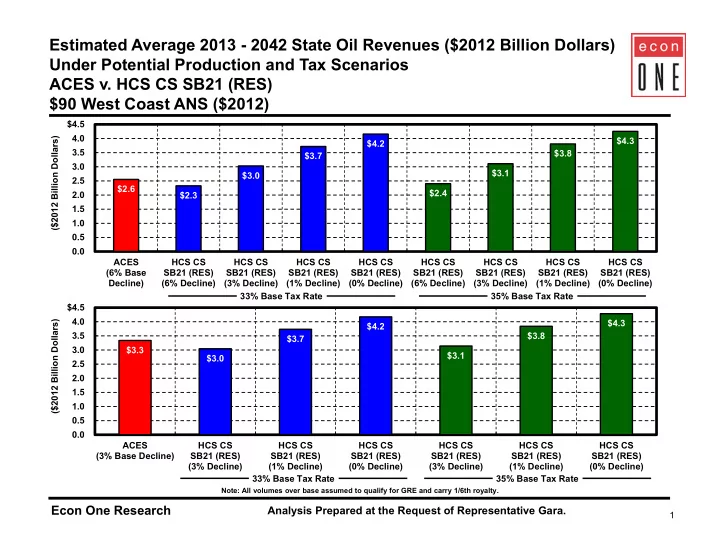

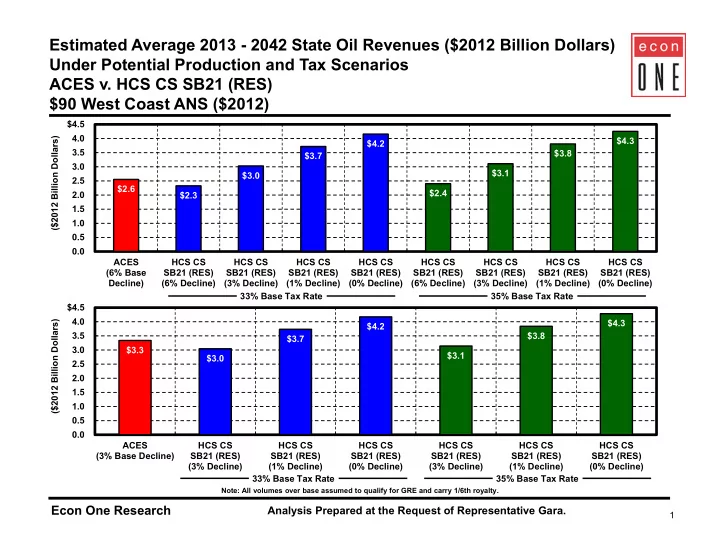

Estimated Average 2013 - 2042 State Oil Revenues ($2012 Billion Dollars) Under Potential Production and Tax Scenarios ACES v. HCS CS SB21 (RES) $90 West Coast ANS ($2012) $4.5 4.0 ($2012 Billion Dollars) $4.3 $4.2 3.5 $3.8 $3.7 3.0 $3.1 $3.0 2.5 $2.6 $2.4 2.0 $2.3 1.5 1.0 0.5 0.0 ACES HCS CS HCS CS HCS CS HCS CS HCS CS HCS CS HCS CS HCS CS (6% Base SB21 (RES) SB21 (RES) SB21 (RES) SB21 (RES) SB21 (RES) SB21 (RES) SB21 (RES) SB21 (RES) Decline) (6% Decline) (3% Decline) (1% Decline) (0% Decline) (6% Decline) (3% Decline) (1% Decline) (0% Decline) 33% Base Tax Rate 35% Base Tax Rate $4.5 4.0 $4.3 ($2012 Billion Dollars) $4.2 3.5 $3.8 $3.7 3.0 $3.3 $3.1 $3.0 2.5 2.0 1.5 1.0 0.5 0.0 ACES HCS CS HCS CS HCS CS HCS CS HCS CS HCS CS (3% Base Decline) SB21 (RES) SB21 (RES) SB21 (RES) SB21 (RES) SB21 (RES) SB21 (RES) (3% Decline) (1% Decline) (0% Decline) (3% Decline) (1% Decline) (0% Decline) 33% Base Tax Rate 35% Base Tax Rate Note: All volumes over base assumed to qualify for GRE and carry 1/6th royalty. Econ One Research Analysis Prepared at the Request of Representative Gara. 1

