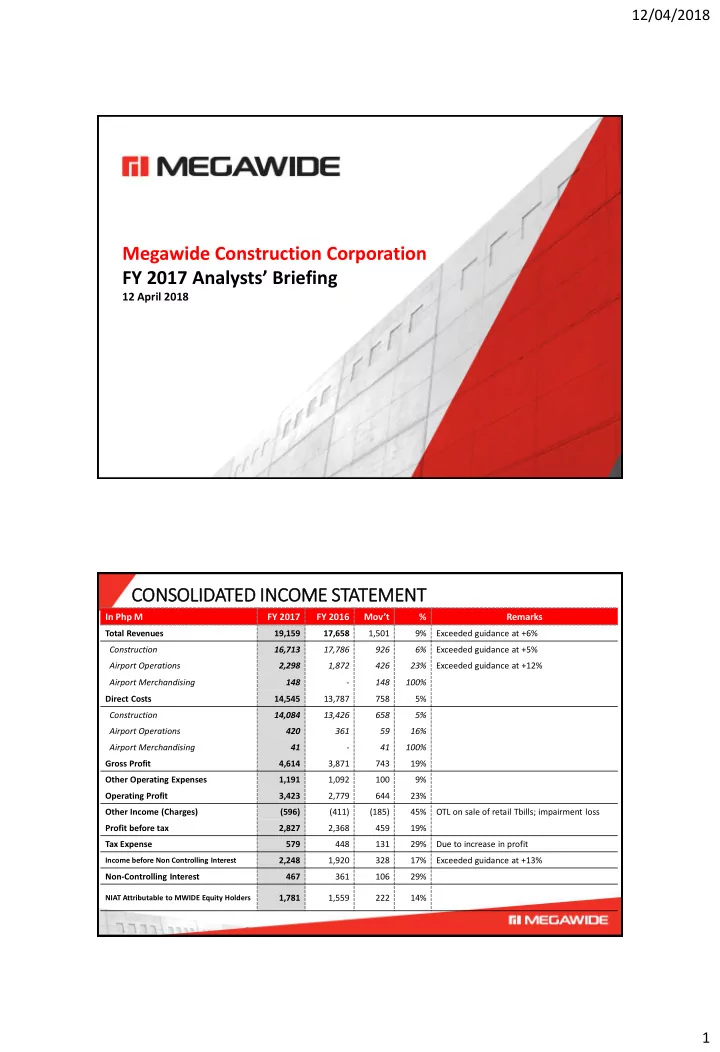

12/04/2018 Megawide Construction Corporation FY 2017 Analysts’ Briefing 12 April 2018 CONSOLIDATED INCOME STATEMENT In Php M FY 2017 FY 2016 Mov’t % Remarks Total Revenues 19,159 17,658 1,501 9% Exceeded guidance at +6% Construction 16,713 17,786 926 6% Exceeded guidance at +5% Airport Operations 2,298 1,872 426 23% Exceeded guidance at +12% Airport Merchandising 148 - 148 100% Direct Costs 14,545 13,787 758 5% Construction 14,084 13,426 658 5% Airport Operations 420 361 59 16% Airport Merchandising 41 - 41 100% Gross Profit 4,614 3,871 743 19% Other Operating Expenses 1,191 1,092 100 9% Operating Profit 3,423 2,779 644 23% Other Income (Charges) (596) (411) (185) 45% OTL on sale of retail Tbills; impairment loss Profit before tax 2,827 2,368 459 19% Tax Expense 579 448 131 29% Due to increase in profit Income before Non Controlling Interest 2,248 1,920 328 17% Exceeded guidance at +13% Non-Controlling Interest 467 361 106 29% NIAT Attributable to MWIDE Equity Holders 1,781 1,559 222 14% 1

12/04/2018 FY 2017 FINANCIAL HIGHLIGHTS REVENUE EBITDA NET INCOME 1% 1% 2% 12% 38% 50% Construction Airport 87% 61% 48% Merchandising AIRPORT** CONSOLIDATED CONSTRUCTION +31% 2,446 +9% +6% 19,159 16,713 +31% 1,705 +28% 1,158 +19% +12% +7% 4,289 +17% 2,584 1,090 2,248 Revenue EBITDA Net Income Revenue EBITDA Net Income Revenue EBITDA Net Income *In M Php **Includes airport merchandising FY Y 2017 MARGIN PER ERFORMANCE In Php Million FY 2017 FY 2016 Remarks Gross Profit Margin 24% 22% Due to increase in both Cons & Airport Construction 16% 15% GP increased by 11% Airport Operations 82% 81% GP increased by 24% Airport Merchandising 72% - EBITDA Margin 22% 20% Construction 15% 15% Airport Operations 71% 70% Airport Merchandising 43% - Net Income Margin 12% 11% Construction 7% 6.44% Airport Operations 49% 48% Airport Merchandising 29% - 2

