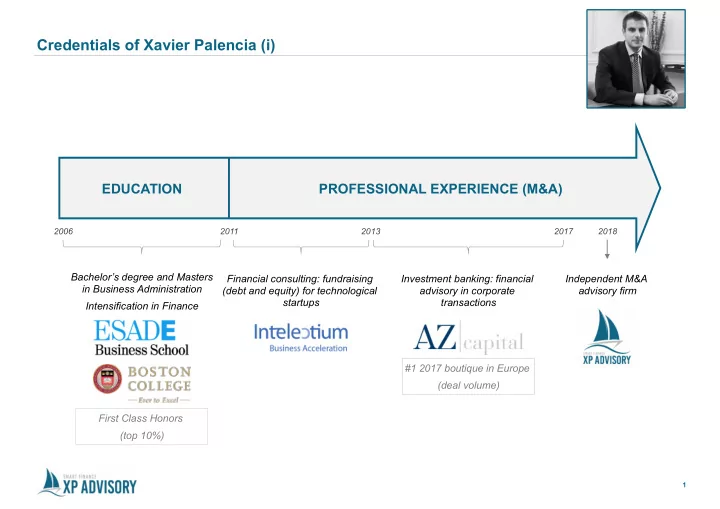

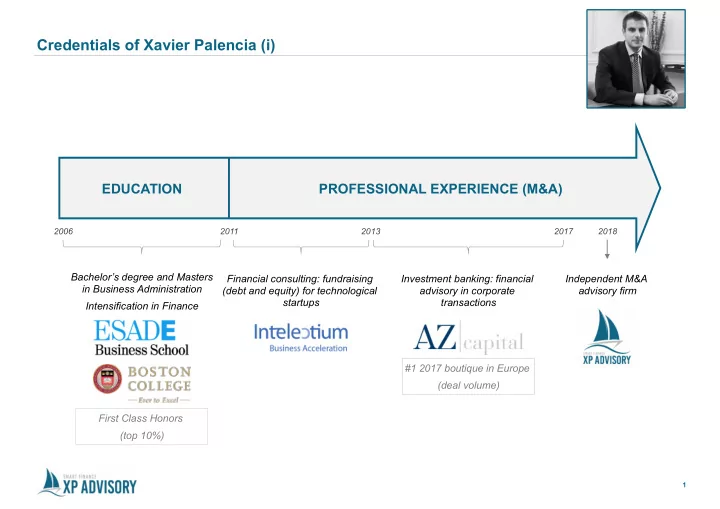

Credentials of Xavier Palencia (i) CORPORATE PRESENTATION EDUCATION PROFESSIONAL EXPERIENCE (M&A) 2006 2011 2013 2017 2018 Bachelor’s degree and Masters Financial consulting: fundraising Investment banking: financial Independent M&A in Business Administration (debt and equity) for technological advisory in corporate advisory firm startups transactions Intensification in Finance #1 2017 boutique in Europe (deal volume) First Class Honors (top 10%) 1

Credentials of Xavier Palencia (ii): Case Studies at AZ Capital 1 CORPORATE PRESENTATION Divestments Acquisitions IPO 2015 2014 2017 2016 2016 Advisor of a potential Gas Natural Fenosa’s Advisor of a potential investor in the acquisition of Agrolimen’s advisor in the advisor in the sale of its investor in the acquisition of Sapec (agro-chemical Abertis’ advisor in the IPO sale of Bicentry (healthy fiber optics business to Continental Foods (food company: crop protection of its telecom tower food) to Nutrition & Santé Cinven sector) and crop nutrition products) subsidiary Cellnex € 510 MM c. € 1,000 MM c. € 450 MM € 3,240 MM Mergers Debt reorganization Financial Strategy 2017 2014 2017 2016-2017 2015-2017 Investindustrial’s advisor in Criteria’s advisor in the Advisor in the debt Advisor in the proactive Strategic and financial the merger between Emeru exchange of a 24% stake in reorganization of Celsa’s management of Mango’s advisory analyzing the (ambulance services) and Agbar for a 4% stake in Spanish subsidiary (steel (fast fashion) financial debt portfolio of businesses at Ambuibérica) Suez Environ. plus cash company) and relationship with banks Group Puig (fragrances) c. € 600 MM € 2,673 MM 1. Projects developed while at AZ Capital 2

Credentials of Xavier Palencia (iii): Case Studies at Intelectium 1 CORPORATE PRESENTATION Public debt Fundraising Private investments Finance consulting / Strategy consulting 1. Projects developed while at Intelectium Consulting 3

Vision of XP Advisory CORPORATE PRESENTATION XP Advisory offers all companies access to maximum quality financial advisory services providing top technical rigor regardless of its size, industry or geographic location The Smart Finance concept reflects how XP Advisory works: to helping companies to manage their finance in an intelligent, professional and efficient manner 4

Fundamental purpose CORPORATE PRESENTATION Financial and M&A advisory with the aim of accompanying clients to reach their financial targets • Maximization of the value of a business and optimization of its management from a financial standpoint • Search for opportunities (acquisitions) and/or potential shareholders to develop the business • Analysis of potential business divestments and preparation for the sale process Full range of services • Full advisory in corporate transactions: acquisitions, mergers, divestments, capital increases or debt reorganizations • Analysis to a potential launch of a new business and fundraising (both debt or equity) • Support defining the optimal financial strategy and its execution in ongoing businesses Total focus in developing a long-term professional relationship with the client • Close advisory. Independent and trustworthy • Work with the maximum quality and rigor. 100% result-based approach 5

Values CORPORATE PRESENTATION 1 Independence and confidentiality • Independent and objective advisory • No conflict of interests • Total discretion and maximum confidentiality 2 High-quality service • Global perspective and analytical skills • Maximum technical rigor in the analysis and professionality in the Long-term process execution relationship with 3 Work performed jointly with the client the client • Smooth, direct and honest relationship with the client • Formulation of innovative and effective solutions • Ethical and trustworthy advisory 4 Flexibility and customer focus • Tailored service • Availability and flexibility • Close and honest relationship with the client 6

Who is XP Advisory’s advice addressed to? CORPORATE PRESENTATION Family businesses Entrepreneurs / Management Independent teams businessmen Advice provided to any type of clients Private Equity Public funds administrations Venture Capital funds 7

Service delivery CORPORATE PRESENTATION 2 DIFFERENTIATED FOCUSES OF WORK: Mergers & Acquisitions (M&A) Finance and Economic Consulting Corporate deals in ongoing Launch of new businesses and Finance strategy and management businesses startups of ongoing companies External opinion on financial strategy Business valuation Development of a Business Plan and management Financial modelling to identify financial Recommendations to increase the Acquisition of companies or assets needs value of a business Divestment of companies or business Search of equity (shareholders) Advisory in debt transactions units Strategic analysis linked to corporate Financial reorganizations Project fundraising processes Capital increases 8

Contact details CORPORATE PRESENTATION Corporate contact details Personal contact details XP Advisory Xavier Palencia (Partner) Web: www.xpadvisory.com Phone: +34 690 650 131 Email: info@xpadvisory.com Email: xpalencia@xpadvisory.com 9

CORPORATE PRESENTATION 10

Recommend

More recommend