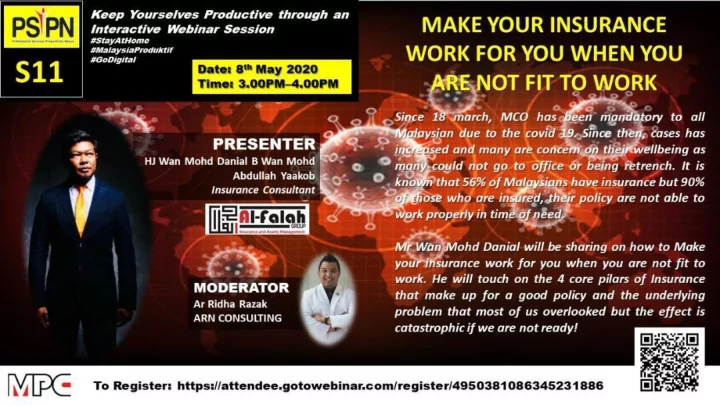

Make your Insurance Work For YOU

4 Ways Of Ways Of Losing Our Income Losing Our Income 25% Controllable Risk 25% Cont rollable Risk 1) Quit Yo 1) Quit Your Job / S ur Job / Sack acked By Comp ed By Company any 2) Tot 2) Total & Perman al & Permanent Disabilit ent Disability ( y (eg eg. . Accident) Accident) 75% Uncontrollable Ris 75% Uncontro llable Risk 3) Crit 3) Critical I ical Illness llness (eg eg. . Cancer, Stroke, Cancer, Stroke, Heart Heart Attack Attack) 4) Early Deat 4) Ear ly Death

Insurance 101 Life/ TPD Medical & Surgical Upon death or Total Takes care of the These are the basic Permanent Disability in-hospitalisation bills elements that makes an insurance complete. Leave one out, a person would most Personal Accident 36 Critical likely complaint in the ONLY upon death or lose Illness future. limbs due to accident

Properties, Unit Back to basic Investments Trust, Shares, FD Most people go straight to second and the top tier Lifestyle & Children Education, and neglect the needed House, Cars , Shopping Other Expenses etc foundation. Life Insurance, Critical Illness, Medical Protection & Surgical , Personal Accident

30% What most people are worried about Surgical Bill, Doctor’s Consultation Fee, Room & Board- which is most likely covered by your medical card What most FORGET !!! Other Expenses Education, Children , Parents Loans Car, House, Personal , Hidden Credit Cards Expenses Living 70% Supplements, Alternative Expenses Treatments, Medication, Therapy, Special Diet Groceries, Utilities, Petrol, Toll

Lets review A p o l i c y v s a G O O D P O L I C Y Ask yourself: Do i have a proper plan?? Am i covered from all angles?? a good A policy “savings” Am i paying too little/too much?? should plan? cover all OR a angles with Am i getting the best value ?? protection the right plan ? amount Am i part of the statistics??

Medical & Life / TPD Be in the Surgical Benefit know 5-10 Times of your annual income Know the full benefits and Paying a hefty premium does annual / lifetime not mean you have a good limits Waiver policy. Be responsible enough Enjoy the benefits without to know what you have AND having to worry about paying what you don’t . Also, whether the premium! Personal its sufficient. Never let Critical Accident yourself be part of the sad Illness statistic! Have at least a basic cover , A solid coverage of RM unless you have a 300,000- RM 500,000 if high risk job. its affordable.

MOVING FORWARD – Under Covid 19 pandemic lets see how we could use insurance as a tool for : 1) 1) Business Business Owners Owners 2) 2) Staff Staff 3) 3) Freque Frequent Traveler nt Travelers 4) 4) Contrac Contractors tors

Directors Coverage / Keyman Policy Working hard in business for future betterment of love ones but what happen when we are no longer here…. HAVE A PEACE OF MIND, PLAN NOW, BUILD A TRUST FUND AS HERITAGE

Personal Medical Coverage for Staff

Recommend

More recommend