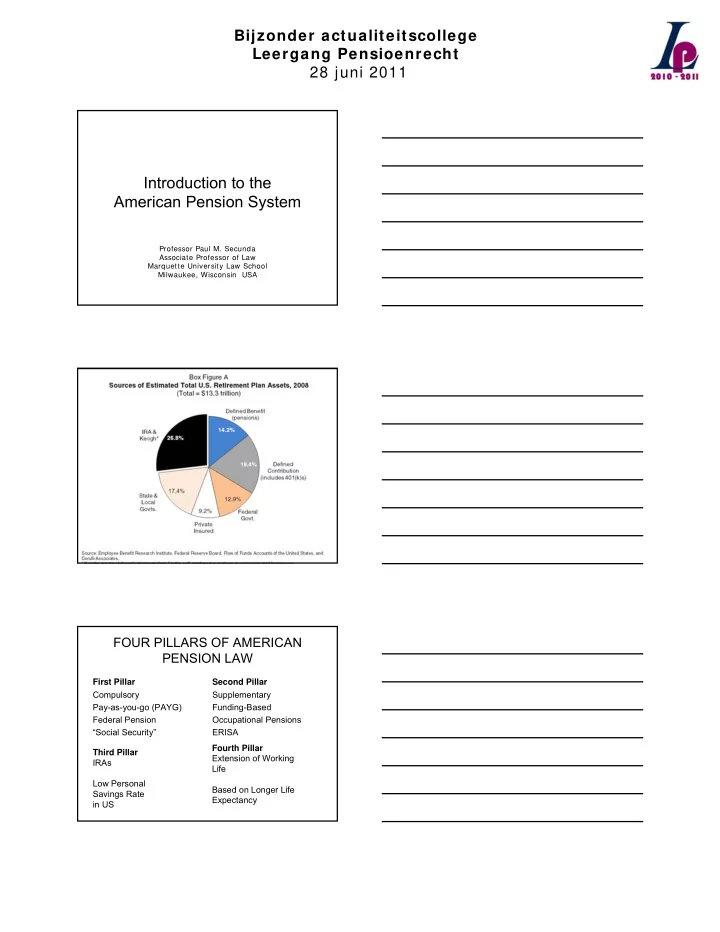

Bijzonder actualiteitscollege Leergang Pensioenrecht 28 juni 2011 Introduction to the American Pension System Professor Paul M. Secunda Associate Professor of Law Marquette University Law School Milwaukee, Wisconsin USA Chapter Three FOUR PILLARS OF AMERICAN PENSION LAW First Pillar Second Pillar Compulsory Supplementary Pay-as-you-go (PAYG) Funding-Based Federal Pension Occupational Pensions “Social Security” ERISA Fourth Pillar Third Pillar Extension of Working IRAs Life Low Personal Based on Longer Life Savings Rate Expectancy in US

Bijzonder actualiteitscollege Leergang Pensioenrecht 28 juni 2011 US Pension “Exceptionalism” First Pillar (minor) Second Pillar (major) Social Security alone does not As proportion of retirement income provide adequate retirement replaced by Social Security decreases, proportion replaced by other sources has to increase For large majority of US workers, Social Security will lead to about 40% income replacement ratio (SSA Consequently, many higher-salaried 2011). US employees must receive much larger percentage of retirement from occupational pensions to have Yet, to maintain a comfortable adequate retirement lifestyle in post-retirement years, a US worker will need at least 70% to 80% income replacement ratio Or, of course, additional personal savings (third pillar) June 28, 2011 US Social Security Basics • Social Security Act (SSA) enacted in 1935 by FDR as part of “New Deal” • Purpose: provide for economic security of its citizens for: disability, death, old-age, and unemployment • Federal Old-Age Benefits (Title II): Pay retired workers age 65 or older a continuing income after retirement • Mandatory for private-sector employees • Participation for federal, state and local employees varies • Benefit payment affected by age at which worker decides to retire June 28, 2011 US Social Security Basics - Continued • PAYG – benefits based on payroll tax (FICA Tax) contributions worker makes while working • Current contributions largely paid out in current benefits (but baby boomer issue; intergenerational transfers) • 1 in 7 Americans (2008) receives social security benefits • When workers pay Social Security taxes, they earn “credits” toward Social Security benefits • The number of credits workers need to get retirement benefits depends on when they were born. If they were born in 1929 or later, workers need 40 credits (10 years of work) June 28, 2011

