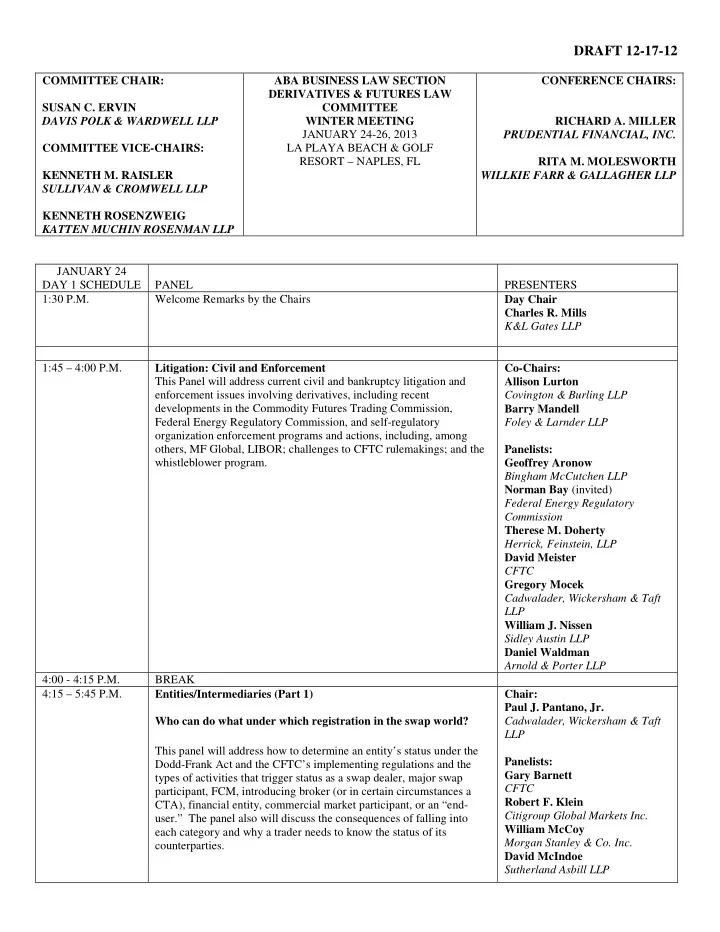

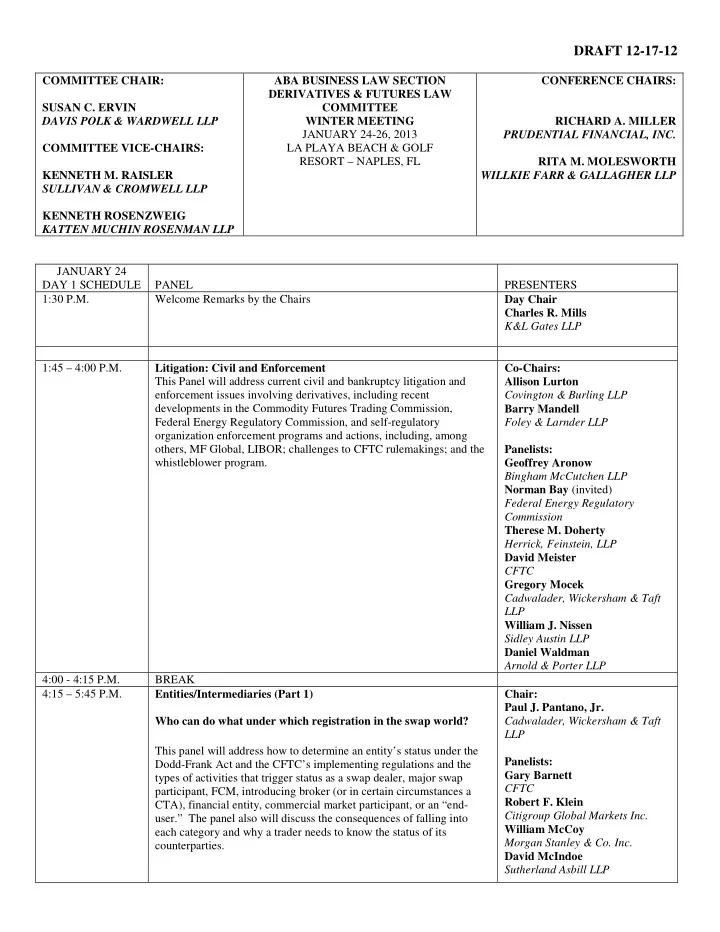

DRAFT 12-17-12 COMMITTEE CHAIR: ABA BUSINESS LAW SECTION CONFERENCE CHAIRS: DERIVATIVES & FUTURES LAW SUSAN C. ERVIN COMMITTEE DAVIS POLK & WARDWELL LLP WINTER MEETING RICHARD A. MILLER JANUARY 24-26, 2013 PRUDENTIAL FINANCIAL, INC. LA PLAYA BEACH & GOLF COMMITTEE VICE-CHAIRS: RESORT – NAPLES, FL RITA M. MOLESWORTH KENNETH M. RAISLER WILLKIE FARR & GALLAGHER LLP SULLIVAN & CROMWELL LLP KENNETH ROSENZWEIG KATTEN MUCHIN ROSENMAN LLP JANUARY 24 DAY 1 SCHEDULE PANEL PRESENTERS 1:30 P.M. Welcome Remarks by the Chairs Day Chair Charles R. Mills K&L Gates LLP 1:45 – 4:00 P.M. Litigation: Civil and Enforcement Co-Chairs: This Panel will address current civil and bankruptcy litigation and Allison Lurton enforcement issues involving derivatives, including recent Covington & Burling LLP developments in the Commodity Futures Trading Commission, Barry Mandell Federal Energy Regulatory Commission, and self-regulatory Foley & Larnder LLP organization enforcement programs and actions, including, among others, MF Global, LIBOR; challenges to CFTC rulemakings; and the Panelists: whistleblower program. Geoffrey Aronow Bingham McCutchen LLP Norman Bay (invited) Federal Energy Regulatory Commission Therese M. Doherty Herrick, Feinstein, LLP David Meister CFTC Gregory Mocek Cadwalader, Wickersham & Taft LLP William J. Nissen Sidley Austin LLP Daniel Waldman Arnold & Porter LLP 4:00 - 4:15 P.M. BREAK 4:15 – 5:45 P.M. Entities/Intermediaries (Part 1) Chair: Paul J. Pantano, Jr. Cadwalader, Wickersham & Taft Who can do what under which registration in the swap world? LLP This panel will address how to determine an entity’s status under the Panelists: Dodd-Frank Act and the CFTC’s implementing regulations and the Gary Barnett types of activities that trigger status as a swap dealer, major swap CFTC participant, FCM, introducing broker (or in certain circumstances