12/04/2018 FINANCIAL POSI SITION In Php M 31-Dec-17 31-Dec-16 Movement % Change Cash & Financial Assets 8,140 10,938 (2,798) (26%) Other Current Assets 10,559 10,033 526 5% Total Current Assets 18,699 20,971 (2,272) (10%) Concession Assets 25,608 20,339 5,269 26% Total Non Current Assets 35,719 30,113 5,606 19% 54,418 51,085 3,331 7% Total Assets Current Liabilities 9,413 11,459 (2,046) (18%) Non Current Liabilities 26,869 23,416 3,453 15% Total Liabilities 36,282 34,875 1,407 4% Equity 18,136 16,210 1,926 12% LIQUIDITY AND ND GEARING RATIOS 0.70 2014 2015 2016 2017 0.57 PROFITABILITY RATIOS 0.41 0.35 24% 22% 21% 17% 13% 12% 12% 11% 10% 9% 9% 7% Gross Profit Margin Net Profit Margin Return on Equity Earnings per Share SOLVENCY RATIOS LIQUIDITY RATIOS 1.99 6.36 1.83 1.78 1.56 4.85 1.38 1.35 4.39 4.11 0.90 0.67 1.59 1.60 1.29 1.36 1.15 0.80 0.91 0.77 Gross Debt to Equity Net Debt to Equity Net Debt to EBITDA Current Ratio Quick Ratio Ratio * Interest Bearing loans: FY 2016 - P25.8bn FY 2017 – P28.9bn **Net debt: FY 2016 - P14.8bn FY 2017 – P20.8bn 3

12/04/2018 CONSTRUCT CTION OPER ERATIONS +11% Construction Revenues Quarterly Revenues 2015 2016 2017 +6% (in M Php) 18,585 Revenue 19,000 15,786 16,713 (in Php M) GP Margin 32.0% Net Income Margin 13,958 14,000 5,478 -24% +24% +31% 10,880 +11% 4,708 4,189 -33% 9,842 +40% 4,270 22.0% 4,107 4,146 4,272 -20% 8,205 3,695 7,742 9,000 17.0% 16.4% 3,174 16.2% 15.0% 15.0% 16.0% 14.2% 3,439 2,346 2,632 12.3% 9.7% 12.9% 12.0% 4,000 8.4% 7.0% 7.0% 6.4% 2.0% -1,000 2011 2012 2013 2014 2015 2016 2017 E2018 Q1 Q2 Q3 Q4 Construction Income Quarterly Income (in M Php) +19% (in Php M) +52% +7% 1,301 +18% 1% 386 363 +86% -28% 1,092 1,090 1,013 1,017 973 314 311 293 281 838 276 +27% 254 750 -56% +117% 207 163 158 75 2011 2012 2013 2014 2015 2016 2017 E2018 Q1 Q2 Q3 Q4 * 2015 Expiration of ITH 4

12/04/2018 CONSTRUCT CTION OPER ERATI TIONS ORDER BOOK Office & ORDER BOOK MIX FY17 (in Php Bn) Comm'l 39.06 38.49 21% Infra 32.60 6% 22.63 20.30 18.80 Residential 73% 2012 2013 2014 2015 2016 2017 ORDER BOOK MIX FY16 Office & 37.73 NEW CONTRACTS Comm'l (in Php Bn) 28% 17.60 14.10 Infra 12.73 12.42 10.82 7% Residential 65% 2012 2013 2014 2015 2016 2017 5

12/04/2018 AIRPORT T OPER ERATI TIONS 193.0 Air Traffic Passenger Traffic 30.4 174.0 (in ‘000) (In Million) 39.4 10.2 26.2 Domestic Int'l 152.2 Domestic Int'l 36.1 9.0 21.7 105.3 112.1 116.3 119.4 125.2 130.6 32.0 28.0 6.9 8.0 8.9 9.9 11.3 12.7 14.0 15.3 16.3 17.5 7.5 27.8 27.7 26.5 25.0 86.6 24.5 6.0 72.6 5.7 5.4 65.0 21.3 137.9 153.6 4.9 16.4 4.3 120.2 9.9 10.6 11.5 14.2 17.2 20.2 13.8 3.7 97.4 102.6 3.1 89.8 91.7 87.1 2.0 2.5 80.9 1.7 9.4 65.3 56.2 51.2 9.1 8.4 7.6 6.4 6.8 5.9 2.0 5.2 7.4 FY 2017 Air Traffic Volume FY 2017 Passenger Volume Growth 2016 2017 % Increase 2016 2017 % Increase Domestic 56,210 65,300 16% Domestic 6.38 6.84 6. 84 7% International 16,383 21,300 30% International 2.52 3.13 3. 13 24% Total 72,593 86,600 19% Total 8.89 9. 9.97 97 12% AIRPORT OPER ERATIONS +23% AIRPORT REVENUE QUARTERLY REVENUE 2,298 In Php M 2015 2016 2017 (in Php M) 295 +16% +26% +17% +32% +26% +17% AERO 1,872 586 575 570 568 +29% NON-AER0 +27% 232 +38% +24% 1,484 493 723 +23% +36% 483 PSC 465 431 168 532 +57% 380 381 374 349 339 1,280 +16% 1,108 +13% 977 200 26 42 131 Q1 Q2 Q3 Q4 2014 2015 2016 2017 1 st Step-Up: Effective June 2015 FY 2017 Revenue Mix Passenger Service Domestic – from P200 to P300 Charge (PSC) AERO International – from P550 to P750 RELATED 13% Aircraft service charges – fees collected from Aero Related airlines for the payment for aero bridges, ground handling, fuel, etc. PSC NON-AERO 56% Rental revenues from concession tenants 31% Non-aero such and Retail. Also includes advertising, car parking and other rental revenues 6

