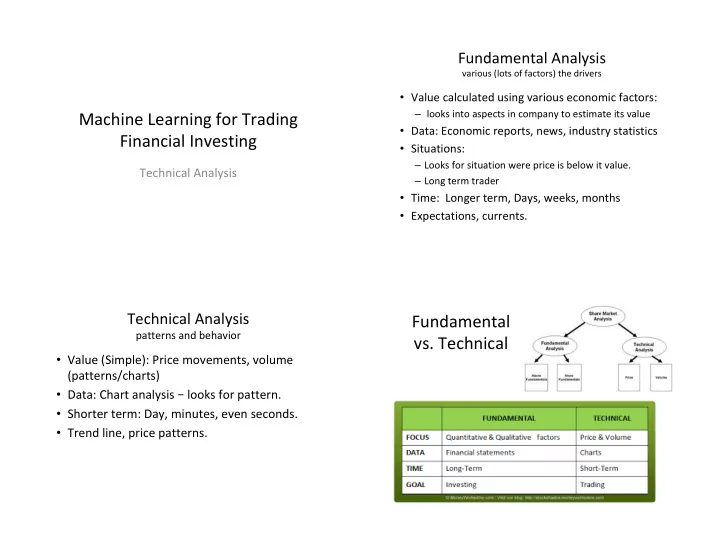

Fundamental Analysis various (lots of factors) the drivers • Value calculated using various economic factors: – looks into aspects in company to estimate its value Machine Learning for Trading • Data: Economic reports, news, industry statistics Financial Investing • Situations: – Looks for situation were price is below it value. Technical Analysis – Long term trader • Time: Longer term, Days, weeks, months • Expectations, currents. Technical Analysis Fundamental patterns and behavior vs. Technical • Value (Simple): Price movements, volume (patterns/charts) • Data: Chart analysis – looks for pattern. • Shorter term: Day, minutes, even seconds. • Trend line, price patterns.

Characteristics Technical Analysis Technical Analysis Indicators • Indicators: What it is Why it may work • Forecasting direction of • There is information in price – Lets you see if it is a buy and sell. prices by looking at • Heuristics work. primarily • Example : price going outside or – historical price and volume . inside Bollinger bands can be an • Computer statistics called indicators . indicator of buy or sell. • Indicators are heuristics • Signals Criticism of Technical Analysis Fundamental or Technical? • Not for investment (recall investment is longer (T) For Techical, (F) for Fundamental term) q Moving Average of price • Based on Heuristics q % Change in volume – Artificial Intelligent, heuristics and work, and they q Price/Earnings Ratio work frequently. q Intrinsic Value • Does not consider the value of the company – Only trends or movement in price (volume)

When is Technical Analysis Effective Fundamental or Technical? (in practice). (T) For Techical, (F) for Fundamental • Individual indicators weak q Moving Average of price • Combination is stronger q % Change in volume • Look for contrast – One stock vs. another. q Price/Earnings Ratio Fundamental – Stock vs. Market) q Intrinsic Value Fundamental • Shorter time periods. When does Technical Analysis Have Indicator: Momentum Value? • Momentum [t] = price • Fundamental – Humans [t]/price[t-n]-1. • Technical – Computers – Fast. • n is the window n-day 5, 10. • Bull – trend is up. – Bull thrusts is horns up into the air • Bear – trend is down – Bear swipes it paws downward.

Indicator: Simple Moving Average Indicator: Simple Moving Average • Two moving • Length averages parameter – Longer term bigger window • Crossover for – Shorter term shorter window buy and sell • BUY: Shorter term • Red arrow Sell, crosses above longer term. Golden Cross. • Green arrow • SELL: shorter-term MA crosses below Buy the longer-term MA SMA: Proxy of Underlying Value Revisit Bollinger Bands. • SMA[t] = price[t]/ • Bollinger price[t-n:t].mean() Bands • Idea: – IF above, Price will come back down to average. Sell – IF below , price come up to average Buy .

Quiz Buy or Sell Quiz Buy or Sell Quiz Buy or Sell Normalization • Normed =( values – mean ) / values.std() • Z-score þ þ þ þ

Recommend

More recommend