a Robert F. Klein CTA), financial entity, commercial market participant, or an “end- Citigroup Global Markets Inc. user.” The panel also will discuss the consequences of falling into William McCoy each category and why a trader needs to know the status of its Morgan Stanley & Co. Inc. counterparties. David McIndoe Sutherland Asbill LLP

Annette Nazareth Davis Polk & Wardwell LLP Barbara Wierzynski (invited) Futures Industry Association 5:45 P.M. ADJOURN FOR THE DAY 6:30P.M. WELCOME RECEPTION [Bayview Ballroom and Terrace at La Playa] 8:00 P.M. REGULATORS' DINNER (by Invitation Only) Sea Salt, Naples JANUARY 25 DAY 2 SCHEDULE PANEL PRESENTERS Day Chair: Kathryn Trkla Foley & Lardner 8:00 - 9:15 A.M. Entities/Intermediaries (Part 2) Chair: Joanne Medero BlackRock Everyone into the Pool -- Implications of Regulatory Change for Collective Investments Panelists: This panel will review how Dodd Frank changes and CFTC Jennifer Han rulemakings have changed the regulatory landscape for collective Managed Funds Association investment vehicles and what constitutes a “commodity pool.” Gary Barnett Securitizations, funds of funds, registration, systemic risk reporting, CFTC RICs and harmonization, and impact on funds from position limits and Ellen Marks the district court decision in the Regulation 4.5 litigation. Latham Watkins Lawrence Patent K&L Gates Thomas Sexton National Futures Association 9:15 - 9:30 A.M. BREAK 9:30 - 11:00 A.M. Follow the Money – Clearing and Financial Security Chair: Michael Philipp Morgan, Lewis & Bockius LLP This panel will address mandatory clearing developments, segregation requirements, credit/margin arrangements for uncleared swaps, Panelists: portfolio margining, cross-border clearing issues, and living wills. Ananda Radhakrishnan CFTC Douglas Harris Promontory Financial Group Tracey Jordal PIMCO Jason Silverstein CME Group James McDaniel Sidley Austin LLP Alessandro Cocco JP Morgan - 2 -

