = + = + + Max R 2 x 4 x Max R rx ... r x 1 2 x 1 1 n n x + ≤ + + ≤ 1 x 3 x 300 a x ... a x b 1 2 11 1 1 n n 1 + ≤ 2 x 1 x 200 ...... 1 2 + ≤ + + ≤ 4 x 1 x 360 a x ... a x b 1 2 m 1 1 mn n m = ≥ = ≥ x ( , x x ) 0 x ( ,..., x x ) 0 1 2 1 n = ⋅ Max R r x x ⋅ ≤ = a x b i , 1,..., m i i ≥ x 0 1

= + Max R 2 x 4 x 1 2 x + ≤ 1 x 3 x 300 1 2 + ≤ 2 x 1 x 200 1 2 + ≤ 4 x 1 x 360 1 2 = ≥ x ( , x x ) 0 1 2 m = slope of constraint i. x i 2 m = − 1 1 3 100 m = − 2 (60,80) 2 (80,40) m = − 4 3 90 x 1 1 + = m = − Constant revenue line has slope 2 x 4 x R 1 2 0 2 2

x 2 λ = shadow value of resource 2 i 100 λ = 0 3 (60,80) (80,40) m = − 4 3 90 x 1 Consider the effect of relaxing the second constraint + = x 3 x 300 1 2 + = + = x 3 x 300 6 x 3 3 b = − = − = − 1 2 1 2 2 , 3 60 2 120 1 x b x b x b + = 1 5 2 2 2 1 5 2 2 x x b __________ 1 2 2 = − 5 x 3 b 300 1 2 = + = − + − R 2 x 4 x 2( 3 b 60) 4(120 1 b ) 1 2 5 5 ∂ R λ = = 2 ∂ 2 5 b 2 3

Imputed prices/ shadow prices (Lagrange Multipliers) λ = * imputed price forconstraint i i n ≤ a x b ∑ ij j j = 1 j λ ≥ * 0 Value of relaxing the constraint so i λ = value to firm of an additional unit of capacity * i = extra revenue that the firm would get = cost to firm if it had to give up a unit of capacity Shadow prices are "as if" prices which support the optimum. What does this mean? Think of the profit maximizing decision as if these were actual prices. > − = − λ − λ − λ = * If x 0 then MR MC 0, that is 2 1 2 4 0 . 1 1 1 1 2 3 = − ≤ − λ − λ − λ ≤ If x * 0 then MR MC 0, that is 2 1 2 4 0 . 1 1 1 1 2 3 > − = − λ − λ − λ = If x * 0 then MR MC 0, that is 4 3 1 1 0 . 2 2 2 1 2 3 = − ≤ − λ − λ − λ ≤ If * 0 then 0, that is 4 3 1 1 0 x MR MC . 2 2 2 1 2 3 4

λ = * We already know that the third constraint is not binding so 0 . 3 We also know that the optimal levels of outputs 1 and 2 are positive. Thus for these outputs MR = MC and so − λ − λ = − λ − λ = * * * * 2 1 2 0 4 3 1 0 and . 1 2 1 2 λ + λ = 2 2 1 2 λ + λ = λ + λ = 2 2 6 2 8 λ = λ = * * 1 2 1 2 = , Hence 6 and 2 λ + λ 1 5 2 5 3 4 _________ 1 2 λ = 5 6 1 5

We now look at the general programming problem . Programming problem n Maximize r x ∑ j j = j 1 subject to the constraints n = ≥ ≤ a x b and x ( ,..., x x ) 0 ∑ 1 n ij j i = j 1 Valuing total output aij = amount of input i needed to produce a unit of output j . = x ( x ,..., xn ) an n -vector of outputs. 1 λ = λ λ ( ,..., ) an m -vector of non-negative (shadow) prices, one for 1 m each input. λ = λ λ We seek shadow prices ( ,..., ) which will “support” the optimal 1 m output plan. 6

Necessary condition: No Marginal profit (otherwise firm could make an infinite profit by increasing output) For output j m = = ∑ λ ≥ MR r MC a . We require MC MR j j j i ij j j = i 1 Thus we consider only non-negative shadow prices for which m λ ≥ a r ∑ i ij j = i 1 = If MC MR the total profit from producing product j is j j m − λ = * ( r a ) x 0 ∑ j i ij j = i 1 > x = thus again the * The other possibility is MC MR in which case 0 j j j total profit from producing product j is zero. Since this holds for all products we have the following Proposition. Proposition: If shadow prices support the maximum the total revenue equals total “shadow” cost. 7

Fundamental Theorem of Linear Programming λ = λ λ * * * There exists a vector of shadow prices ( ,..., ) which supports 1 m * the optimal output vector x . 8

Recommend

More recommend