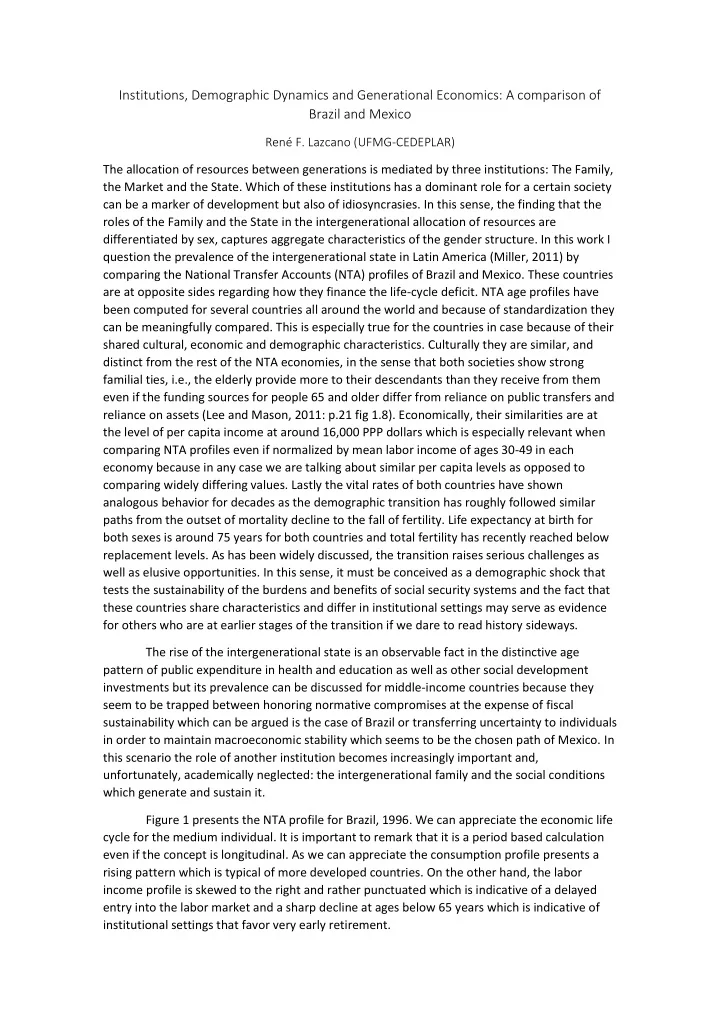

Institutions, Demographic Dynamics and Generational Economics: A comparison of Brazil and Mexico René F. Lazcano (UFMG-CEDEPLAR) The allocation of resources between generations is mediated by three institutions: The Family, the Market and the State. Which of these institutions has a dominant role for a certain society can be a marker of development but also of idiosyncrasies. In this sense, the finding that the roles of the Family and the State in the intergenerational allocation of resources are differentiated by sex, captures aggregate characteristics of the gender structure. In this work I question the prevalence of the intergenerational state in Latin America (Miller, 2011) by comparing the National Transfer Accounts (NTA) profiles of Brazil and Mexico. These countries are at opposite sides regarding how they finance the life-cycle deficit. NTA age profiles have been computed for several countries all around the world and because of standardization they can be meaningfully compared. This is especially true for the countries in case because of their shared cultural, economic and demographic characteristics. Culturally they are similar, and distinct from the rest of the NTA economies, in the sense that both societies show strong familial ties, i.e., the elderly provide more to their descendants than they receive from them even if the funding sources for people 65 and older differ from reliance on public transfers and reliance on assets (Lee and Mason, 2011: p.21 fig 1.8). Economically, their similarities are at the level of per capita income at around 16,000 PPP dollars which is especially relevant when comparing NTA profiles even if normalized by mean labor income of ages 30-49 in each economy because in any case we are talking about similar per capita levels as opposed to comparing widely differing values. Lastly the vital rates of both countries have shown analogous behavior for decades as the demographic transition has roughly followed similar paths from the outset of mortality decline to the fall of fertility. Life expectancy at birth for both sexes is around 75 years for both countries and total fertility has recently reached below replacement levels. As has been widely discussed, the transition raises serious challenges as well as elusive opportunities. In this sense, it must be conceived as a demographic shock that tests the sustainability of the burdens and benefits of social security systems and the fact that these countries share characteristics and differ in institutional settings may serve as evidence for others who are at earlier stages of the transition if we dare to read history sideways. The rise of the intergenerational state is an observable fact in the distinctive age pattern of public expenditure in health and education as well as other social development investments but its prevalence can be discussed for middle-income countries because they seem to be trapped between honoring normative compromises at the expense of fiscal sustainability which can be argued is the case of Brazil or transferring uncertainty to individuals in order to maintain macroeconomic stability which seems to be the chosen path of Mexico. In this scenario the role of another institution becomes increasingly important and, unfortunately, academically neglected: the intergenerational family and the social conditions which generate and sustain it. Figure 1 presents the NTA profile for Brazil, 1996. We can appreciate the economic life cycle for the medium individual. It is important to remark that it is a period based calculation even if the concept is longitudinal. As we can appreciate the consumption profile presents a rising pattern which is typical of more developed countries. On the other hand, the labor income profile is skewed to the right and rather punctuated which is indicative of a delayed entry into the labor market and a sharp decline at ages below 65 years which is indicative of institutional settings that favor very early retirement.