11:00 - 11:15 A.M. BREAK 11:15 - 12:45 P.M. Derivatives Market Structure in 2018; How Might Analogous Chair: Historical Precedents Help Predict Evolution Gary DeWaal Newedge This panel will look forward five years and conjecture what derivatives markets will look like: how will derivatives be executed and cleared, Panelists: both OTC and on exchange or exchange-like platforms, and how Dan Berkovitz regulation will influence such evolution or react to it. Drawing on CFTC historical precedents for swaps clearing and trading, as well as the Tony Leitner evolution of clearing, reporting and trading in other asset classes such A J Leitner & Associates as futures, equity options and corporate debt, this panel will try to Trabue Bland extrapolate to what may happen as Title VII of Dodd Frank is finally ICE implemented. The panel will consider key factors such Randall Costa as: standardization versus customization, collateral and capital Citadel dynamics, transparency, deployment of new technologies, multiple Arthur Hahn CCPs and trading venues, the role of brokers and other intermediaries, Katten Muchin Rosenman LLP and futurization. Finally, this panel will consider the US role in Suzanne Calcagno shaping or reacting to equivalent developments outside of its borders, LCH.Clearnet as well as the possible evolution of regulators in overseeing markets both within the US and internationally. 1:00 P.M. LUNCHEON [Speaker TBA ] 2:15 P.M. ADJOURN FOR THE DAY [ subcommittee meetings deleted ] 6:00 P.M. COCKTAIL RECEPTION [Gulf Lawn at LaPlaya] 7:30 P.M. DINNER ON OWN – DOWNTOWN NAPLES Transportation will be provided to and form LaPlaya JANUARY 26 DAY 3 SCHEDULE PANEL PRESENTERS Day Chair: Ronald S. Oppenheimer Vitol Inc. 8:30 – 9:30 A.M. Professional Responsibility Chair: Ethical challenges uncovered in the Dodd Frank implementation Alexandra Guest process Barclays Capital The panel will discuss some of the many ethical issues uncovered as Firms move to implement a wide range of Dodd-Frank regulations, Panelists: including: Howard Schneider Navigant Economics, Inc. 1. Challenges in making the new whistleblower provisions work Michael Sackheim 2. The perils of the anti-evasion prohibition Sidley Austin LLP 3. Keeping both the CCO and the organization safe Peter Y. Malyshev 4. Rethinking conflicts and confidential information in the new world Latham & Watkins Robert Mass Goldman Sachs & Co. Robert Paul Tradeweb - 3 -

9:30 - 10:45 A.M. International Developments Chair: The international panel will focus on legislative and regulatory Jacqueline Mesa initiatives inside and outside the United States and their impacts on the CFTC financial services industries in the US, Canada, Europe and Asia. Panelists will compare and contrast a variety of regulatory proposals Panelists: and will discuss their impact on competition, cost, legal certainty and Christopher Bates risk. Panelists also will discuss global initiatives that influence the Clifford Chance LLP legislative and regulatory work, including current work in standard Andrea Corcoran setting bodies such as IOSCO. Align International Ronald Filler New York Law School Kevin Fine Ontario Securities Commission Michael Otten Nomura 10:45 - 11:00 A.M. BREAK 11:00 A.M. – Implementation of DFA: Co-Chairs: 12:30 P.M. Biggest Challenges and Biggest Risks Kenneth M. Raisler Sullivan & Cromwell LLP A wrap-up examination of the impact of the Dodd-Frank Act on the markets and market participants. Open issues and regulators’ next Panelists: steps will be examined. Timing, litigation and legislative amendment Robert Pickel potential will be addressed. ISDA Edward Rosen Cleary Gottlieb, Steen & Hamilton LLP Jerrold Salzman Skadden, Arps, Slate, Meagher & Flom, LLP Hon. Mark P. Wetjen CFTC Walter Lukken Futures Industry Association Philip McBride Johnson Former CFTC Chairman Lauren Teigland-Hunt Tiegland Hunt LLP 12:30 P.M. ADJOURN - 4 -

Recommend

More recommend