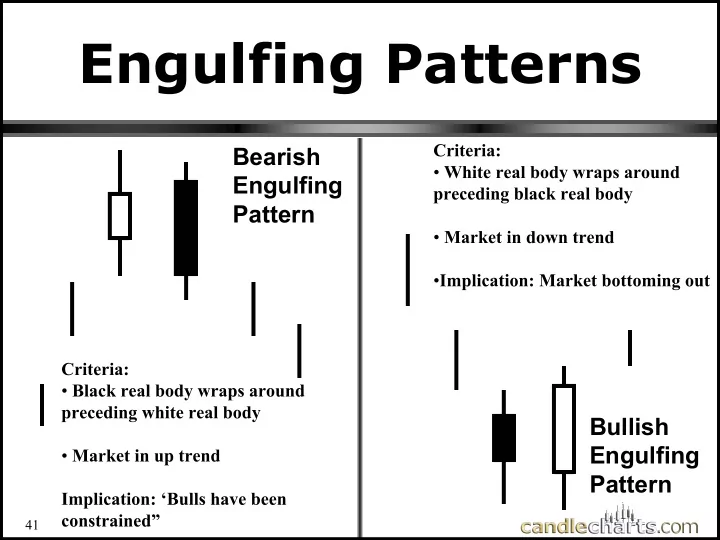

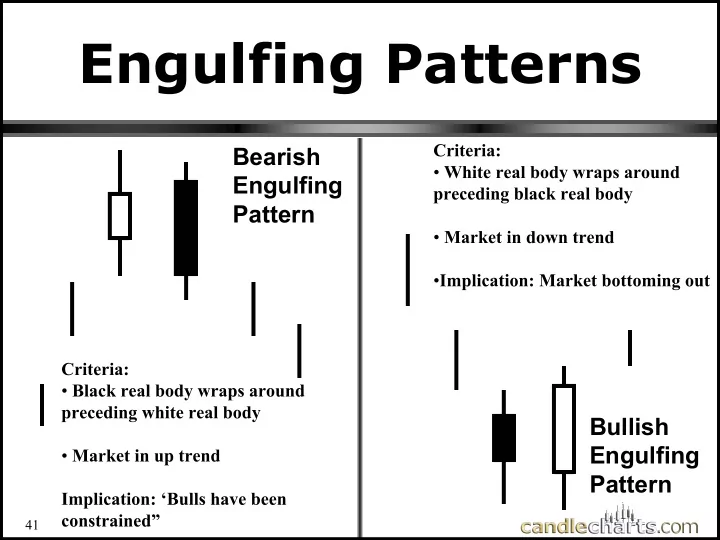

Engulfing Patterns Criteria: Bearish Bearish • White real body wraps around Engulfing Engulfing preceding black real body Pattern Pattern • Market in down trend • Implication: Market bottoming out Criteria: • Black real body wraps around preceding white real body Bullish Bullish Engulfing Engulfing • Market in up trend Pattern Pattern Implication: ‘Bulls have been constrained” 41

Bullish engulfing pattern as support ORACLE 10.3 10.2 10.1 One of most powerful aspects of 10.0 the bullish engulfing pattern is 9.9 9.8 their use as support. 9.7 9.6 9.5 9.4 9.3 9.2 9.1 9.0 8.9 8.8 8.7 8.6 8.5 8.4 8.3 8.2 8.1 8.0 7.9 7.8 7.7 7.6 7.5 7.4 16 23 30 7 14 21 October 42

Bullish engulfing pattern S&P Continuation Shooting star Note how many black candles the white candle wrapped around 43

Bullish engulfing pattern as support While the low of the bullish engulfing pattern is support, for those who are more eager to buy you can use the center Center tall of the tall white real body as white an entry point. Keep in the mind the risk –reward of the trade. 44

Bearish engulfing pattern as resistance If the first candle is a doji instead of a white real body it is still viewed as a bearish engulfing pattern. 45

Bearish Engulfing Pattern compared to Western outside reversal 46

Relative Strength On this day Dow was down 150 47

Bullish Engulfing Pattern Is this a Bullish Engulfing Pattern ? 48

Engulfing pattern – comparing size of real bodies SIERRA WIRELESS 10.6 10.5 10.4 10.3 10.2 10.1 10.0 9.9 9.8 9.7 9.6 9.5 9.4 9.3 9.2 9.1 9.0 8.9 8.8 Consider the relative size of 8.7 8.6 the real bodies. Here they are 8.5 equal size, so reversal is less 8.4 8.3 likely. Final confirmation of 8.2 it’s failure comes with the close 8.1 8.0 under its support area. 7.9 1 8 15 22 29 6 April May 49

Last Engulfing Pattern Bullish Bullish Engulfing Engulfing Pattern Pattern Last Last Engulfing Engulfing Pattern Pattern 50 50

Last Engulfing Pattern 51 51

Last Engulfing Pattern Note: This is the same chart as slide 51 52 52

Last Engulfing Pattern 53 53

Dark Cloud Cover Criteria: • Opens above prior high (or close) • Closes as long black real body • Close well into prior long white candle • Market moving north Implication: “Advance is exhausting itself” 54

Nison Trading Nison Trading Principle Principle Not all candle signals should Not all candle signals should be used to buy or sell. Always be used to buy or sell. Always consider the risk/reward consider the risk/reward aspect of the trade. aspect of the trade. 55

Dark Cloud Cover and Risk/Reward Pattern Completed Here 56

The Blended Candle Line close 2 = close 2 open 1 open 1 Blended candle real body = open of the first session, close of the last session. Blended candle shadows = highest high and lowest close of all sessions 57

The Blended Candle Line = = 58

The Checkmate Principle: The Checkmate Principle: � A series of tall white candles followed by A series of tall white candles followed by � black candles (or small real bodies) near the black candles (or small real bodies) near the same resistance level reveals that the bulls’ same resistance level reveals that the bulls’ drive is being “checkmated” drive is being “checkmated” � A series of long black candles followed by A series of long black candles followed by � white candles (or small real bodies) near the white candles (or small real bodies) near the same support level reveals that the bears’ same support level reveals that the bears’ drive is being “checkmated” drive is being “checkmated” 59 59

Bearish Checkmate Bearish Checkmate ☺ ☺ � � ☺ � � ☺ ☺ = strong session � = failure to sustain rally This shows lack of bullish follow through shows that each time this gets in the 60-64 range. 60 60

Recommend

More recommend