Half year results 2012 John Grill

Overview ► Strong first half paves the way for good full year result • Reported revenue of $3,300 million. Record aggregated revenue of $3,399 million; up 17% • EBIT increase of 29% on HY11 underlying result • Reported NPAT of $152 million up 18% (up 27% on HY11 underlying NPAT) • Earnings grew across all sectors compared to HY11 • Markets strengthening in Australia, Canada and USA, but productivity, cost and schedule issues currently impacting margins • Continuing expansion in the developing world • Expanded and awarded new framework agreements with Tier 1 customers • People numbers continue to increase • FX impact was material • Interim dividend 40.0 cents per share 2

Financial highlights HY12 vs HY11 HY12 Underlying Results* Net profit after tax $152m 27% Aggregated revenue $3,399m 17% EBIT $248m 29% Operating cash flow $64m 49% Basic earnings per share 61.8 c/s 27% Interim dividend 40.0 c/s * The underlying results for HY2011 excludes the fair value gains on acquisitions of $9.4m The IFRS financial information contained within this presentation has been derived from the 31 December 2011 Interim Financial Report, which has been reviewed by Ernst & Young. This presentation however has not been reviewed or audited. 3

Safety performance Our safety performance remains solid Areas of focus • Project and site activity initiation and implementation for safety success • Road safety. Pledged to the UN Global Road Safety Commitment program Highlights • WorleyParsons Singapore awarded 2011 Risk Management Award of the Workplace Safety & Health (WSH) Council • 40 million hours lost time injury free on the Singapore Parallel Train project for ExxonMobil Zero Harm 4

Snapshot Capital spending in resource markets continue to increase, led by global majors in Hydrocarbons and Minerals & Metals Solid growth in Australia, Canada, USA and China Economic uncertainty in light of the Eurozone debt concerns impacting smaller resource clients. Currency fluctuations on translation continue to impact results Major resource companies are seeking global support from their suppliers I&E markets strong in resource sector, weak in others Power markets stabilising 5

Snapshot Our focus on the developing world has led to key project awards in: • Brazil • Costa Rica • Ecuador • Indonesia • South Africa Board composition • The Board has been strengthened − Ms Wang Xiao Bin; and − Dr Christopher Haynes 6

