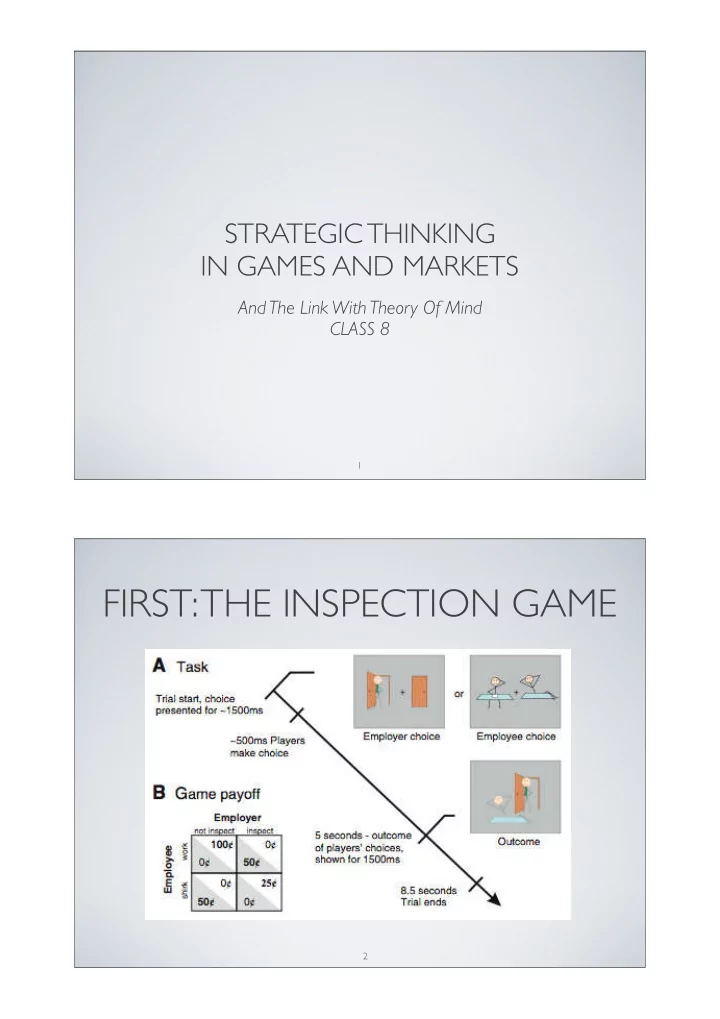

STRATEGIC THINKING IN GAMES AND MARKETS And The Link With Theory Of Mind CLASS 8 1 FIRST: THE INSPECTION GAME 2

UNCERTAINTY: • Employee does not know what employer will do • Employer does not know what employee will do 3 PREDICTING UNDER THIS UNCERTAINTY • This skill is extremely important in modern economic life • Yet we don’t understand why (many) humans are good at it • Humans seem to apply the right “intuition” • Who? • What is this intuition? 4

NASH • Subjects do not play the equilibrium strategies from the one-shot game • So, forecasting what the opponent will do cannot be based on this prediction • (Of course, you can try to figure out the Nash equilibrium of the multi-stage game, but there are lots, lots,...) 5 PSYCHOLOGISTS TALK ABOUT: THEORY OF MIND • “Theory of Mind” (or “mentalizing”) is the ability to recognize and understand intentions or goal-directness in patterns in one’s environment • … as opposed to mere expression of physical laws • Intention: • Malevolent • Benevolent • Involves (“new”) regions of the cortex, distinct from formal mathematical and probabilistic brain regions 6

Example: The intentional stance of a moving object Base Situation New Situation 1 Physics OK New Situation 2: ?! ( Uller, Nichols, Cognition , 2000 ) 7 REMARKS • One-year old infant (and apes) may be able to recognize goal- directness but cannot use it to its advantage (E.g., chocolate-in- drawer experiment) • But: • What does Theory of Mind mean formally? • Enter Economics … 8

THEORY OF MIND ENGAGES PART OF THE “SOCIAL BRAIN” 9 IN GAMES: • Recently, Theory of Mind brain regions have been found to be activated also when playing strategic games • … such as rock, paper, scissors (Gallager-Frith, 2003: contrast between playing against human and against simple computer- based rule) 10

BUT… • These are simple contrasts (affectionately called “blobology”) • What computations are involved? Hampton, Bossaerts, O’Doherty, PNAS, 2008 11 MATHEMATICS: REINFORCEMENT LEARNING Prediction Action Value Error Logit Model for Probability of Action a 12

MATHEMATICS: FICTITIOUS PLAY Prediction Error Learning of Opponent’s Strategy Stochastic (Logit) Best Response Given Beliefs 13 MATHEMATICS: “INFLUENCE” Taylor Expansion of Strategies Getting Opponent’s Beliefs Learning From Action Of Opponent (“Fictitious Play”) Predicted Change In Opponent Actions (“Influence”) 14

THE REWARD ERROR FROM THE “INFLUENCE” PREDICTION IS ENCODED IN PCC: Hampton, ea, PNAS 2008 15 (HERE IS THE FICTITIOUS PLAY REWARD PREDICTION ERROR:) Striatum: Traditionally involved in reinforcement learning (Based on “dopamine”) 16