Estimated Average 2013 - 2042 State Oil Revenues ($2012 Billion Dollars) Under Potential Production and Tax Scenarios ACES v. HCS CS SB21 (RES) $100 West Coast ANS ($2012) $6.0 ($2012 Billion Dollars) 5.0 $5.1 $5.0 $4.5 4.0 $4.4 $3.7 $3.6 3.0 $3.3 $2.9 $2.8 2.0 1.0 0.0 ACES HCS CS HCS CS HCS CS HCS CS HCS CS HCS CS HCS CS HCS CS (6% Base SB21 (RES) SB21 (RES) SB21 (RES) SB21 (RES) SB21 (RES) SB21 (RES) SB21 (RES) SB21 (RES) Decline) (6% Decline) (3% Decline) (1% Decline) (0% Decline) (6% Decline) (3% Decline) (1% Decline) (0% Decline) 33% Base Tax Rate 35% Base Tax Rate $6.0 ($2012 Billion Dollars) 5.0 $5.1 $5.0 $4.6 4.0 $4.5 $4.3 $3.8 $3.7 3.0 2.0 1.0 0.0 ACES HCS CS HCS CS HCS CS HCS CS HCS CS HCS CS (3% Base Decline) SB21 (RES) SB21 (RES) SB21 (RES) SB21 (RES) SB21 (RES) SB21 (RES) (3% Decline) (1% Decline) (0% Decline) (3% Decline) (1% Decline) (0% Decline) 33% Base Tax Rate 35% Base Tax Rate Note: All volumes over base assumed to qualify for GRE and carry 1/6th royalty. Econ One Research Analysis Prepared at the Request of Representative Gara. 2

Estimated Average 2013 - 2042 State Oil Revenues ($2012 Billion Dollars) Under Potential Production and Tax Scenarios ACES v. HCS CS SB21 (RES) $110 West Coast ANS ($2012) $6.0 $5.9 $5.7 ($2012 Billion Dollars) 5.0 $5.3 $5.1 4.0 $4.3 $4.2 $4.0 3.0 $3.4 $3.3 2.0 1.0 0.0 ACES HCS CS HCS CS HCS CS HCS CS HCS CS HCS CS HCS CS HCS CS (6% Base SB21 (RES) SB21 (RES) SB21 (RES) SB21 (RES) SB21 (RES) SB21 (RES) SB21 (RES) SB21 (RES) Decline) (6% Decline) (3% Decline) (1% Decline) (0% Decline) (6% Decline) (3% Decline) (1% Decline) (0% Decline) 33% Base Tax Rate 35% Base Tax Rate $6.0 $5.9 $5.8 ($2012 Billion Dollars) 5.0 $5.3 $5.2 $5.2 4.0 $4.4 $4.3 3.0 2.0 1.0 0.0 ACES HCS CS HCS CS HCS CS HCS CS HCS CS HCS CS (3% Base Decline) SB21 (RES) SB21 (RES) SB21 (RES) SB21 (RES) SB21 (RES) SB21 (RES) (3% Decline) (1% Decline) (0% Decline) (3% Decline) (1% Decline) (0% Decline) 33% Base Tax Rate 35% Base Tax Rate Note: All volumes over base assumed to qualify for GRE and carry 1/6th royalty. Econ One Research Analysis Prepared at the Request of Representative Gara. 3

Estimated Average 2013 - 2042 State Oil Revenues ($2012 Billion Dollars) Under Potential Production and Tax Scenarios ACES v. HCS CS SB21 (RES) $120 West Coast ANS ($2012) $7.0 $6.7 ($2012 Billion Dollars) 6.0 $6.5 $6.0 $5.8 5.0 $4.9 $4.8 $4.8 4.0 $3.8 $3.7 3.0 2.0 1.0 0.0 ACES HCS CS HCS CS HCS CS HCS CS HCS CS HCS CS HCS CS HCS CS (6% Base SB21 (RES) SB21 (RES) SB21 (RES) SB21 (RES) SB21 (RES) SB21 (RES) SB21 (RES) SB21 (RES) Decline) (6% Decline) (3% Decline) (1% Decline) (0% Decline) (6% Decline) (3% Decline) (1% Decline) (0% Decline) 33% Base Tax Rate 35% Base Tax Rate $7.0 $6.8 ($2012 Billion Dollars) $6.6 6.0 $6.2 $6.1 $5.9 5.0 $5.0 $4.8 4.0 3.0 2.0 1.0 0.0 ACES HCS CS HCS CS HCS CS HCS CS HCS CS HCS CS (3% Base Decline) SB21 (RES) SB21 (RES) SB21 (RES) SB21 (RES) SB21 (RES) SB21 (RES) (3% Decline) (1% Decline) (0% Decline) (3% Decline) (1% Decline) (0% Decline) 33% Base Tax Rate 35% Base Tax Rate Note: All volumes over base assumed to qualify for GRE and carry 1/6th royalty. Econ One Research Analysis Prepared at the Request of Representative Gara. 4