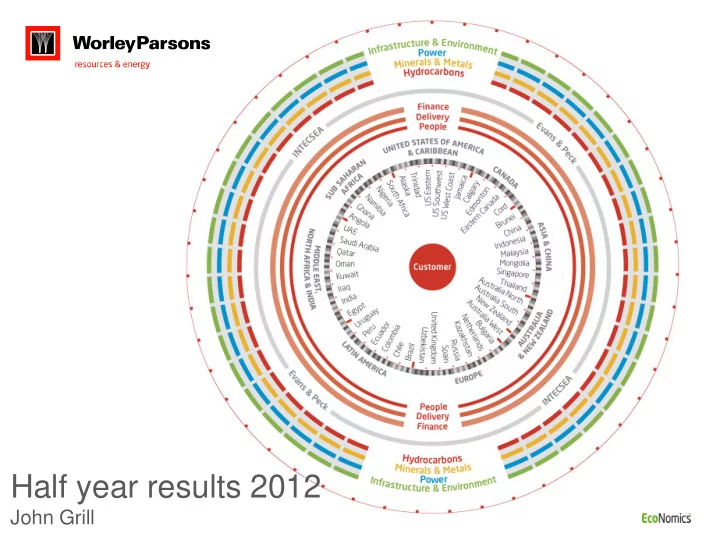

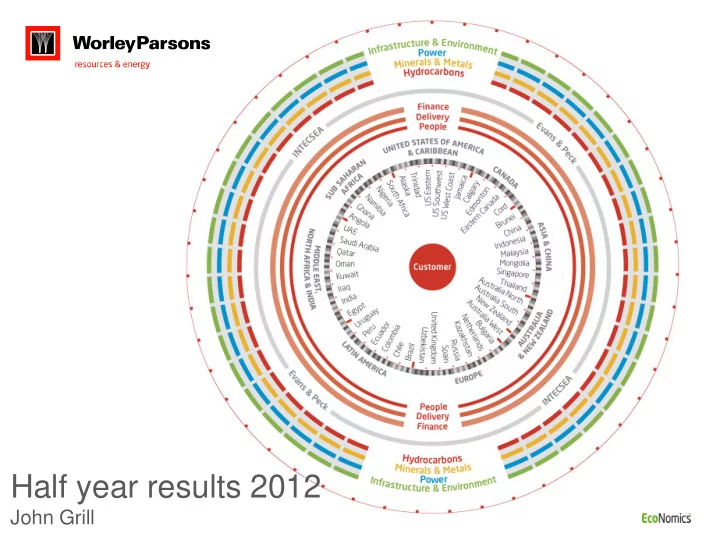

Local delivery, Global support 2.1 million workshare hours 37,800 people 148 offices 44 countries 7

Improve contracts ► WorleyParsons’ performance continues to be underpinned by our extensive long-term contract base Total of 18 new Improve contracts ● awarded 11 contracts renewed ● ● 240 Improve contracts ► Our selection was based upon: Recognition of our leadership position in ● long term contracts Proven safety performance ● Global footprint ● New Global or Multi-Site Agreements 8

Sector reporting change Group wide organisation restructure Outstanding location based delivery – effective global support Five Regions into Nine groups of locations 1. Australia East and New Zealand (AENZ) 1. Australia and New Zealand (ANZ) 2. Australia West (AUW) 3. Asia China (ASCH) 2. Asia and Middle East (AME) 4. Middle East, North Africa and India (MENAI) 3. Canada (CAN) 5. Canada (CAN) 6. Europe (EUR) 4. Europe and Africa (E&A) 7. Sub-Saharan Africa (SSA) 5. United States and Latin America 8. United States and Caribbean (USAC) (USLAC) 9. Latin America (LAM) Change to sector reporting to align with management reporting 9

Financial results Andrew Wood

Financial profile vs. $m HY08 HY09 HY10 HY11* HY12 HY11 Aggregated Revenue 2,362 3,256 2,548 2,905 3,399 17% EBIT 232 315 210 193 248 29% EBIT Margin 9.8% 9.7% 8.2% 6.6% 7.3% 0.7% Net profit 153 198 138 119 152 27% Net profit margin 6.5% 6.1% 5.4% 4.1% 4.5% 0.4% Basic EPS (cps) 63.3 81.6 56.8 48.5 61.8 27.4% Cash flow from operating activities 112 235 148 125 64 (49%) ROE 27.9% 23.7% 18.9% 15.6% 18.8% 3.2% * The underlying results for HY2011 excludes the fair value gains on acquisitions of $9.4m 11

5 year financial profile Aggregated Revenue $m EBIT Margin % 6,219.4 5,903.5 4,967.1 10.7 4,882.4 9.7 8.6 8.0 11.4 9.8 9.0 9.4 3,256.1 3,399.0 2,905.1 2,548.1 2,354.1 9.8 9.7 8.2 7.3 6.6 FY08 FY09 FY10 FY11 FY12 FY08 FY09 FY10 FY11 FY12 Net profit $m 390.5 343.9 Record aggregated revenue 298.5 291.1 EBIT margin has improved by 0.7% from HY11 to 7.3% Effective tax rate up 1.4% from HY11 to 27.1% 197.5 NPAT unfavourable FX impact of $10.1m 152.7 151.9 138.0 Dividend payout of 40 cents per share, 119.2 79.3% franked FY08 FY09 FY10 FY11 * FY12 12 * The underlying results for HY2011 excludes the fair value gains on acquisitions of $9.4m

Change in net profit after tax HY2011 v HY2012 14.2 (11.5) (4.4) 31.3 (19.5) (3.9) (10.1) 4.8 31.8 151.9 $m 119.2 HY11 * Hydrocarbons Power Minerals & Infrastructure & Corporate Net Interest Income Tax Minority FX Impact HY12 Metals Environment overhead Interest * The underlying results for HY2011 excludes the fair value gains on acquisitions of $9.4m 13

