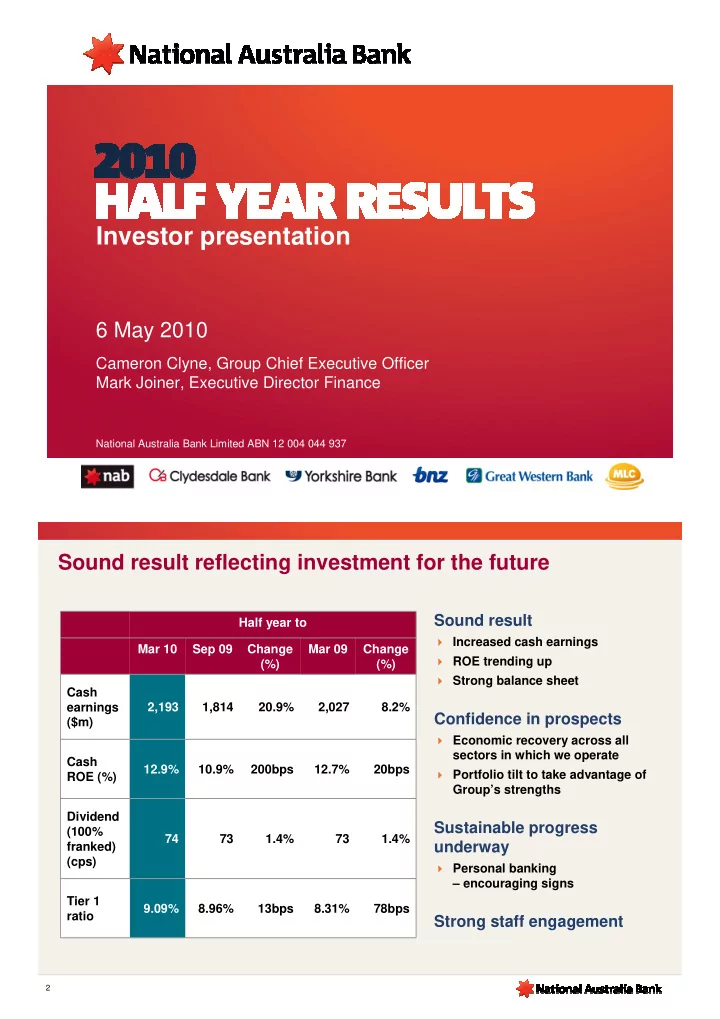

Investor presentation 6 May 2010 Cameron Clyne, Group Chief Executive Officer Mark Joiner, Executive Director Finance National Australia Bank Limited ABN 12 004 044 937 Sound result reflecting investment for the future Sound result Half year to � Increased cash earnings Mar 10 Sep 09 Change Mar 09 Change � ROE trending up (%) (%) � Strong balance sheet Cash 2,193 1,814 20.9% 2,027 8.2% earnings Confidence in prospects ($m) � Economic recovery across all sectors in which we operate Cash 12.9% 10.9% 200bps 12.7% 20bps � Portfolio tilt to take advantage of ROE (%) Group’s strengths Dividend Sustainable progress (100% 74 73 1.4% 73 1.4% underway franked) (cps) � Personal banking – encouraging signs Tier 1 9.09% 8.96% 13bps 8.31% 78bps ratio Strong staff engagement 2

United Kingdom Economic outlook � GDP growth re-commenced late 2009 but slowly. Should be under Australia 1% in 2010 � Asset markets appear past the worst: � Business confidence has improved sharply > Housing markets have modestly strengthened with upturn in activity > Commercial property prices rising 74% � Large gains in bulk � Large government deficit will need to commodity prices and 15% be corrected mining projects helping � Sterling depreciation to support drive renewed period of exports economic expansion New Zealand � Expect GDP growth of approx 3½% for � Commodity prices moving up calendar 2010, over 4% strongly in 2011 � Housing market stabilised 10% � Consumer spending growing but � Very strong V-shaped still not very robust recovery in growth across non-Japan Asia � GDP forecast 3% in 2010 – especially in China – boosting export United States 1% volumes and � Responding to government stimulus commodity prices � Economic growth resumed � RBA has started raising � Higher business confidence levels rates – to end up above � Unemployment levelled out neutral by end 2010 � Mid-West region looking better % represent share of 30 September 2009 GLAs. 3 Australia includes Asia Factors influencing the future of Australian Financial Services � Increased consumer and political scrutiny Post GFC � Fewer participants in short term banking environment � 2010 Federal election � In banking, potential for lower growth, and dislocation in returns � Funding and liquidity for medium term Banking regulation � Capital � Current account deficit Australian reliance � In wealth management, � Deposit funding gap on wholesale funding more transparency and elimination of conflicts clears the way for � Strong market growth potential growth Changing Australian Wealth Management � Retirement income gap issue environment � Regulatory reforms 4

