INDIRECT UTILITY FUNCTION U ( P x , P y , M ) = max { U ( x, y ) | - PDF document

ECO 305 FALL 2003 September 25 INDIRECT UTILITY FUNCTION U ( P x , P y , M ) = max { U ( x, y ) | P x x + P y y M } U ( x , y ) = = U ( D x ( P x , P y , M ) , D y ( P x , P y , M ) ) PROPERTIES OF U : (1) No money

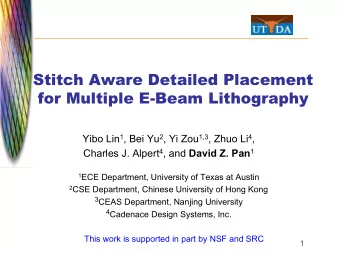

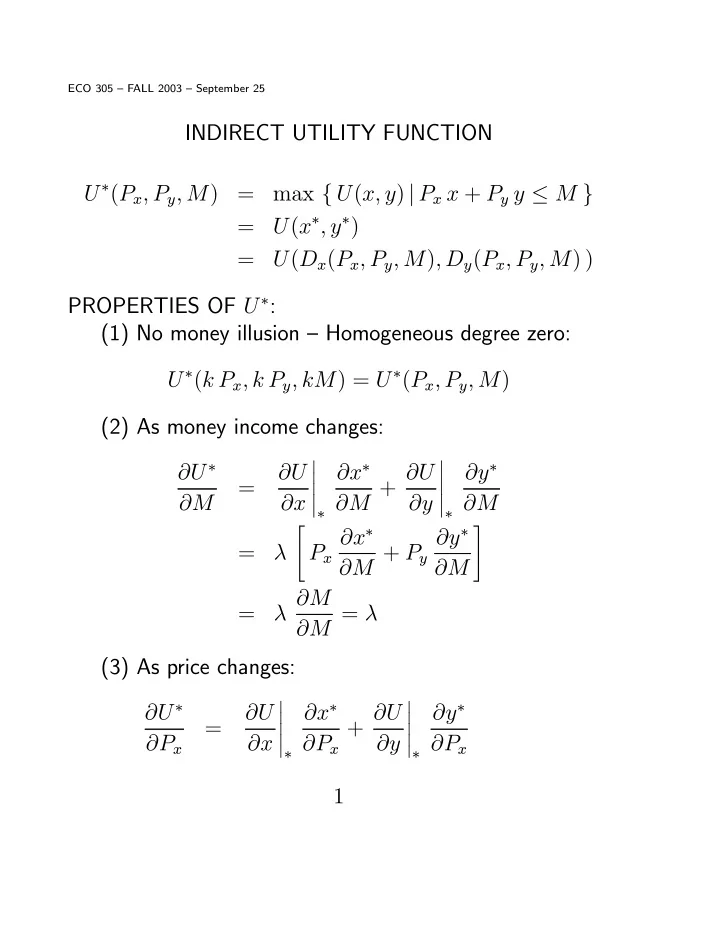

ECO 305 — FALL 2003 — September 25 INDIRECT UTILITY FUNCTION U ∗ ( P x , P y , M ) = max { U ( x, y ) | P x x + P y y ≤ M } U ( x ∗ , y ∗ ) = = U ( D x ( P x , P y , M ) , D y ( P x , P y , M ) ) PROPERTIES OF U ∗ : (1) No money illusion — Homogeneous degree zero: U ∗ ( k P x , k P y , kM ) = U ∗ ( P x , P y , M ) (2) As money income changes: ¯ ¯ ¯ ¯ ∂ U ∗ ∂ x ∗ ∂ y ∗ ∂ U ∂ M + ∂ U ¯ ¯ = ¯ ¯ ¯ ¯ ∂ M ∂ x ∂ y ∂ M ∗ ∗ " # ∂ x ∗ ∂ y ∗ = λ P x ∂ M + P y ∂ M λ ∂ M = ∂ M = λ (3) As price changes: ¯ ¯ ¯ ¯ ∂ U ∗ ∂ x ∗ ∂ y ∗ ∂ U + ∂ U ¯ ¯ = ¯ ¯ ¯ ¯ ∂ P x ∂ x ∂ P x ∂ y ∂ P x ∗ ∗ 1

" # ∂ x ∗ ∂ y ∗ = λ P x + P y ∂ P x ∂ P x − λ x ∗ (just like M ↓ by x ∗ ) = (Last step: di ff erentiate adding-up identity w.r.t. P x : P x x ∗ + P y y ∗ = M ∂ x ∗ ∂ y ∗ x ∗ + P x + P y = 0 ) ∂ P x ∂ P x Divide price- and income-change equations : Roy’s Identity: x ∗ = − ∂ U ∗ / ∂ P x ∂ U ∗ / ∂ M (4) Contours of U ∗ in ( P x , P y ) space with M fi xed: (Like theater with stage at NE corner) 2

