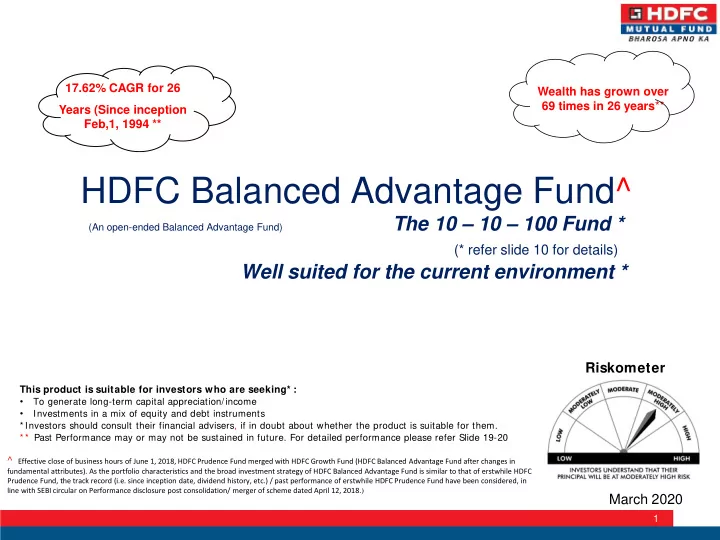

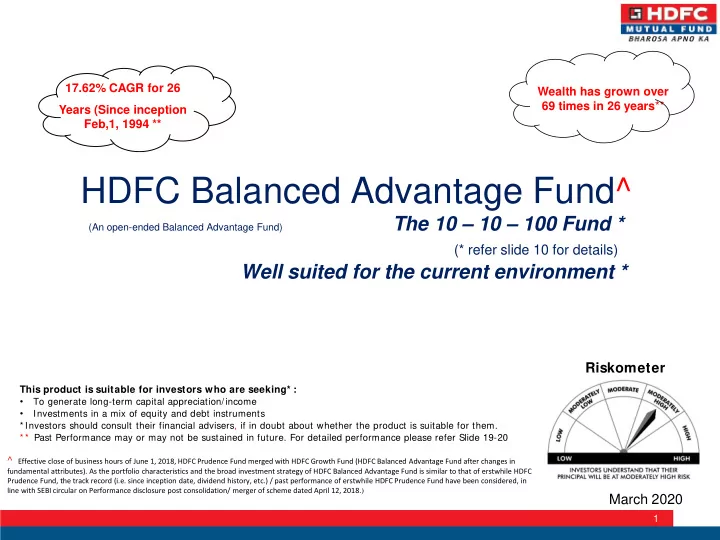

17.62% CAGR for 26 Wealth has grown over 69 times in 26 years ** Years (Since inception Feb,1, 1994 ** HDFC Balanced Advantage Fund^ The 10 – 10 – 100 Fund * (An open-ended Balanced Advantage Fund) (* refer slide 10 for details) Well suited for the current environment * Riskometer This product is suitable for investors who are seeking* : • To generate long-term capital appreciation/income • Investments in a mix of equity and debt instruments * Investors should consult their financial advisers, if in doubt about whether the product is suitable for them. * * Past Performance may or may not be sustained in future. For detailed performance please refer Slide 19-20 ^ Effective close of business hours of June 1, 2018, HDFC Prudence Fund merged with HDFC Growth Fund (HDFC Balanced Advantage Fund after changes in fundamental attributes). As the portfolio characteristics and the broad investment strategy of HDFC Balanced Advantage Fund is similar to that of erstwhile HDFC Prudence Fund, the track record (i.e. since inception date, dividend history, etc.) / past performance of erstwhile HDFC Prudence Fund have been considered, in line with SEBI circular on Performance disclosure post consolidation/ merger of scheme dated April 12, 2018. ) March 2020 1

HDFC Balanced Advantage Fund – Aims at an optimal Debt / Equity Mix Current market environment is characterized by • Attractive equity market valuations and positive equity markets outlook (Refer slide 4) • Healthy Dividend Yields : With removal of DDT in current budget, Dividend Yields are likely to improve further. • Strategic sale route for PSU divestment. ETF route to be less preferred & Removal of DDT– Positives for PSUs (Refer slide 6) • Attractive credit spreads – Corporate Bonds spreads look attractive over 3Y Gsec’s • Low Interest rates which are positive for equities (Refer slide 5), Fund is overweight in Equities currently (Refer slide 16) HDFC Balanced Advantage Fund has a proven track record of more than 26 years since inception (February 1, 1994) across market cycles, several crises, bubbles, market excesses etc. Scheme has generated CAGR of ~ 18% since scheme inception vs ~ 9% CAGR of S&P BSE SENSEX during the same period ( As of 29 th Feb 2020) ^ Refer disclaimers on slide 21. For complete performance please refer slide no.19-20 ^ S&P BSE SENSEX used for comparison as Benchmark (NIFTY 50 Hybrid Composite 65:35 Index) and Additional Benchmark (NIFTY 50 TRI) are not available since inception of the scheme (Feb 01, 1994) 2