Continuing to realign portfolio Significant Smaller Strong position, Unsatisfactory upside from businesses, with growth returns today in continuing resilient in tough opportunity tough conditions reinvention conditions Contribution (FY08): 48% 12% 8% 32% � RWA � Cash Earnings 1 55% 24% 8% 13% (1H10): � RWA 53% 13% 11% 23% � Cash Earnings 1 71% 23% 11% (5%) � Business � Personal (Aust) � BNZ (NZ) � CYB (UK) � Custody � Investments/ � GWB (US) � Specialised Group Key superannuation Assets (SGA) – non � Insurance (Aust) � Asia Businesses franchise activity � Asset � Markets Management � Private Wealth (Aust) Maintain value, innovation & Focus in Australia options internationally Invest behind advantage Restructure nabCapital (1) Cash earnings excludes conduit write-offs, distributions on hybrids and Corporate Functions 5 Well positioned for the future � Transparent � Strong balance sheet Group � Focus on leadership and culture Business Wholesale Personal MLC & International Banking Banking Banking NAB Wealth Strengthened Refocused around Rebuilding and Leveraging Leverage and leadership NAB franchise differentiating advantage optionality position � 150 bankers � Business Bank � Differentiation � BNZ – leveraging � Well positioned in 2009 cross-sell through innovation into for: reputation - Fair broader Group > industry and � 200 bankers to � Specialised Value demographic be hired in 2010 finance � UK – strategic trends expertise � Working to lift options and cycle � Differentiation > new regulation sales and service recovery through capability � Enhanced specialisation � GWB – agri franchise � New channels - initiative and capabilities: � Focus on UBank, attractive in-fill cross-sell > JBWere Advantedge opportunities > Aviva > nabInvest 6

2010 Engagement results Response rate – 85% Overview of strongest Strategic alignment with performing engagement our people Differences to Financial Norm drivers – All above � “ I have a good Finance Norm understanding of the organisation’s � “ There are career 1% strategies and opportunities for me priorities” in this organisation” 2010 # 2007* 2008 ^ Financial Norm � “ I believe that the � “ My people leader organisation’s strategies empowers me to and priorities are the carry out my role right ones for the effectively” organisation at this -8% * Employee Opinion Survey Jul 2007 � “ I can freely express my time” -10% ^ Employee Opinion Survey Jul 2008 views and ideas without # Speak Up Step Up Survey Mar 2010 fear of consequence” Achievements 7 2010 Priorities � Supporting customers and improving reputation � Continuing to address portfolio priorities � Efficiency and cost program to support investment � Balance sheet strength � Leadership, culture and talent 8

1H10 Financials Group financial result Half year to ($m) Mar 10 Sep 09 Change (%) Mar 09 Change (%) Net interest income 6,114 6,188 (1.2%) 5,884 3.9% Other operating 2,123 2,204 (3.7%) 2,630 (19.3%) income (incl MLC) Net operating income 8,237 8,392 (1.8%) 8,514 (3.3%) Operating expenses (3,861) (3,810) (1.3%) (3,770) (2.4%) Underlying profit 4,376 4,582 (4.5%) 4,744 (7.8%) B&DDs (1,230) (2,004) 38.6% (1,811) 32.1% Cash earnings 2,193 1,814 20.9% 2,027 8.2% ROE 12.9% 10.9% 200bps 12.7% 20bps Tier 1 ratio 9.09% 8.96% 13bps 8.31% 78bps RWA ($bn) 332.8 342.5 (2.8%) 352.4 (5.6%) Diluted cash EPS 102.5 90.1 13.8% 107.4 (4.6%) (cents) 10

Group financial result ex acquisitions and FX Half year to Mar 10 Sep 09 Change (%) Ex Acqn and FX 1 ($m) Reported Net interest income 6,238 6,188 0.8% Other operating income 1,973 2,204 (10.5%) (incl MLC) Net operating income 8,211 8,392 (2.2%) Operating expenses (3,815) (3,810) (0.1%) Underlying profit 4,396 4,582 (4.1%) B&DDs (1,309) (2,004) 34.7% Cash earnings 2,131 1,814 17.5% Acquisitions 81 FX (19) Cash earnings (reported) 2,193 (1) March 2010 results exclude Aviva, JBWere, Advantedge and GWB Colorado acquisitions and are translated using 11 September 2009 foreign exchange rates Update on acquisitions Aviva – estimated synergies (full run rate) Advantedge monthly settlement volumes 1 90 97% ($m) ($m) +29% increase in 20 70 197 activity 20 100 70 50 Initial Expectations** Updated Expectations Oct 09 Mar 10 Expense synergies Revenue synergies (1) Current capacity c$500m pcm ** As announced 22 June 2009 Great Western Bank Contribution to 1H10 cash earnings ($m)* Net operating income 268 19.2x 17.0x 16.5x Operating expenses (167) Underlying profit 101 5,400 4,953 3,468 B&DDs (4) IoRE 13 GWB GWB + Col GWB + Col + F&M Cash earnings 81 Tangible Assets ($USm) Blended PE Ratio at acquisition * Includes Aviva, Advantedge, JBWere and GWB Colorado acquisitions at March 2009 FX rates 12

Recommend

More recommend