Hydrocarbons Aggregated revenue $M HY12 aggregated revenue % by region ASCH 10% USAC 22% MENAI 11% 2,366.4 2,069.8 1,844.5 1,556.3 LAM 1% SSA 3% AENZ 7% 2,373.7 2,344.9 1,974.1 1,869.1 1,760.3 EUR 13% AUW 9% FY08 FY09 FY10 FY11 HY12 Overall strong performance CAN 24% Strong performance in the Europe driven by increased activity for global majors EBIT by Region HY12 vs HY11 1 $M Significant increase in activity in the USA particularly upstream 7.4 11.5 1.4 0.2 0.2 9.5 Improved results in ASCH coming from Malaysia, China and 1.6 1.0 5.9 Brunei 4.9 AENZ results up due to additional work in the coal seam 263.0 methane market 246.0 Lower margins during the period caused by a few major projects that are expected to be completed in the second half HY11 ASCH AENZ AUW CAN EUR LAM MENAI SSA USAC FX HY12 Impact 1 Regions in constant currency 14

Power Aggregated revenue $M HY12 aggregated revenue % by region ASCH 5% MENAI 2% AENZ 9% 257.0 USAC 37% 235.5 262.1 248.2 AUW 12% 289.3 278.2 259.8 247.3 217.7 CAN 7% FY08 FY09 FY10 FY11 HY12 LAM 6% EUR 21% SSA 1% Increased activity in the European nuclear EBIT by Region HY12 vs HY11 1 $M market Improved US performance with the US 0.6 0.8 2.0 2.4 0.8 0.0 0.7 and Latin America contributing 43% of 0.3 0.4 0.0 segment revenue 27.2 23.6 HY11 ASCH AENZ AUW CAN EUR LAM MENAI SSA USAC FX HY12 Impact 15 1 Regions in constant currency

Minerals & Metals Aggregated revenue $M HY12 aggregated revenue % by region USAC 4% LAM 4% ASCH 14% SSA 1% EUR 2% CAN 8% MENAI 4% 211.2 332.3 322.7 255.2 400.0 371.8 311.5 239.8 214.1 FY08 FY09 FY10 FY11 HY12 AENZ 33% AUW 30% Record first half aggregated revenue EBIT by Region HY12 vs HY11 1 $M for Minerals & Metals 0.9 0.4 0.3 1.0 1.0 0.1 Continuing to grow our relationships 2.3 14.6 with major global companies 11.4 Strong commodity prices driving 6.2 65.7 demand for services 34.9 HY11 ASCH AENZ AUW CAN EUR LAM MENAI SSA USAC FX HY12 Impact 1 Regions in constant currency 16

Infrastructure & Environment Aggregated revenue $M HY12 aggregated revenue % by region USAC 5% ASCH 6% MENAI 8% LAM 9% 360.8 SSA 10% 277.9 128.7 180.4 AENZ 22% 394.3 EUR 4% 341.3 221.3 191.9 162.0 FY08 FY09 FY10 FY11 HY12 CAN 14% First half FY12 reports record aggregated AUW 22% revenue for the I&E business EBIT by Region HY12 vs HY11 1 $M Increased investment in resource projects is driving an increased demand for 1.3 1.2 services 7.2 0.9 0.6 Pit to port projects executed with the 0.0 1.3 1.5 0.2 0.2 Minerals & Metals segment providing 54.1 growth 42.5 Six month contribution from the acquisition of KV3 in South Africa in January 2011 HY11 ASCH AENZ AUW CAN EUR LAM MENAI SSA USAC FX HY12 Impact 1 Regions in constant currency 17

Cash Flow $m HY08 HY09 HY10 HY11 HY12 EBIT 232 315 210 203 248 Depreciation and amortisation 31 40 43 47 50 Interest and tax paid (75) (103) (132) (56) (64) Working capital / other (76) (17) 27 (69) (170) Net cash inflow from operating activities 112 235 148 125 64 Net cash outflow from investing activities (104) (82) (51) (24) (34) Net cash (outflow) / inflow from financing activities 10 (111) (111) (48) (55) 18

Gearing and key metrics Key Metrics FY09 FY10 FY11 HY12 Gearing ratio 26% 26% 22% 26% Facility utilization 54% 61% 53% 60% Average cost of debt 5.5% 5.2% 5.7% 5.3% Average maturity (years) 4.1 3.8 4.6 4.1 Interest cover * 14.1x 13.3x 12.0x 13.4x Net Debt/EBITDA * 0.8x 1.2x 0.9x 1.0x * Rolling 12 month calculation 19

Recommend

More recommend