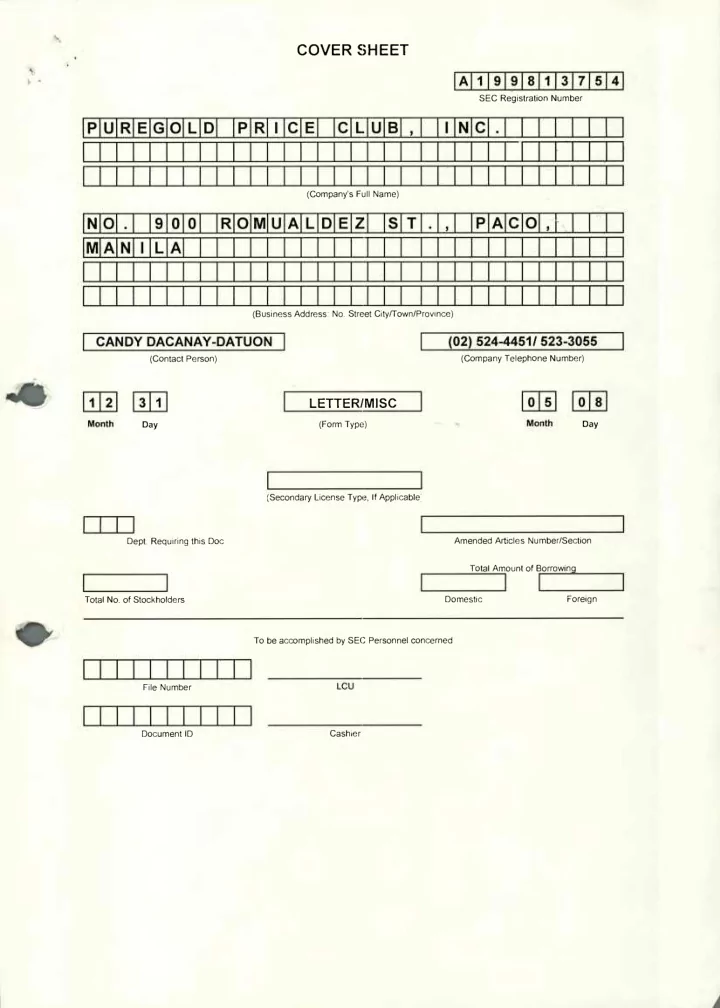

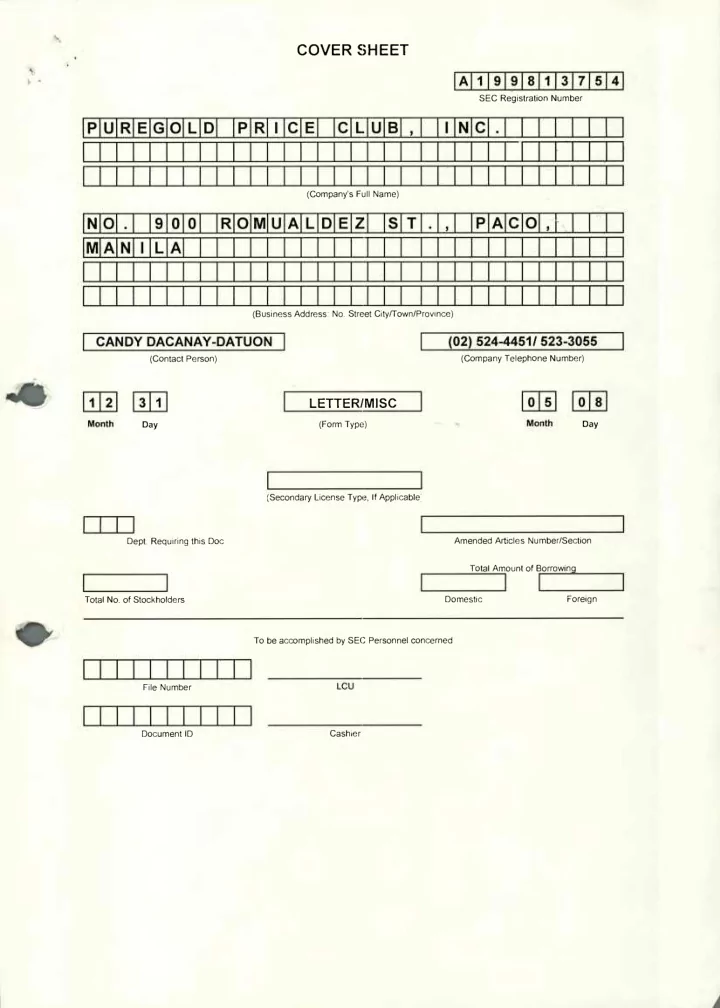

COVER SHEET A 1 9 9 8 1 3 7 5 4 SEC Registration Number i E C L. U B � P U R E G O L D P R C N C (Company's Full Name) R O M U A L D E S T P A C O N O 9 0 0 A N A M L (Business Address: No. Street City/Town/Province) CANDY DACANAY-DATUON (02) 524-4451/ 523-3055 (Contact Person) (Company Telephone Number) 1 2 3 LETTER/MISC 0 5 0 8 (Form Type) Month � Day Month � Day (Secondary License Type, If Applicablej Dept. Requiring this Doc Amended Articles Number/Section Total Amount of Borrowing Total No. of Stockholders Domestic Foreign To be accomplished by SEC Personnel concerned File Number LCU Document ID Cashier

