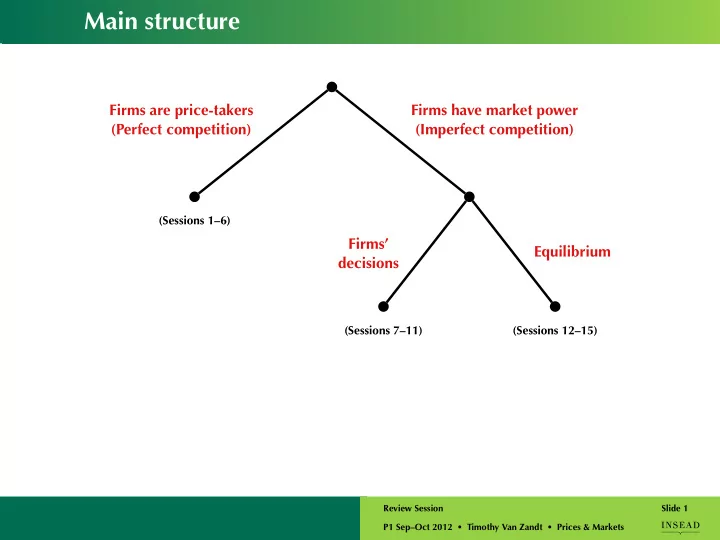

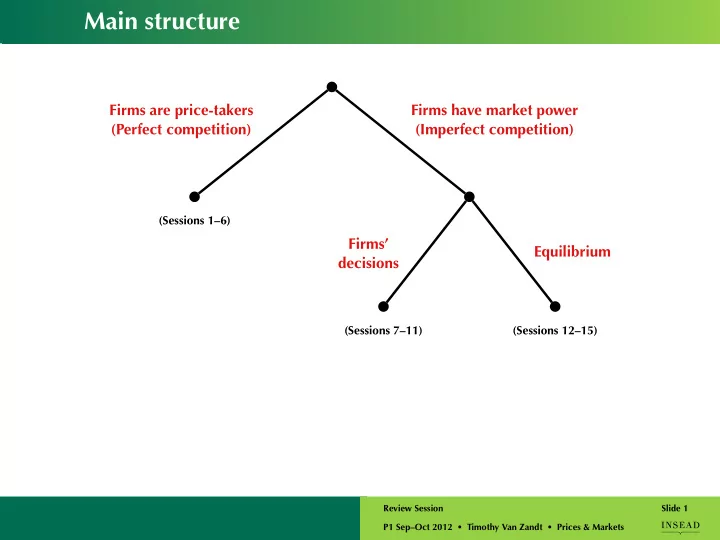

Main structure Firms are price-takers Firms have market power (Perfect competition) (Imperfect competition) (Sessions 1–6) Firms’ Equilibrium (Firms’ decisions decisions & equilibrium) (Sessions 7–11) (Sessions 12–15) In each case: fixed firms in the market, then entry/exit Review Session Slide 1 P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets

Key ideas on imperfect competition Imperfect competition Entry Fixed firms in market & exit Firms’ Equili- Firms’ Equilibrium decisions brium decisions MC = MR Nash eqm. V Π > FC? Each active firm has ⇓ economic profit ≥ 0 . P, Q No potential entrant could make economic profit > 0 by entering. Review Session Slide 2 P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets

And their analogues for perfect competition Perfect competition Entry Fixed firms in market & exit Firms’ Equili- Firms’ Equilibrium decisions brium decisions MC = MR = P V Π > FC? s(P) = d(P) Each active firm has ⇓ P > AC u ? economic profit ≥ 0 . s i (P) No potential entrant could make economic profit > 0 by entering. Review Session Slide 3 P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets

Prices with imperfect competition $ 25 20 P π 15 MC 10 d ( P ) 5 20 40 60 80 100 120 140 160 Q π Q MR Pricing reflects both marginal cost and a markup. Review Session Slide 4 P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets

Advantage of the model of perfect competition? There are no mark-ups, so we can isolate the effects of cost on prices. … with a remarkably simple 2-dimensional picture: supply=demand . Review Session Slide 5 P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets

� � Price after a shift in demand: perfect competition € 90 60 s ( P ) 30 d new ( P ) d ( P ) Q 3000 6000 9000 Review Session Slide 6 P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets

Reasons for the upward sloping supply curve? 1. Increasing marginal cost of firms in the market. • Particularly pronounced in the short-run, hence the lower elasticity of short-run supply and the greater short-run volatility of prices. 2. Increasing minimum average cost of subsequent entrants (entry by heterogeneous firms). 3. Increasing cost of key inputs $ 60 (example: cranberry bogs) s ( P ) 50 40 P ∗ 30 Producer surplus 20 d ( P ) 10 Total cost 100 200 300 400 500 600 700 800 900 Q Q ∗ Review Session Slide 7 P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets

� � Price after a shift in demand: perfect competition € 90 60 s ( P ) 30 d new ( P ) d ( P ) Q 3000 6000 9000 Change in price is due entirely to increasing marginal costs (of existing firms, of new entrants, or of scarce inputs). Review Session Slide 8 P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets

