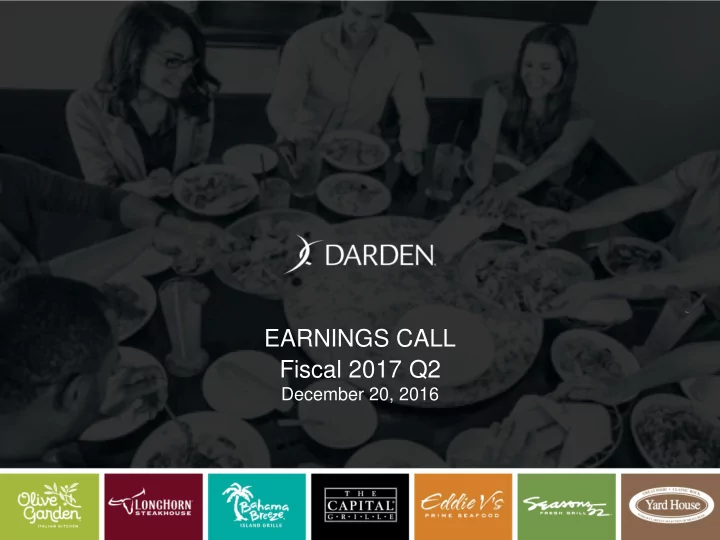

EARNINGS CALL Fiscal 2017 Q2 December 20, 2016 DISCLAIMER / - PowerPoint PPT Presentation

EARNINGS CALL Fiscal 2017 Q2 December 20, 2016 DISCLAIMER / NON-GAAP INFORMATION IMPORTANT NOTICE The following slides are part of a presentation by Darden Restaurants, Inc. (the "Company") and are intended to be viewed as part of

EARNINGS CALL Fiscal 2017 Q2 December 20, 2016

DISCLAIMER / NON-GAAP INFORMATION IMPORTANT NOTICE The following slides are part of a presentation by Darden Restaurants, Inc. (the "Company") and are intended to be viewed as part of that presentation (the "Presentation"). No representation is made that the Presentation is complete. Forward-looking statements in this communication regarding our expected earnings performance and all other statements that are not historical facts, including without limitation statements concerning our future economic performance and expenses, are made under the Safe Harbor provisions of the Private Securities Litigation Reform Act of 1995. Any forward-looking statements speak only as of the date on which such statements are first made, and we undertake no obligation to update such statements to reflect events or circumstances arising after such date. We wish to caution investors not to place undue reliance on any such forward-looking statements. By their nature, forward-looking statements involve risks and uncertainties that could cause actual results to materially differ from those anticipated in the statements. The most significant of these uncertainties are described in Darden's Form 10-K, Form 10-Q and Form 8-K reports. These risks and uncertainties include technology failures including failure to maintain a secure cyber network, food safety and food-borne illness concerns, litigation, unfavorable publicity, risks relating to public policy changes and federal, state and local regulation of our business, labor and insurance costs, failure to execute a business continuity plan following a disaster, health concerns including food-related pandemics or virus outbreaks, intense competition, failure to drive profitable sales growth, our plans to expand our smaller brands Bahama Breeze, Seasons 52 and Eddie V's, a lack of availability of suitable locations for new restaurants, higher-than-anticipated costs to open, close, relocate or remodel restaurants, a failure to execute innovative marketing tactics, a failure to develop and recruit effective leaders, a failure to address cost pressures, shortages or interruptions in the delivery of food and other products and services, adverse weather conditions and natural disasters, volatility in the market value of derivatives, economic factors specific to the restaurant industry and general macroeconomic factors including interest rates, disruptions in the financial markets, risks of doing business with franchisees and vendors in foreign markets, failure to protect our intellectual property, impairment in the carrying value of our goodwill or other intangible assets, failure of our internal controls over financial reporting, an inability or failure to manage the accelerated impact of social media and other factors and uncertainties discussed from time to time in reports filed by Darden with the Securities and Exchange Commission. The information in this communication includes financial information determined by methods other than in accordance with accounting principles generally accepted in the United States of America (“GAAP”), such as adjusted net earnings per diluted share from continuing operations . The Company’s management uses these non- GAAP measures in its analysis of the Company’s performance. The Company believes that the presentatio n of certain non- GAAP measures provides useful supplemental information that is essential to a proper understanding of the operating results of t he Company’s businesses. These non-GAAP disclosures should not be viewed as a substitute for operating results determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies. 1