12/04/2018 AIRPORT T OPER ERATI TIONS Quarterly EBITDA 2015 2016 2017 AIRPORT EBITDA +23% (in Php M) 71% In Php M +28% 25% +36% 433 +20% 420 399 389 70% +26% +42% 368 +32% Margin 1,641 329 +49% 320 306 65% 1,302 285 243 231 971 191 45% 90 Q1 Q2 Q3 Q4 2014 2015 2016 2017 AIRPORT NET INCOME Quarterly Income 2015 2016 2017 49% +113% +105% In Php M (in Php M) -5% +104% +44% -5% 304 48% +24% 294 280 274 271 1,115 260 +60% Margin 903 34% 187 +32% 148 138 134 117 501 112 25% 49 Q1 Q2 Q3 Q4 2014 2015 2016 2017 AIRPORT OPER ERATIONS Passenger Passe r Mix International International 28% 31% FY 2016 FY 2017 Domestic Domestic 69% 72% Breakdown of Brea of Inter ernatio ional Tou ouris rists ts 2016 2016 % of Cebu Int’l Arrivals to Total PH Int’l Arrivals 8.1 Taiwan 2% Others 5% 6.7 EU, 4% Korea 48% Australia 3% 5.4 China 7% USA 10% 2.2 1.6 1.0 2015 2017E 2019E Cebu Int'l arrivals (Mn) Other Ph Int'l arrivals (Mn) Japan 21% EU: UK, Germany & France 7

12/04/2018 AIRPORT T OPER ERATI TIONS 35 109 22 25 PARTNER 29 AIRLINE CARRIERS 8 Local 17 International AIRPORT OPER ERATIONS Details of new routes/frequency in 2017 Details of new routes/frequency in 2017 Airline Destination Start Date Aircraft/Frequency Airline Destination Start Date Aircraft/Frequency DOMESTIC INTERNATIONAL PAL Clark March 26 A321/3 Xiamen Airlines Fuzhuo April 18 B738/2 PAL Chengdu Jan 16 A321/3 PAL General Santos March 26 A320/7 Sichuan Airlines Chongqing Mar 28 A321/4 PAL Puerto Princesa March 26 A321/7 Lucky Air Kunming June 1 B737-800/3 PAL Busuanga March 26 Q400/7 AirAsia Kuala Lumpur July 15 A320 PAL Surigao March 26 Q400/7 China Eastern Shanghai Oct 18 A320/7* PAL Butuan March 26 A320/7 Air Asia Davao April 22 A320/7 Juneyao Airlines Shanghai Oct 31 A321/3 Air Asia Puerto Princesa April 22 A320/7 Okay Airways Xi’an Oct 31 B737-800/3 Cebu Pacific Busuanga May 15 ATR500/3 PAL Beijing Nov 26 A320/1 PAL Bangkok Dec 2 A320/3 Cebu Pacific Cotabato May 16 ATR500/4 Pan Pacific Muan Dec 9 A320/2 Air Asia Kalibo June 19 A320/7 Pan Pacific Incheon Dec 10 A320/7 AirJuan Tagbilaran June 19 Cessna Caravan *Daily/effective 18-28 Oct then resumes 18Jan18 onwards AirJuan Bantayan June 19 Cessna Caravan AirJuan Biliran June 19 Cessna Caravan AirJuan Siquijor June 19 Cessna Caravan PAL Tagbilaran June 22 A320 Details of new routes/frequency in 2018 Cebu Pacific Masbate July 26 ATR-500 Airline Destination Start Date Aircraft/Frequency Air Juan Maasin Aug 1 Cessna Caravan/2 INTERNATIONAL Air Juan Sipalay Aug 2 Cessna Caravan/2 China Eastern Guangzhou Jan 20 A320/2 PAL Camiguin Dec 1 Q400/7 Pan Pacific Pusan Feb 15 A320/2 PAL Siargao Dec 1 Q400/7 DOMESTIC PAL Legazpi Dec 1 Q400/7 Air Juan Ormoc Mar 15 Cessna Caravan/2 PAL Ozamiz Dec 1 Q400/7 Air Juan Catbalogan Mar 19 Cessna Caravan/2 8

Recommend

More recommend