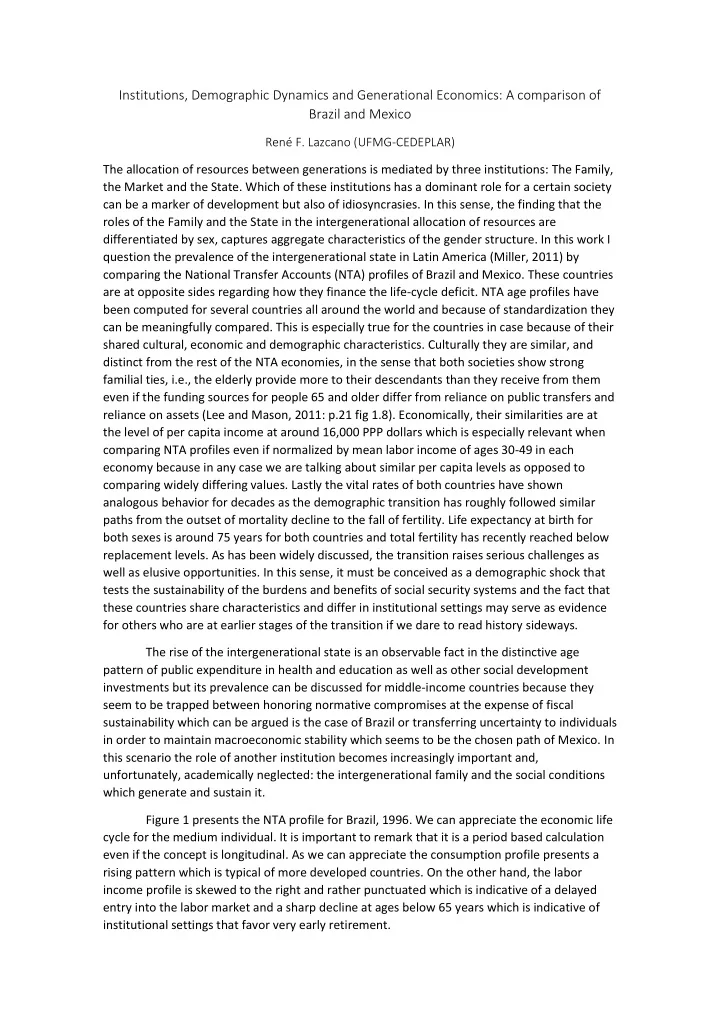

Age profile Brazil, 1996 1,20 1,00 0,80 0,60 0,40 0,20 0,00 1 9 17 25 33 41 49 57 65 73 81 89 Consumption Labor Income Figure 1: From Turra et al, 2011 Figure 2 presents the age profile for Mexico, 2004. In contrast to Brazil, Mexico has a consumption profile that is rather flat and decreasing at older ages. The labor income on the other hand seems to rise at earlier ages and does not fall sharply as the Brazilian does. What explains these differences? Age profile Mexico, 2004 1,20 1,00 0,80 0,60 0,40 0,20 0,00 1 9 17 25 33 41 49 57 65 73 81 89 Consumption Labor Income Figure 2: From Mejía-Guevara, 2012 Intergenerational transfers profiles are linked to institutional choices that are not neutral to demographic change. To illustrate figure 3 presents the labor income profiles for both countries. As can be appreciated Mexico´s profile covers a wider area as it raises earlier and drops later which is a reflex of labor market entry and exit conditions. On the other hand Brazil´s profile raises higher which can be a an indication of higher returns to human capital investments but the curve breaks rather unsmoothly and this is a product of a short labor life

