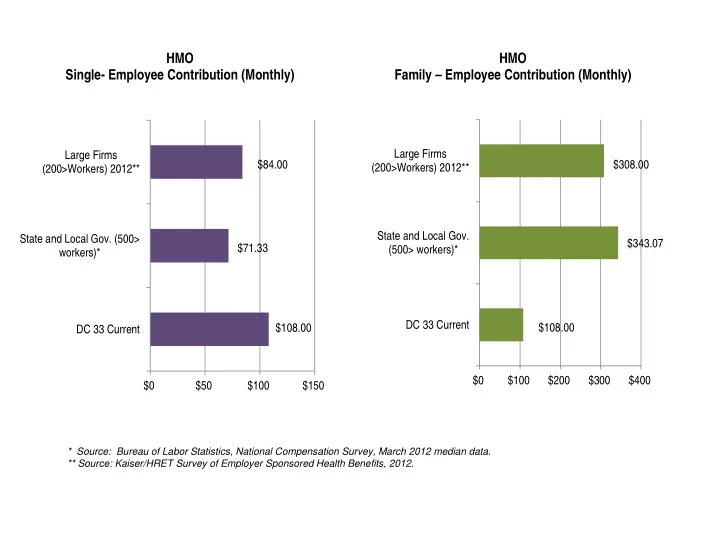

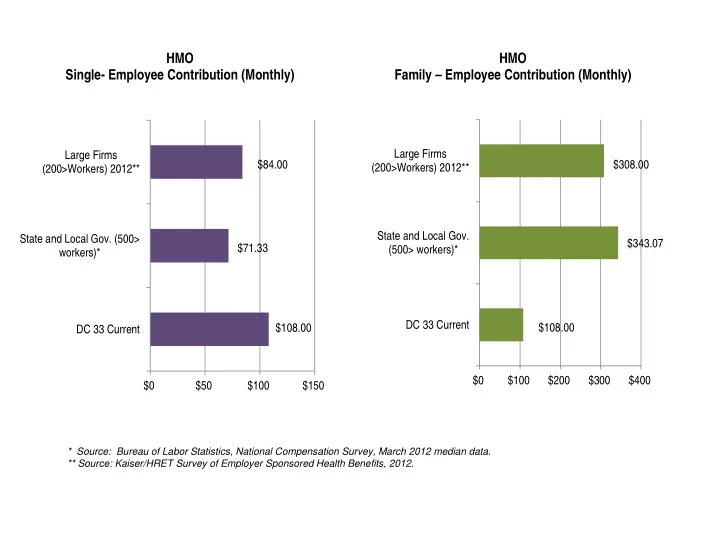

HMO HMO Single- Employee Contribution (Monthly) Family – Employee Contribution (Monthly) Large Firms Large Firms $84.00 $308.00 (200>Workers) 2012** (200>Workers) 2012** State and Local Gov. State and Local Gov. (500> $343.07 $71.33 (500> workers)* workers)* DC 33 Current $108.00 $108.00 DC 33 Current $0 $100 $200 $300 $400 $0 $50 $100 $150 * Source: Bureau of Labor Statistics, National Compensation Survey, March 2012 median data. ** Source: Kaiser/HRET Survey of Employer Sponsored Health Benefits, 2012.

Employee Pension Contribution (% of Pay) State and Local Governmnts (500> workers)*** City Proposal** Current* 6.40% Plan 87 3.20% 1.93% 6.40% Plan 67 6.00% 3.75% * Municipal plan only. Plan 67 assumes earnings below the Social Security maximum. Employees currently pay 6% on earnings above the Social Security maximum. Plan 87 contribution is 30% of normal cost based on the March 2012 valuation report. ** Municipal plan only. Plan 67 assumes normal cost of no more than 12%. Plan 87 contribution is 50% of normal cost based on the March 2012 valuation report. *** Source: Bureau of Labor Statistics, National Compensation Survey, March 2012 median data for all workers.

Cash compensation (wages/longevity/overtime) $46,000 $44,844 $45,000 $44,000 $42,838 $42,869 $43,000 $42,000 $41,272 $41,000 $40,000 $39,000 City Current for DC 33 City Proposed for DC 33 Civilian Private Industry employees Source: BLS Employer Cost of Employee Compensation September 2012. Each series used all employees data. Civilian includes state and local government employees. All data annual based on full-time employees (2080 hours).

Employer Health Care Cost $16,000 $13,659 $14,000 $11,709 $12,000 $10,109 $10,000 $8,000 $5,450 $6,000 $4,659 $4,000 $2,000 $0 City Current for City Proposed State and Local Civilian Private Industry DC 33 for DC 33 Government employees Source: BLS Employer Cost of Employee Compensation September 2012. Each series used all employees data. Civilian includes state and local government employees. All data annual based on full-time employees (2080 hours).

Employer Retirement Cost Total $10,167 $7,654 $2,974 $2,163 $12,000 $10,000 $8,000 $666 $6,000 $4,000 $1,165 $2,000 $1,248 $10,167 $6,989 $1,810 $915 $0 City Current for DC 33 State and Local Civilian Private Industry Government Employer Retirement Cost for Defined Contribution Plans Employer Retirement Cost for Defined Benefit Plans Source: BLS Employer Cost of Employee Compensation September 2012. Each series used all employees data. Civilian includes state and local government employees. All data annual based on full-time employees (2080 hours). City current is based on March 2012 valuation report for municipal /elected plan.

Recommend

More recommend