HDFC Balanced Advantage Fund – A fund that has performed across market cycles, crises, market bubbles etc. ! Period Event Market Reaction / Correction 9,000 Value of Rs 100 invested in 1994 HDFC Balanced Advantage Fund - Reg - July 97 - Sensex down 35%, INR depreciated Asian Crisis 8,000 Growth(Adjusted-NAV) Nov 98 by 19%, Crude down by 45% NIFTY 50 Hybrid Composite Debt 65:35 Index* Feb 00 - Sensex down 46%, IT Index down 7,000 Tech Bubble Apr 01 83% S&P BSE SENSEX 6,000 Sensex down 52%, Real Estate Index Dec 07 - down 88%, Power, Capital Goods Lehman crisis, GFC 5,000 Mar 09 indices down 60-65%, Crude down 48% 4,000 Dec 10 - PIIGS, European crisis Sensex down 25%, Capital Goods, Mar 11 Metal indices down 45-50% 3,000 Oct 15 - Correction in Pharma Auto Index down 31%, largest Pharma Sep 19 sector company in India down 55% 2,000 25% correction in Midcap Index, 1,000 Dec 17 - Correction in Midcaps / Smallcap down 34%. Auto Index down Jul 19 Smallcaps, Auto 42%, - 94 95 96 97 98 99 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 18 19 20 Dec 17 - NBFC Crisis Banks / NBFCs down 60-90%, Dec 19 HDFC Balanced Advantage Fund has navigated through market cycles, crises, market excesses etc. with its disciplined approach to investing, focus on long term & effective portfolio diversification. It has generated a CAGR return of ~ 18% vs BSE SENSEX return of ~9% since inception of the scheme (i.e. February 1, 1994). HDFC Balanced Advantage Fund NAV is up ~ 69 times since inception in Feb 94’ vs BSE SENSEX which is up ~ 10 times in the same period. (As of 29 th February 2020) ^ * Since Sep’01 (Inception date of NIFTY 50 Hybrid Composite 65:35 Index) , HDFC Balanced Advantage Fund NAV is up ~ 29 times vs ~ 10 times for benchmark (NIFTY 50 Hybrid Composite 65:35 Index) during the same period.. ^ S&P BSE SENSEX used for comparison as Benchmark (NIFTY 50 Hybrid Composite 65:35 Index) and Additional Benchmark (NIFTY 50 TRI) are not available since inception of the scheme (Feb 01, 1994). For detailed performance, please refer Slide 19-20. Refer disclaimers on slide 21 3

Indian equities – Attractive Valuations Table 1 – Periods when10 year NIFTY Return trailed / exceeded • Over the long term, stock market indices in India are growing around the same rate as the Nominal GDP Growth materially nominal GDP Nominal GDP Previous 10 year Next 10 year Growth Year NIFTY Return NIFTY Return ‒ Historically, whenever indices have grown significantly less than nominal GDP in any (Previous 10 (CAGR) (CAGR) year CAGR) extended period of, say 10 years, they have delivered higher returns in next 10 years 2001 7% 13% 16% 2002 4% 13% 18% & vice versa. Interestingly, we are in a similar situation presently (Table 1 grown 2003 6% 12% 13% 2004 6% 12% 15% significantly less) 2006 16% 12% 8% 2007 19% 12% 6% 2016 8% 14% ? 2017 6% 13% ? 2018 14% 13% ? 2019 9% 13% ? India market cap to GDP ratio, calendar year-ends 2005-21E (%) • Marketcap to GDP at 61% and CY21(E) P/E of ~15x is attractive, specially at a time when NIFTY50 profit growth is estimated at 18% CAGR over FY19-22E and interest rates are low • 1Y-Forward NIFTY 50 Earning yield [ i.e. 100/ (one year forward P/E) ] less 10Y Gsec yield is ~ (0.4%) vs 10 year average of (1.7%). This indicates that equities are attractively valued relative to current bond yields. Low Marketcap to GDP, Bond yields equal to Earnings yield and recovery in profit growth make us optimistic on equity markets over medium to long term Source: Kotak Institutional Equities, updated till 3 rd March 2020, From 2005-18, NIFTY50 PE is based on 12 month forward estimated EPS. For 2019E, by Kotak Institutional Equities has calculated PE based on EPS numbers as of Mar-20 end, 2020E based on EPS of Mar-21 end and for 2021E based on EPS of Mar-22 end. Refer disclaimers on slide 21 4

Lower interest rates: Positive for equities • Equities benefit in several ways from lower interest rates: • Lower interest rates mean lower interest expense & higher profits • Lower interest rates imply higher fair P/E multiples • Lower interest rates improve economic growth prospects • HDFC Balanced Advantage Fund with an overweight position in equities is positioned well for current environment with a medium to long term view. “ Low rates reduces the discount factor used in calculating the net present value of future cash flows. Thus, all else being equal, there is a direct connection between declining interest rates and rising asset prices ” – Howard Marks Refer disclaimers on slide 21 5

Underperformance of PSUs – Is this an Opportunity ? 12,000 45,000 • BSE PSU Index was performing broadly in line with/ outperforming the BSE Sensex BSE PSU index 40,000 Index for 18 years from 2000 to end 2017 (see adjacent chart). However, since then in last 2 10,000 SENSEX (RHS) 35,000 years there has been sharp divergence with BSE PSU Index underperforming by 50% vs BSE 8,000 30,000 SENSEX 25,000 6,000 20,000 • In our opinion, Divestment through ETF’s has impacted PSU stocks performance as: 4,000 15,000 10,000 ‒ Regular supply of PSU shares through various ETFs distorts market demand and supply 2,000 5,000 ‒ Discount offered on ETF’s creates interest amongst arbitragers & short term investors as against 0 0 long term investors. 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 18 19 20 • An announcement of a strategic sale in BPCL, Air India, Cochin Shipyard, Shipping Corporation suggests a significant shift in strategy with ETF utility as disinvestment took on the decline Will strategic sale route preferred over ETFs for divestment change things going forward ? • Between FY02 & FY05 a large number of disinvestments took place through strategic route or an offer for sale route. The market reaction to the same was positive with BSE PSU Index outperforming BSE SENSEX by ~170% in 3 years as can be seen from adjacent chart. Refer disclaimers on slide 21 Source: Bloomberg 6

Recommend

More recommend