PUREG OLD SEC - FIRAD 30 April 2012 APR 3 0 2012 1 2 Director Justina F. Callangan It% • Corporate Finance Division • ,c .r; SECURITIES AND EXCHANGE COMMISSION SEC Building, EDSA, Greenhills, Mandaluyong City, Metro Manila Attention: Ms. Trixie Posadas. SEC Analyst Dear Director Callangan: Please be informed that Puregold Price Club, Inc. (PGOLD) conducted an Investors Presentation on 26 April 2012 at Singapore and on 27 April 2012 at Hongkong. Enclosed herewith is the presentation material which PGOLD used during the said Investors' Presentation. Thank you. Very truly yours, ATTY. CANDY H ACANAY-DATUON Compliance Offic 2nd Floor Tabacalera Bldg., 900 D. Romualdez St., Paco, Manila, Philippines, 1007 Telefax No.: (632) 523-3055

9 PUREGOLD PRICE CLUB, INC. Investor Presentation 26-27 April 2012

Disclaimer PUREGOLD These presentations and/or other documents have been written and presented by Puregold Price Club, Inc. (PGOLD). PGOLD is solely responsible for the accuracy and completeness of the contents of such presentations and/or other documents. The materials and information in the presentations and other documents are for informational purposes only, and are not an offer or solicitation for the purchase or sale of any securities or financial instruments or to provide any investment service or investment advice. 2

PUREGOLD , Always Panalo! 5a 1. Update on Puregold

Business vision and mission PUREGOLD "To be the most customer-oriented hypermarket offering one-stop shopping convenience and best value for money to our Customers" Sa PUREGOLD, Always Panalo! The mission of our company is to: 111* Commit to profitable growth and results for our stockholders 1111* Provide products, services and business opportunities to every Filipino family 1111I � Establish lasting relationships with our suppliers and business partners Strive to promote the personal and professional development of our employees 4

History and development � PUREGOLD Stores roll-out through the years 150 125 100 62 41 30 20 16 3 1 1998 � 2001 � 2006 � 2007 � 2008 � 2009 � 2010 � 2011 � 2012 Target 2013 Target First store Expansion Brand recognition Market leadership Rapid expansion Continuing new • Opened in • Launched loyalty • Reader's Digest • The 2nd largest • Highest number of store stores roll-out Mandaluyong program in 2001; Asia's "Most hypermarket and openings in history, • Targets to open City, Metro Manila renamed as Trusted Brands" supermarket opening 38 new stores twenty five (25) Tindahan ni Aling retailer in the • Retail Asia's one of Top new stores in Puring in 2004 Philippines in 500 Retailers in ASPAC each of 2012 terms of net sales • Between 2002 and region and 2013 2006, launched an average of 3 new stores every year First format New format New format and expanded introduction introduction introduction operations in North PUREGOLD and South Luzon PUREGOLD PUREGOLD 1 , 1:1( � ( I LB I.( 1'1 AtMARKE Rapid store expansion from 1 to 100 stores in 13 years 5

Operating Statistics Q1 2012 PUREGOLD P sy REGOL I P 4 c p PUREGOLD PRICE CLUB, INC. Formats Hypermarket Supermarket Discounter No. of stores 62 28 11 Net selling area (sqm) 186,158 25,436 4,528 Avg. net selling space (sqm) 3,003 908 412 Supermarket (Junior) 11.8% Hypermarket (Price Net selling area composition Club) Discounter (Extra) 86.1% 2.1% No. of stock-keeping units (SKUs) 30,000 — 50,000 Up to 8,000 � 1,500 — 2,000 Close proximity to major Locations Residential areas � Residential areas intersections and transportation hubs Retail consumers (65%) & Customer targets Retail consumers Re-sellers and retail consumers re-sellers (35%) Non-food 411 Non-food Non-food 20% 25% 26% Wide Product Distribution Food Food Food 74% 75% 80% 6

Store Portfolio Q1 2012 PUREGOLD 101 Caloocan BULACAN 0 31 cities and 24 Presence in Valenzuela municipalities Quezon City Net selling M 216,122 sqm Navotas Malabon area Caloocan Marikina 62 IMP Mandaluyong RIZAL Number of retail outlets 17 Pasig MID Pateros 13 Taguig 28 —1 - dt-- I 4 4 32 11 Mindanao ler Laguna de Bay #PUREGOLD PUREGOLD PUREGOLD PRICE (1 t'R. INC. � PFRNIARKI I LAGUNA South Luzon � ■ Metro Manila � North Luzon � Area with Puregold store coverage 7

