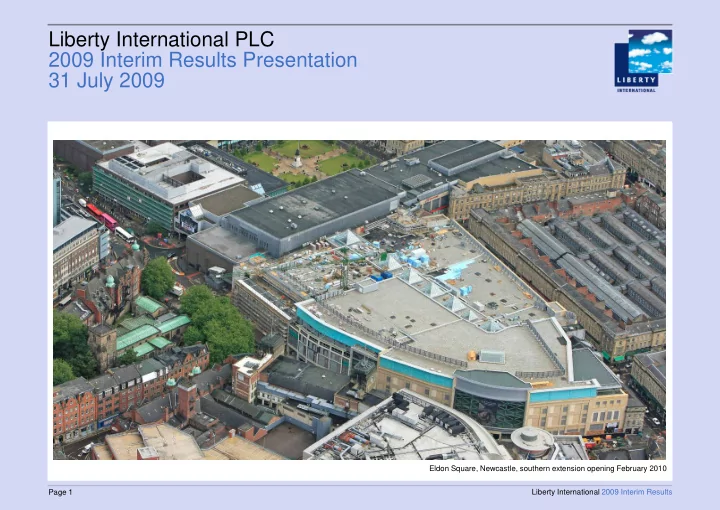

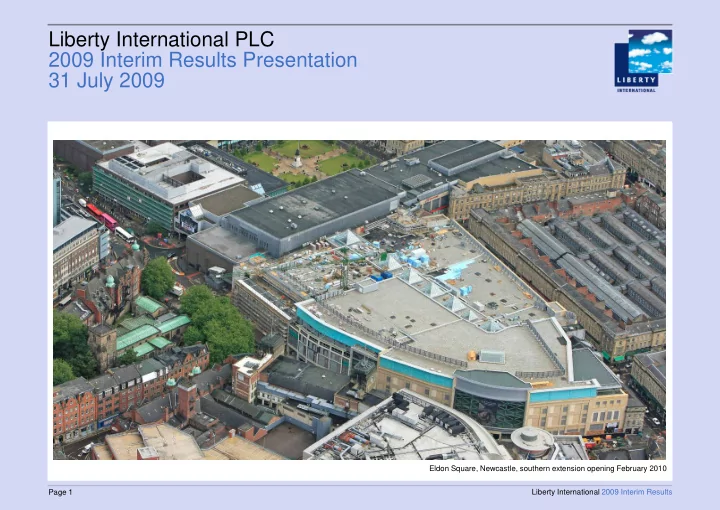

Liberty International PLC 2009 Interim Results Presentation 31 July 2009 Eldon Square, Newcastle, southern extension opening February 2010 Page 1 Liberty International 2009 Interim Results

Important Notice This presentation includes statements that are forward-looking in nature. Forward- looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of Liberty International PLC to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Any information contained in this presentation on the price at which shares or other securities in Liberty International PLC have been bought or sold in the past, or on the yield on such shares or other securities, should not be relied upon as a guide to future performance. Page 2 Liberty International 2009 Interim Results

Liberty International Interim Report 2009 Group overview David Fischel Financial review Ian Durant Operating review Kay Chaldecott Ian Hawksworth Group prospects David Fischel Questions Page 3 Liberty International 2009 Interim Results

Group overview A measure of stability, if not yet recovery Financial position improved by £592 million capital raising Slowdown in property valuation declines – 8.5 per cent (Q1), 4.3 per cent (Q2) £187 million disposals of non-core assets Resilient net rental income – 2 per cent decline Slowdown in tenant failures and steady re-letting progress Specialist in quality retail property – 86 per cent of investment properties Page 4 Liberty International 2009 Interim Results

Property valuations H1 2009 – CSC (12.8) per cent – Capital & Counties UK (10.0) per cent – USA (14.8) per cent – Overall (12.4) per cent vs. IPD (13.2) per cent Cumulative since 30 June 2007 – (36.2) per cent vs. IPD (44.1) per cent NEY increase for CSC from 6.67 per cent to 7.37 per cent CSC ERV decline 3 per cent Yields stabilising for prime assets Rental levels now the key to performance Page 5 Liberty International 2009 Interim Results

Valuations Liberty International’s assets have outperformed IPD since 30 June 2007 36.2% vs 44.1% 5.0% Cumulative change in capital value from June 2007 0.0% Jun-07 Sep-07 Dec-07 Mar-08 Jun-08 Sep-08 Dec-08 Mar-09 Jun-09 -5.0% -10.0% -15.0% -20.0% -25.0% -30.0% -35.0% -40.0% -45.0% CSC capital value C&C UK capital value C&C USA capital value IPD monthly all property, capital value index Page 6 Liberty International 2009 Interim Results

Financial Review St David’s 2, Cardiff Page 7 Liberty International 2009 Interim Results

First half performance First half First half Change 2008 2009 £m £m 190 194 -2% Net rental income 47 50 -7% Underlying earnings 76 (151) +151% Cash flow before financing 11.6p 13.9p -17% Adjusted earnings per share 5.0p 16.5p -70% Dividend per share Page 8 Liberty International 2009 Interim Results

Net rental income “bridge” CSC – tenant failures reducing the rent roll, C&C – acquisitions and disposals 200 (0.5) 2.7 (4.2) (6.8) (1.4) 6.2 175 C&C C&C 54.1 57.5 150 £'M 125 CSC CSC 140.1 132.7 100 75 First half 2008 CSC like-for- C&C UK like- Acquisitions Disposals Foreign Other First half 2009 like for-like Exchange Page 9 Liberty International 2009 Interim Results