Session 8: Pricing with Market Power 1. The firm’s “pricing” problem: MC = MR . 2. Profit-maximization versus social efficiency. 3. Exit and entry. 4. Social efficiency with a LR fixed cost. Review Session Slide 9 P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets

Once upon a time, on some exam … You manage the Zenith, a venue for concerts in Paris. You have signed a contract with a band called “Tool” for a concert on December 10. The contract specifies that the band receives €60,000 plus €12 per ticket sold. Assume that you have additional (constant) marginal costs of €8 per ticket sold and that you are not capacity constrained. The demand curve for the concert is Q = 8,000 − 100 P . a . What price should you charge? Review Session Slide 10 P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets

b . Suppose that Trent Reznor, a musician, has offered to join the concert to perform together with Tool. His presence would cause demand at any price to double. Reznor wants a fixed payment that does not depend on the number of tickets sold. What is the maximum amount you would be willing to pay him? Review Session Slide 11 P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets

Session 9: How pricing depends on demand 1. Useful formula: � � 1 − 1 MR = P E 2. Price-sensitivity effect: (Assuming constant marginal cost …) If demand becomes less price sensitive, then the firm should raise its price. 3. Volume effect: (Keeping price-sensitivity constant …) If a firm has increasing marginal cost and the volume of demand goes up, then the firm should raise its price. Review Session Slide 12 P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets

Session 10: Explicit price discrimination Bottom line: • Equate MR across market segments. • Charge higher price to segment with less elastic demand. Review Session Slide 13 P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets

Once upon a time, on some exam … A pharmaceutical firm sells a patented drug in Hong Kong and Taiwan. It produces the drug with constant marginal cost in a plant in Singapore and transportation costs for delivering the drug to Hong Kong and Taiwan are the same. The drug sells for 30 in Hong Kong and 20 in Taiwan (prices in $US). Recent estimates have shown that the elasticity of demand is 2 for the Hong Kong market and 5 for the Taiwanese market. You are told that the price is set correctly (i.e., maximizes profit) for the Taiwanese market. Show that the price is not correct for the Hong Kong market. In which direction should the firm adjust its price? Review Session Slide 14 P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets

Session 11: Implicit price discrimination (Screening) 1. Perfect price discrimination (benchmark) 2. Screening via differentiated products 3. Bundling Review Session Slide 15 P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets

FPM Ex. 11.8 Zahra sells a good with unit demand. She has constant MC = 5 . Zahra has perfect information about her customers’ valuations. But she is initially prohibited by law from price discrimination. She chooses to charge $10, which results in sales to 10,000 customers. She calculates that these customers obtain a total of $50,000 in consumer surplus. Then the regulation is lifted and she engages in perfect price discrimination. Based on this limited information, what can you say about … > 10,000 (a) how many customers she will sell to? (all her old customers plus more) 5 and up (b) what range of prices she will charge? (down to her MC) > 50,000 (c) how much her profit will go up by? (prior consumer surplus + deadweight loss) Review Session Slide 16 P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets

Sample Exam 3, Problem 17 (Bundling) You are a monopolist selling two different types of concert tickets. You have zero marginal cost and hence your objective is to maximize revenue. You face three groups of potential customers, with an equal number of customers in each group. The following table summarizes the valuation of each group for each concert. (Each customer’s valuation of going to both concerts is just the sum of his individual valuations.) Valuation Type Rock World A 5 60 B 35 65 C 40 70 Review Session Slide 17 P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets

Sample Exam 3, Problem 17 (Bundling) (Continued) Valuation Bundle Type Rock World 65 A 5 60 100 B 35 65 110 C 40 70 (a) Pure bundling: What is the optimal price for the bundle of both tickets? What is your profit? See valuations of bundle above. Possible price points are 65, 100, and 110, yielding revenue (profit) 195, 200, and 110. So optimal bundle price is 100 for a profit of 200. (b) Mixed bundling: Find one mixed bundle pricing strategy that gives you higher profit than your answer with pure bundling. Offer World ticket alone for 60; sell this to A. Offer bundle for 95; sell this to B and C. (Price has to leave surplus of at least 5 for type B and 10 for type C, so that they do not prefer the single ticket. Total profit is 60 + 2 × 95 = 240 . Review Session Slide 18 P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets

With 4 sessions on game theory … Tools/concepts that go beyond our applications to pricing and competition Session 12: Static Games and NE Basic and universal tools. Session 13: Imperfect Competition Core session Price and quantity competition: static games. vis-à-vis the framework. Session 14: Explicit and Implicit Cooperation How—and why—to explicitly or implicitly cooperate. Session 15: Strategic Commitment How timing and commitment matter. Review Session Slide 19 P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets

Session 12: Static Games and Nash Equilibrium 1. Players, actions, payoffs. 2. Best responses. 3. Dominant strategies. 4. Nash equilibrium. Review Session Slide 20 P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets

Session 13: Price competition with fixed firms 1. Each firm’s decision is same as pricing with market power: Topics 8&9 2. Goods are substitutes ⇒ prices are strategic complements (Always with linear demand; almost always in real life.) 3. Interaction captured by Nash equilibrium Each firm’s price maximizes its own profit given price of the other firm. Review Session Slide 21 P1 Sep–Oct 2012 • Timothy Van Zandt • Prices & Markets

Recommend

More recommend