Store Rollout PUREGOLD Per format location distribution of 38 new stores in CY 2011 Expansion in net selling area 3 2 29% 2 8% 5 9 8 4 17 of 12 of 9 of PUREGOLD PUREGOLD PUREGOLD 35,953 sqm. 48,280 sqm. PR � ( I L'IL INC. SUPIRMARkl I OP - • Metro Manila North Luzon South Luzon • CY 2010 CY 2011 8

Store Rollout � PUREGOLD ■ ■ Hypermarket � Hypermarket � Junior � Extra � Junior � Extra 2 1 8 4 1 13 2 6 3 2 3 2 2 in 1 2 2 10 2010 2Q 2010 30 2010 40 2010 � 10 2011 2Q 2011 3Q 2011 4Q 2011 9

Financial Performance CY 2011 PUREGOLD PUREGOLD PUREGOLD PUREGOLD SUPERMARKET PRICE CLUB, INC. Format Hypermarket Supermarket Discounter No. of stores 61 � 28 11 4,694.7 Net sales per format (PHP million) 33,556.5 � 736.7 Supermarket (Junior) 12.0% Hypermarket (Price Revenue contribution club) Discounter (Extra) 86.1% 1.9% Gross profit per format 4,668.7 (13.9%) 766.3 (16.3%) 99.8 (13.6%) (PHP million) Sales per square meter (PHP) 181,609 � 184,572 162,687 Total traffic (million) 52 14 2 Average net ticket (PHP) 642 329 340 Net sales growth (%) 22 � 96 1,620 Traffic growth (%) 17 78 � 2,097 Average net ticket growth (%) 4 11 � -22 Like-for-like net sales growth (%) 6 � 14 Like-for-like traffic growth (%) 1 � 8 Like-for-like average net ticket 5 � 6 growth (%) 10

Financial Performance Q1 2012 PUREGOLD PUREGOLD PUREGOLD PUREGOLD SUPERMARKET PRICE ( I LIB, INC. Format Hypermarket Supermarket Discounter No. of stores 62 28 11 Net sales per format (PHP million) 8,912.7 � 1,539.7 288.0 upCI I II l (Junior) 14.3% Revenue contribution Hypermarket (Price Discounter (Extra) club) 2.7% 83.0% Gross profit per format 1,448.2 (16.2%) 253.0 (16.4%) 40.1 (13.9%) (PHP million) Sales per square meter (PHP) 47,877 60,533 63,597 Total traffic (million) 14.3 4.7 � 1.0 Average net ticket (PHP) 623 330 302 Net sales growth (%) 22 78 � 226 Traffic growth (%) 20 71 289 Average net ticket growth (%) 2 4 � -16 Like-for-like net sales growth (%) 4 12 � 28 Like-for-like traffic growth (%) -2 7 � -12 Like-for-like average net ticket 6 5 � 45 growth (%) 11

Financial Performance PUREGOLD Revenues Gross profit PHP billion PHP billion 5.5 39.0 29.1 3.5 24.1 16.2% 16.0% 1.7 10.7 1.3 8.2 WIMPA MIN CY 2009 � CY 2010 � CY 2011 � Q1 2011 � Q1 2012 CY 2009 � CY 2010 � CY 2011 Q1 2011 Q1 2012 Gross profit � Gross margin (%) • Strong revenue growth driven by continuing store roll out • Scale of operations resulted to stronger support from suppliers in terms of discount and rebates • Gross margins have improved from 9.2% to 14.2% in 2011 Note: Puregold Junior results were consolidated from 2H 2010 onwards 12

Financial Performance PUREGOLD Selling expenses General and administrative and Other operating expenses PHP million PHP million 10.7% 9 . 9% 9 . 3% � 803 9.2% 8.6% 3,568 631 2,696 2.4% 2.3% 2.2% 2,082 249 1,147 195 817 CY 2009 CY 2010 � CY 2011 � Q1 2011 � Q1 2012 CY 2009 � CY 2010 � CY 2011 Q1 2011 Q1 2012 G&A and other operating expenses � % of revenues Selling expenses � % of revenues Note: Puregold Junior results were consolidated from 2H 2010 onwards 13

Financial Performance PUREGOLD Net income PHP million PHP million 2,216 4.6% 1,545 4.4% 6.50% 5.90% 633 534 CY 2009 � CY 2010 � CY 2011 � Q1 2011 � Q1 2012 CY 2009 � CY 2010 � CY 2011 Q1 2011 � Q1 2012 Operating income Operating margin (%) Net income Net margin (%) Note: Puregold Junior results were consolidated from 2H 2010 onwards 14

Financial Performance � PUREGOLD 44.8 45.0 44.4 41.5 40.5 34.3 32.3 31.5 3.6 2.7 2.6 2.3 CY 2009 � CY 2010 CY 2011 Q1 2012 ■ Trade receivables tummr days Inventory turnover days � Trade payables turnover days Notes: Average of inventory at the beginning and end of the period / cost of sales x 363 (for full year) or x 91 (for Q1) Average of trade receivables at the beginning and end of the period / net sales x 363 (for full year) or x 91 (for Q1) Average of trade payable at the beginning and end of the period / cost of sales x 363 (for full year) or x 91 (for Q1) 15

Recommend

More recommend