Underlying profit before tax “bridge” 70 60 6.4 0.8 (11.0) (7.4) 50 3.4 40 £'M 30 57.1 49.3 20 10 0 First half 2008 CSC net rental C&C net rental Other income Administration Net finance costs First half 2009 income income costs Finance costs – servicing higher debt including Empress, not yet fully reflecting capital raise Administration costs – on track for £45m for the full year Page 10 Liberty International 2009 Interim Results

Items excluded from underlying profit First half First half 2009 2008 £m £m Adjusted earnings after tax for the period 11.6p 47 50 Property revaluation deficit and losses on sales (891) (639) Change in fair value of derivatives 417 140 Deferred tax on the above (42) 8 Minority interests on the above 25 33 Other finance (costs)/income (20) 4 Impairment of goodwill - (22) Other non-operating items (6) - Basic (loss) for the period (117.0p) (470) (426 ) Page 11 Liberty International 2009 Interim Results

Net assets per share 448 pence 30 June 31 Dec 2009 2008 £b £b 7.1 Total properties 6.1 Net external debt (3.4) (4.1) Other assets/liabilities (0.6) (1.0) Net assets 2.1 2.0 Net assets diluted, adjusted 2.6 2.8 800 700 (147p) 600 (105p) 9p 500 10p (57p) (11p) 4p pence 400 745p 300 493p 200 448p 100 0 31 Dec Valuation Capital Proforma Underlying Valuation Other 'non- Taxation Minority 30 Jun 2008 deficit Q1 raising profit deficit Q2 operating' interest 2009 Page 12 Liberty International 2009 Interim Results

Cash flow Cash generation from capital raising & disposals £m £m Opening net external debt 1 January 2009 (4,100) Recurring cash flow from operations* 13 REIT entry charge (1) Cash flow from operating activities 12 Investments: CSC (110) Capital & Counties (13) Disposals 187 Cash flow before financing 76 Proceeds of capital raising 592 Effect of exchange rate changes on US debt 29 Other 13 Closing net external debt 30 June 2009 (3,390) *after working capital movements Page 13 Liberty International 2009 Interim Results

Capital commitments UK commitments £172 million, principally Cardiff 250 200 £11m £172m £58m 150 £m £103m 100 £104m 50 0 2009 2010 2011 Total Year St David's 2, Cardiff Eldon Square, Newcastle Metrocentre Yellow Quadrant Other CSC committed projects C&C UK committed projects Other capital commitments - £53m overseas investments Page 14 Liberty International 2009 Interim Results

Financial position 30 June 31 Dec 2009 2008 Net external debt ` £3,390m £4,100m Cash balances £568m £71m Undrawn available facilities £360m £220m Net debt to assets 56% 58% Weighted average cost of gross debt 6.0% 6.0% Interest cover (for period) 147% 145% Weighted average maturity of debt 5.8 years 5.5 years Page 15 Liberty International 2009 Interim Results

Financial covenants In compliance with all loan covenants Detail of covenants and current compliance – contained in appendix to interim report In compliance with all loan covenants Some remedies applied since 30 June – £19m cash deployed – includes Bromley, Uxbridge, Watford, Norwich – constructive dialogue with lenders including Nottingham Page 16 Liberty International 2009 Interim Results

Derivatives – interest rate hedging 0 (2) - (14) (22) (23) (41) (100) (105) Estimated Carrying Value (£m) (200) (217) (300) (358) (400) (500) 0 1 2 3 - 5 6 - 10 11 - 15 16 - 20 21 - 25 26 - 30 Time Periods (Years) Reduction in liability by £431m to £358m at 30 June 2009 Remaining liability diminishes as interest is paid over time Closed £1.6 billion of forward-starting swaps in the period for a cash cost of £10m Page 17 Liberty International 2009 Interim Results

Financial prospects New debt/refinancing – Cardiff – outstanding £79m convertible bond September 2010 – Lakeside CMBS refinancing July 2011 Second half earnings prospects affected by capital raising and CSC net rental income Page 18 Liberty International 2009 Interim Results

Operating review Page 19 Liberty International 2009 Interim Results

Operating review – Capital Shopping Centres Asset management in a downturn (1) Compelling destinations – footfall up over 3% – outperforming “FootFall index” down 2.1% (Experian) – total sales – CSC centres estimated to have outperformed ONS non-food (down 3.1% first half 2009 compared to 2008) – vacancy decreased from 6.3% to 3.7% – compares favourably to market reduction to 5.1% (source DTZ – top 20 prime shopping centres) – cash collection June quarter date – 98% collected excluding tenants in administration and payment plans (December 2008 – 97%) Short and long term lettings – 142 deals – £11.5m new annual passing rent, previously £14.2m – reduction as a result of short term lettings – short term deals provide flexibility to benefit from market recovery eg Hawkshead, Punky Fish, Hawkins Bazaar Mitigation of costs – empty rates and non-recoverables Financial impact: like-for-like net rental income down 5.1% first half 2009 Page 20 Liberty International 2009 Interim Results

Operating review – Capital Shopping Centres Asset management in a downturn (2) Benefit of scale and quality – specialised management skills – tenant relationships – speed of response – single negotiation covering top destinations “Pre-pack” tenants keeping majority of units, eg. Mosaic, USC Demand for space from eg Next, H&M, New Look, River Island, Top Shop, JD Sports, Bank, Cult and new brands…. Page 21 Liberty International 2009 Interim Results

Retailer Demand New retail partners Page 22 Liberty International 2009 Interim Results

Recommend

More recommend