Estimated Average 2013 - 2042 State Oil Revenues ($2012 Billion Dollars) Under Potential Production and Tax Scenarios ACES v. HCS CS SB21 (RES) $130 West Coast ANS ($2012) $8.0 7.0 ($2012 Billion Dollars) $7.5 $7.3 $6.7 6.0 $6.5 5.0 $5.5 $5.5 $5.4 4.0 $4.3 $4.2 3.0 2.0 1.0 0.0 ACES HCS CS HCS CS HCS CS HCS CS HCS CS HCS CS HCS CS HCS CS (6% Base SB21 (RES) SB21 (RES) SB21 (RES) SB21 (RES) SB21 (RES) SB21 (RES) SB21 (RES) SB21 (RES) Decline) (6% Decline) (3% Decline) (1% Decline) (0% Decline) (6% Decline) (3% Decline) (1% Decline) (0% Decline) 33% Base Tax Rate 35% Base Tax Rate $8.0 7.0 $7.6 ($2012 Billion Dollars) $7.4 $7.2 $6.8 6.0 $6.6 5.0 $5.6 $5.4 4.0 3.0 2.0 1.0 0.0 ACES HCS CS HCS CS HCS CS HCS CS HCS CS HCS CS (3% Base Decline) SB21 (RES) SB21 (RES) SB21 (RES) SB21 (RES) SB21 (RES) SB21 (RES) (3% Decline) (1% Decline) (0% Decline) (3% Decline) (1% Decline) (0% Decline) 33% Base Tax Rate 35% Base Tax Rate Note: All volumes over base assumed to qualify for GRE and carry 1/6th royalty. Econ One Research Analysis Prepared at the Request of Representative Gara. 5

Estimated Average 2013 - 2042 State Oil Revenues ($2012 Billion Dollars) Under Potential Production and Tax Scenarios ACES v. HCS CS SB21 (RES) $140 West Coast ANS ($2012) $9.0 8.0 ($2012 Billion Dollars) $8.3 $8.1 7.0 $7.5 $7.3 6.0 $6.3 $6.1 $6.0 5.0 $4.8 4.0 $4.6 3.0 2.0 1.0 0.0 ACES HCS CS HCS CS HCS CS HCS CS HCS CS HCS CS HCS CS HCS CS (6% Base SB21 (RES) SB21 (RES) SB21 (RES) SB21 (RES) SB21 (RES) SB21 (RES) SB21 (RES) SB21 (RES) Decline) (6% Decline) (3% Decline) (1% Decline) (0% Decline) (6% Decline) (3% Decline) (1% Decline) (0% Decline) 33% Base Tax Rate 35% Base Tax Rate $9.0 8.0 ($2012 Billion Dollars) $8.4 $8.2 $8.2 7.0 $7.6 $7.4 6.0 $6.2 $6.1 5.0 4.0 3.0 2.0 1.0 0.0 ACES HCS CS HCS CS HCS CS HCS CS HCS CS HCS CS (3% Base Decline) SB21 (RES) SB21 (RES) SB21 (RES) SB21 (RES) SB21 (RES) SB21 (RES) (3% Decline) (1% Decline) (0% Decline) (3% Decline) (1% Decline) (0% Decline) 33% Base Tax Rate 35% Base Tax Rate Note: All volumes over base assumed to qualify for GRE and carry 1/6th royalty. Econ One Research Analysis Prepared at the Request of Representative Gara. 6

Estimated Additional Annual Volumes Needed (2013 - 2042) Under HCS CS SB21 (RES) to Match State Oil Revenues ($2012 Billion Dollars) Under ACES at 6% and 3% Decline Rates ACES at 6% Base Decline Rate 45 33% Base Tax Rate 35% Base Tax Rate 40 (Million Barrels Per Year) 35 37.6 35.3 30 33.3 30.9 30.6 25 26.8 24.4 20 20.8 15 16.8 13.8 10 9.9 5 6.5 0 $90 $100 $110 $120 $130 $140 $90 $100 $110 $120 $130 $140 West Coast ANS ($2012) ACES at 3% Base Decline Rate 55 33% Base Tax Rate 35% Base Tax Rate 50 (Million Barrels Per Year) 45 49.2 46.1 40 43.6 40.5 40.1 35 35.0 30 31.9 25 27.2 20 22.0 15 18.0 10 12.9 5 8.5 0 $90 $100 $110 $120 $130 $140 $90 $100 $110 $120 $130 $140 West Coast ANS ($2012) Note: All volumes over base assumed to qualify for GRE and carry 1/6th royalty. Econ One Research Analysis Prepared at the Request of Representative Gara. 7

Recommend

More recommend