Bijzonder actualiteitscollege Leergang Pensioenrecht 28 juni 2011 The Importance of Retirement Age • For instance, if retire at 62 (the earliest possible retirement age for Social Security), benefit will be lower than if you wait until later to retire • Normal retirement age moving from 65 to 67 for individuals born 1960 or later • May choose to keep working even beyond normal retirement age. If do, can increase future Social Security benefits in two ways – Each additional year of work adds another year of earnings to Social Security record. Higher lifetime earnings may mean higher benefits when retire. – Also, benefit will increase automatically by a certain percentage from the time one reaches full retirement age until start receiving benefits or until reach 70. June 28, 2011 Coverage vs. Non-Coverage • 96% of workers are currently in jobs covered by social security • Not covered: some federal, state, and local employees and employees of non-profits • Most public employees now have Social Security protection because their states and the Social Security Administration entered into special agreements called “Section 218 agreements” • Others public employees are covered by a US federal law passed in July 1991 when Social Security was extended to state and local employees who were not covered by an agreement and were not members of their agency’s public pension system. • Receiving Benefits: 222,000 (1940) v. 44 million (2008) The Finances of Social Security • Workers and employers both subject to Social Security taxes on earned income up to $106,800 for 2010 at a rate of 6.2% for both the employee and employer • So, for worker earning $55,000 in 2010, a total of $6,820 will be paid • The average monthly Social Security benefit for a retired worker was about $1,177 at the beginning of 2011or $14,124 per year. The poverty line for one person in US in 2009 was $10,830 per year • Maximum benefit depends on age a worker chooses to retire. For example, for a worker retiring at age 66 in 2011, the amount is $2,366 per month. This figure is based on earnings at maximum taxable amount for every year after age 21 • If years when did not work or had low earnings, benefit amount may be lower than if had worked steadily. June 28, 2011

Bijzonder actualiteitscollege Leergang Pensioenrecht 28 juni 2011 How is Social Security Amount Determined? • Social Security benefits are based on lifetime earnings • Actual earnings are adjusted or "indexed" to account for changes in average wages since the year the earnings were received • Then Social Security calculates average indexed monthly earnings during the 35 years in which the worker earned the most • A formula is then applied to these earnings and a basic benefit, or "primary insurance amount" (PIA), is determined • The calculated amount is how much a worker would receive at full retirement age—65 or older, depending on date of birth June 28, 2011 US Second Pillar: Occupational Pension Law Relevant Statutes • Employee Retirement Income Security Act of 1974 (ERISA) – Goal to protect assets of the benefits plan and benefits promised to employees • Internal Revenue Code of 1986 (Code) – Provide tax incentives so that employers voluntarily adopt employee benefit plans June 28, 2011 Which Employees and Benefit Plans are Covered Under ERISA ? • Private vs. Governmental and Church employees • Distinction between employees v. independent contractors (Darden Criteria – hiring party's right to control the manner and means by which the product is accomplished) • Covered Benefit Plans (Dillingham and Ft. Halifax Factors) June 28, 2011

Bijzonder actualiteitscollege Leergang Pensioenrecht 28 juni 2011 PLANS SUBJECT TO ERISA Employee Benefit Plan Exclusions §4(a) §4(b) §3(3) Welfare Benefit Pension Benefit Plan §3(1) Plan §3(2) June 28, 2011 Characteristics of Retirement Plans: Shift From DB To DC Design Type Individual $ Employer Defined Accounts Contribution Contribution $ Defined Employer Benefit amount Benefit Contribution defined by plan DB vs. DC Plans DEFINED BENEFIT PLANS DEFINED CONTRIBUTION PLANS Benefits determined by set formula (e.g., 2 percent Benefits determined by contributions and investment times years of service times final average pay) earnings (e.g., 10 percent of annual pay) Funding flexibility Possible discretion in funding Reward older and longer service employees Significant accruals at younger ages (backloaded) Employees face financial penalties for working past No disincentives for working past normal retirement normal retirement age age Long vesting period (e.g., 5 years) Often a short vesting period (e.g., 1 year) Employer bears the investment risk Employee bears the investment risk Employee has no investment discretion Employee has investment discretion High rates of return Significantly lower average rates of return Often not portable Portable Require actuarial valuation Does not require actuarial valuation Relatively low employee understanding and Relatively high employee understanding and appreciation appreciation Unfunded liability exposure No unfunded liability exposure Provide benefits targeted to income Does not provide benefits targeted to income replacement level replacement level Usual form of benefit payment is monthly Usual form of benefit payment is lump sum income (annuity) distribution Employees cannot borrow Employees may be able to borrow

Bijzonder actualiteitscollege Leergang Pensioenrecht 28 juni 2011 Types of Defined Contribution Plans • Profit Sharing Plan • Money Purchase Pension Plan • 401(k) Plan • ESOP June 28, 2011 401K DESIGN FEATURES • Selection of Investment Vehicles for Employees to Choose From – Limited Employer Fiduciary Duties – Company stock, equities, bonds, mutual funds – No requirement to diversify or limit amount of company stock • Plan loans • Employer matching contributions • Hardship distributions • Automatic enrollment/QDIA • Distribution and Direct Rollovers • Reporting and Disclosure Requirements US THIRD PILLAR: Individual Retirement Vehicles – IRAs hold 27% of all retirement income in United States – IRAs classified into four types (EBRI): • traditional (originating from contributions) (33.6%) • rollovers from other retirement plans (33.4%) • Roth IRAs (23.4%) • SEP/SIMPLE (9.6%) – Average and median IRA individual balance (all accounts from the same person combined) was $69,498 and $20,046 at end of 2008. – 11.1 million unique individuals with total assets of $732.9 billion as of year-end 2008 . • Low US Personal Savings Rate • As of April 1, 2011, US Personal Savings Rate: 4.9% (lowest since 2008) (source: Bureau of Economic Analysis, U.S. Department of Commerce)

Recommend

More recommend