FISCAL QUARTER HIGHLIGHTS Darden Sales ($bn) Same-Restaurant Sales Growth - Comparable Calendar Basis 4.2% 2.6% $1.85 $1.79 $1.73 $1.75 $1.69 $1.71 $1.61 $1.64 1.7% 1.3% FY15 FY16 FY15 FY16 FY16 FY17 FY16 FY17 Q3 1 Q4 2 Q1 Q2 Q3 FY16 Q4 FY16 Q1 FY17 Q2 FY17 Darden Adjusted EPS 3 $1.01 $1.21 $1.10 $0.68 $0.99 $0.88 $0.54 $0.64 FY15 FY16 FY15 FY16 FY16 FY17 FY16 FY17 Q4 2 Q3 1 Q1 Q2 1 FY15 Q3 includes the Thanksgiving holiday whereas it occurred in Q2 of FY16. 2 FY15 Q4 adjusted to exclude $0.13bn in sales and $0.07 in adjusted diluted earnings per share due to the 53rd week. 3 EPS values, except for FY17 Q1 & Q2, are adjusted for special items. A reconciliation of reported to adjusted numbers can be found in the additional information section of this presentation. 2

CONTINUED TOP LINE MOMENTUM Same-Restaurant Sales 4.9% 2.8% 2.6% 2.4% 2.0% FY16 Q2 1 FY16 Q3 1 FY16 Q4 1 FY17 Q1 FY17 Q2 Q2 Highlights +540 bps 2.6% +21% Same-Restaurant Same-Restaurant Sales Industry OG To Go Growth Sales Outperformance 2 1 FY16 Same-Restaurant Sales on a comparable calendar basis. 2 Industry excluding Darden brands. 3

STRENGTHENING BUSINESS MODEL Segment Profit Margin Percent 1 21.3% 2 20.3% 2 1.3% 1.3% 17.1% 2 16.0% 2 15.4% 2 1.5% 0.4% 1.6% 20.0% 17.8% 19.0% 16.3% 14.9% 15.6% 15.0% 14.4% FY15 FY16 FY15 FY16 FY16 FY17 FY16 FY17 Q3 Q3 Q4 Q4 Q1 Q1 Q2 Q2 Rent and other tax expense impact on Segment Profit Margin from fiscal 2016 real estate transactions Q2 Highlights +60 bps +290 bps 0.1% Adjusted Segment Same-Restaurant Same-Restaurant Profit Margin % vs. Sales Industry Sales Last Year (Basis Point Outperformance 3 Diff) 2 1 Segment profit margin calculated as (sales less costs of food & beverage, restaurant labor, restaurant expenses and marketing expenses) / sales. 2 Segment profit margin adjusted to exclude the impact of incremental rent and other tax expense from the fiscal 2016 real estate transactions. 3 Industry excluding Darden brands. 4

THANK YOU TO OUR 150,000 TEAM MEMBERS! 5

FINANCIAL UPDATE

FISCAL SECOND QUARTER HIGHLIGHTS $0.64 1.7 % Diluted EPS from Continuing Same-Restaurant Sales Operations 18.5 % ~$70 million Adjusted Diluted EPS Growth Dividends Paid vs Last Year 1 ~0.3 million $19 million Share Repurchases Shares Repurchased 1 Prior year EPS values adjusted for special items. A reconciliation of reported to adjusted numbers can be found in the additional information section of this presentation. 7