expectancy. Brazil has a median age at retirement at just 53 years whilst Mexico ’ s reaches 70 years. Labor income profiles, Brazil and Mexico 1,20 1,00 0,80 0,60 0,40 0,20 0,00 1 4 7 10131619222528313437404346495255586164677073767982858891 Brazil Mexico Figure 3: Based on Turra et al, 2011 and Mejía-Guevara, 2012 Figure 4 shows the contrast between the consumption profiles of both countries. Consumption is higher in Mexico than in Brazil for all ages except from 64 onwards where a crossover appears. This is the picture of the institutional choices which result in the distinctive age profile of poverty. Whereas Mexico has decided to concentrate its more vulnerable people between the aged (women), Brazil has done so among children (girls). Consumption profiles, Brazil and Mexico 1,20 1,00 0,80 0,60 0,40 0,20 0,00 1 4 7 10131619222528313437404346495255586164677073767982858891 Mexico Brazil Figure 4: Based on Turra et al, 2011 and Mejía-Guevara, 2012 What are the consequences of these choices given that both are aging societies? The challenges seem to be very different because on the one hand the sustainability of such a profile is questionable for the Brazilian case which presents a shape like that of some develop countries whilst Brazil is a medium income country. On the other hand, Mexico´s bet is also unsustainable even if seemingly responsible from a fiscal standpoint because as it ages it will face a growing poverty rate.

Logically the age profiles will present changes as institutional reforms take place but experience leaves little hope for adequate reforms as special interest groups and shortsightedness impose. A series of NTA profiles calculated for Mexico from 2004 to 2014 show little change in the age profile which remains constant over the decade (Mejía-Guevara, 2014). However, little reforms where introduced during this period as the same party ruled and did not hold congress. On the other hand, estimates for intergenerational public transfers in Brazil (Turra et al, 2016) show that during the 2000s-decade important public investments in education and social expenditure where implemented and the likely effect of these policies on the NTA age profile would be that the Brazilian bias towards old ages has somewhat balanced. However, this would only mean that consumption has risen overall without accompanying labor market reforms and this would equal an increased burden that makes the Brazilian setting even more untenable. Because these estimates are only of public transfers we must wait for new NTA profiles to be computed for the year 2009 which is forthcoming work. In any case, reforms will be necessary for both countries and the direction that these reforms will take is uncertain because of the logic of politics. Therefore, the role of the intergenerational family is accentuated. This may serve as an indication that aging societies face a fiscal and social dilemma which may only be solved with rising income and because of this the focus for societies at earlier stages of the transition must be to take advantage early on from favorable age structures to generate growth, human capital investment and incentives for capital accumulation instead of over compromising and facing shortsighted reform cycles that leave middle income societies choosing between poor children or poor elderly as exemplified by comparing the NTA profiles of Brazil and Mexico. References Lee, R. and A. Mason. 2011. Population Aging and the Generational Economy: A Global Perspective . Elgar: London. Mejía-Guevara, I. 2012. NTA Country Report, Mexico, 2004. National Transfer Accounts. URL: http://www.ntaccounts.org Mejía-Guevara, I. 2014. Ciclo de vida económico, 2004-2014. In Rabell, C. Los Mexicanos: Un balance del cambio demográfico . FCE: México Miller, T. 2011. “The Rise of the Intergenerational State: Aging and Development” in Lee and Mason, 2011. Turra, C., Queiroz, B. and Rios-Neto, R. 2011. NTA Country Report, Brazil, 2011. National Transfer Accounts. URL: http://www.ntaccounts.org Turra, C., Queiroz, B. and Mason, A. 2016. New Estimates of Intergenerational Public Transfers for Brazil: 1996-2011. NTA working paper.

Recommend

More recommend