EXPENDITURE FUNCTION Solve the indirect utility function for income: u = U ∗ ( P x , P y , M ) M = M ∗ ( P x , P y , u ) ⇐ ⇒ M ∗ ( P x , P y , u ) = min { P x x + P y y | U ( x, y ) ≥ u } “Dual” or mirror image of utility maximization problem. Economics — income compensation for price changes Optimum quantities — Compensated or Hicksian demands x ∗ = D H y ∗ = D H x ( P x , P y , u ) , y ( P x , P y , u ) PROPERTIES OF M ∗ : (1) Homogeneous degree 1 in ( P x , P y ) holding u fi xed: M ∗ ( k P x , k P y , u ) = k M ∗ ( P x , P y , u ) (2) Hotelling’s or Shepherd’s Lemma — Compensated demands partial derivatives w.r.t. prices: D H x ( P x , P y , u ) = ∂ M ∗ / ∂ P x , D H y ( P x , P y , u ) = ∂ M ∗ / ∂ P y Proof: M ∗ = P x D H x + P y D H y , u = U ( D H x , D H y ) . So ∂ M ∗ / ∂ P x D H x + P x ∂ D H x / ∂ P x + P y ∂ D H = y / ∂ P x U x ∂ D H x / ∂ P x + U y ∂ D H 0 = y / ∂ P x λ [ P x ∂ D H x / ∂ P x + P y ∂ D H = y / ∂ P x ] 3

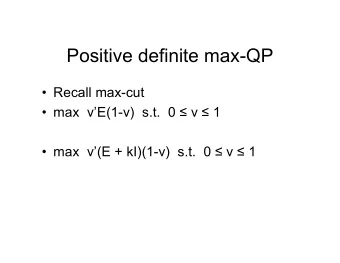

(3) “Weakly” concave in ( P x , P y ) holding u fi xed. Cobb-Douglas example: ( P x ) 1 / 3 ( P y ) 2 / 3 PROPERTIES OF HICKSIAN DEMAND FUNCTIONS: (1) Own substitution e ff ect negative: ¯ ¯ = ∂ D H = ∂ 2 M ∗ ∂ x ¯ x ≤ 0 ¯ ¯ ∂ P 2 ∂ P x ∂ P x u = const x (2) Symmetry of cross-price e ff ects: = ∂ D H ∂ D H ∂ 2 M ∗ y x = ∂ P y ∂ P x ∂ P y ∂ P x (Net) substitutes if > 0 , complements if < 0 General concept : Comparative statics 4

COBB-DOUGLAS EXAMPLE (Direct) UTILITY FUNCTION: U ( x, y ) = α ln( x ) + β ln( y ) , α + β = 1 x ∗ = α M/P x , y ∗ = β M/P y INDIRECT UTILITY FUNCTION U ∗ ( P x , P y , M ) = α [ln( α ) + ln( M ) − ln( P x ) ] + β [ln( β ) + ln( M ) − ln( P y ) ] = junk + ln( M ) − α ln( P x ) − β ln( P y ) Roy’s Identity: − ∂ U ∗ / ∂ P x ∂ U ∗ / ∂ M = − − α /P x = α M = x ∗ 1 /M P x EXPENDITURE FUNCTION M ∗ = M ∗ ( P x , P y , u ) = e u ( P x ) α ( P y ) β Hicksian demand functions x H = α e u ( P x ) α − 1 ( P y ) β , y H = β e u ( P x ) α ( P y ) β − 1 5

SLUTSKY EQUATION Link between Marshallian and Hicksian demands Equal if u = U ∗ ( P x , P y , M ) , M = M ∗ ( P x , P y , u ) . For good i where i may be either x or y , D H i ( P x , P y , u ) = D M i ( P x , P y , M ∗ ( P x , P y , u ) ) Now let P j change, where j may be x or y ∂ D H ∂ D M + ∂ D M ∂ M ∗ i i i = ∂ P j ∂ P j ∂ M ∂ P j ∂ D M + ∂ D M i i D H = j ∂ P j ∂ M ∂ D M + ∂ D M i i D M = j ∂ P j ∂ M For example ¯ ¯ ¯ ¯ ∂ x = ∂ x + y ∂ x ¯ ¯ ¯ ¯ ¯ ¯ ∂ P y ∂ P y ∂ M u = const M = const Price derivative of compensated demand = Price derivative of uncompensated demand + Income e ff ect of compensation. If i = j , LHS is negative. Then Gi ff en implies Inferior 6

Recommend

More recommend

Explore More Topics

Stay informed with curated content and fresh updates.