EAT MARGIN INCREASED 50 BASIS POINTS Fiscal Q2 2017 vs. PY* (bps) ($ millions) Favorable/(Unfavorable) % of Sales Sales $1,642.5 Food & Beverage $478.1 29.1% 90 Restaurant Labor $538.1 32.8% (20) Restaurant Expenses $305.3 18.6% (130) Marketing $57.1 3.5% 10 Restaurant-Level EBITDA $263.9 16.1% (50) G&A $79.5 4.8% (40) Depreciation & Amortization $67.8 4.1% 60 Impairments $0.1 0.0% 50 EBIT $116.5 7.1% 10 Interest Expense $9.5 0.6% 70 EBT $107.0 6.5% 80 Income Tax Expense $27.3 1.7% (40) Note: Effective Tax Rate 25.5% EAT $79.7 4.9% 50 Note: Percentages may not foot due to rounding. 8 * Compared to FY16 Q2 adjusted performance. A reconciliation of reported to adjusted numbers can be found in the additional information section of this presentation.

SEGMENT PERFORMANCE Segment sales growth ($ millions) Fine Dining Other $915 -% $892 $365 $365 $234 $228 $129 $123 FY16 Q2 FY17 Q2 FY16 Q2 FY17 Q2 FY16 Q2 FY17 Q2 FY16 Q2 FY17 Q2 …with strong Segment Profit Margin, excluding incremental rent from real estate transactions 1 Fine Dining Other 19.3% 2 18.3% 2 18.4% 2 18.2% 0.8% 2.5% 0.1% 16.0% 2 15.4% 2 15.4% 2 14.3% 2 0.4% 1.6% 0.6% 0.1% 18.2% 17.6% 16.8% 15.0% 14.8% 14.4% 14.2% FY16 Q2 FY17 Q2 FY16 Q2 FY17 Q2 FY16 Q2 FY17 Q2 FY16 Q2 FY17 Q2 Rent and other tax expense impact on Segment Profit Margin from fiscal 2016 real estate transactions 1 Segment profit margin calculated as (sales less costs of food & beverage, restaurant labor, restaurant expenses and marketing expenses) / sales. 2 Segment profit margin adjusted to exclude the impact of incremental rent and other tax expense from the fiscal 2016 real estate transactions. 9

FISCAL 2017 ANNUAL OUTLOOK Sales Margin Total Sales Growth Cost Savings 1.7% to 2.7% $30 Same Restaurant Sales Total Inflation 1.0% to 2.0% 1.5% to 2.0% New Restaurants Effective Tax Rate 24 to 28 26% to 27% Capital Spending $310 to $350 Earnings per Diluted Share $3.87 to $3.97 (~126 million Weighted Average Diluted Shares Outstanding) Note: Dollars in millions except per share amounts. 10

ADDITIONAL INFORMATION

SECOND QUARTER SAME-RESTAURANT SALES GROWTH 2.6% -0.3% 0.7% 1.2% 2.7% 12

COMMODITIES OUTLOOK – 2 nd HALF OF FISCAL 2017 Product Breakdown and Contract Coverage For 2 nd Half of Fiscal 2017 Dec-May FY2017 Spend by Category Coverage Outlook Beef 20% 55% Low Single Digit Deflation Produce 12% 80% Low Single Digit Inflation Dairy / Oil 1 12% 60% Low Single Digit Inflation Seafood 10% 90% Mid Single Digit Inflation Wheat 2 7% 95% Flat Chicken 7% 95% Low Single Digit Inflation Non-Perishable / Other 32% 65% Low Single Digit Inflation Weighted Average 100% ~70% Coverage ¹ Includes cheese, cream, butter, and shortening ² Includes breadsticks and pasta 13

Recommend

More recommend

Explore More Topics

Stay informed with curated content and fresh updates.