DIFFERENCE WITH CLASSICAL GAME THEORY: • (Static) Nash equilibrium predicts: • Employee works with probability 1/5; shirks with probability 4/5 • Employer inspects with probability 1/2 • No need to predict effect of own actions on opponent’s beliefs and actions! 17 RELATED TO HIGHER-ORDER THINKING NO correlation with accuracy in the calculation task (r = .009, P >.5) Coricelli and Nagel (2009) 18

STAG-HUNT • Complex stag-hunt game • Against sophisticated (order k) computer • E.g., Order 2 = “I think that you think that I will move left” • (Cooperation, i.e., stag hunt, increases when order k increases) 19 UNCERTAINTY ABOUT INFERENCE OF COMPUTER’S LEVEL IS ENCODED IN MPFC (YOSHIDA EA) 20

OWN LEVEL OF K CORRELATES WITH NEURAL ACTIVITY • Lateral PFC, Superior Parietal Lobule, Superior Frontal Sulcus 21 COMPARING AUTISTIC PATIENTS WITH CONTROLS • Patients cannot track changes in sophistication (order k) of computer • Model that assumes fixed k for computer fits choices better than model that tracks changes in k (“ToM model”) • Equivalently: “forgetting rate” (discarding old observations) is higher for controls 22

(ANALOGOUS EFFECTS IN TRUST GAME FOR BORDERLINE PERSONALITY DISORDER PATIENTS) • King Cases ea: When trust is broken in trust game, BPD patients cannot re-establish trust • Related to different activation in anterior insula (they do not expect trust to go away, but once it does, they don’t know anymore what world they live in • COMPUTATIONAL (NEURO)PSYCHIATRY 23 TOWARDS “MANIPULATION” • Bhatt ea, PNAS (2010) • Beyond influence (taking into account that one is learning about a moving target) • Really “teaching” (belief manipulation) 24

OF INCREMENTALISTS, STRATEGISTS AND RATIONALISTS • Incrementalists: correlate price suggestion with value • Rationalists: think everyone is rational, and induce no correlation in relation with value... • Strategist: react to presence of incrementalists by anti-correlating suggested price and value! 25 IQ, SOCIOECONOMIC STATUS AND EARNINGS 26

IMAGING • Differential activation for strategists (between-group comparison) • Compare to Yoshida’s imaging results! 27 NEXT: FINANCIAL MARKETS WITH “INSIDERS” • Even large-scale, anonymous financial markets may be perceived as intentional, goal-oriented – or “strategic:” there may be “insiders” • Questions: Is this within scope of Theory of Mind? 1. Does Theory of Mind help? 2. What does it do? 3. 28

EXPERIMENT: • Markets are re-played in scanner while subject is exposed to risk • Subject: • Predicts price changes in market replay; • Performs Theory of Mind tests; • Performs (financial) mathematics test 20 29 MARKET REPLAY 30

Graphical replay of market 22 31 IMAGING RESULTS Effect of |price-0.25|, contrast between insider and no-insider treatment 23 Bruguier, ea, J Finance 2010 32

EXPLANATORY VARIABLES FOR BRAIN ACTIVATION 33 PREDICTION PERFORMANCE RESULTS Against Math test Against Heider test ! =0.060792, p=0.698569, n=43 ! =0.348247, p=0.022110, n=43 85 75 80 70 75 Financial Market Prediction Financial Market Prediction 70 65 65 60 60 55 55 50 50 45 45 0 2 4 6 8 10 12 14 − 1 0 1 2 3 4 5 6 7 8 Heider Test Mathematical puzzles 34

WHAT DOES THIS MEAN FORMALLY? ! Theory of Mind brain regions are engaged and financial performance correlates with Theory of Mind skills ! Now, Theory of Mind = pattern recognition ! So: What patterns are attended to? ! First of all: What distinguishes presence of insiders? 35 PRICING PATTERNS WHEN THERE ARE INSIDERS: VOLATILITY CLUSTERING 36

“GENERALIZED AUTOREGRESSIVE CONDITIONAL HETEROSKEDASTICITY” (GARCH) ! Typical autocorrelations of absolute price change: GREEN=Insiders; BLUE=No Insiders 37 (CONTRAST WITH ECONOMIC THEORY) ! Rational Expectations Equilibrium : Uninformed are supposed to know how prices relate to information of insiders ! Where does this knowledge come from?! ! Here we provide a partial answer 38

ASSET PRICE BUBBLES • Similar activations when there is mis-pricing... 39 TAKE-HOME MESSAGES I ! Playing strategic games engages “Theory of Mind” ! Theory of Mind is about predicting how the opponent changes strategies because she is learning ! Goes beyond fictitious play and reinforcement learning (opponent is intentional) ! Theory of Mind is mathematics: pattern recognition ! … which is not the mathematics of Nash equilibrium 40

TAKE-HOME MESSAGES II ! Theory of Mind also applies to understanding “social systems” that don’t really have a mind on their own ! We see this in brain activation when exposed to risk in markets with insiders ! We also see this in correlation of performance between predicting prices in such markets and traditional Theory of Mind tasks ! … and in the absence of correlation with mathematical skill (as when playing strategic games) ! Patterns being recognized = GARCH? 41

Recommend

More recommend