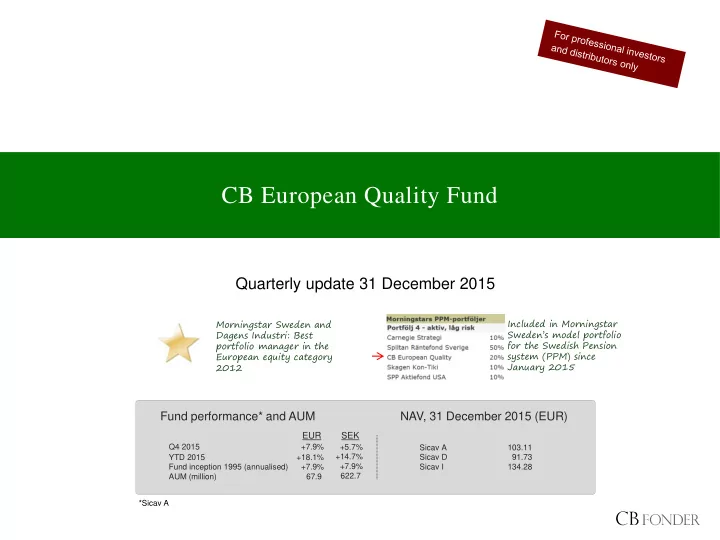

CB European Quality Fund Quarterly update 31 December 2015 Included in Morningstar Morningstar Sweden and Sweden’s model portfolio Dagens Industri: Best for the Swedish Pension portfolio manager in the European equity category system (PPM) since 2012 January 2015 Fund performance* and AUM NAV, 31 December 2015 (EUR) EUR SEK Q4 2015 +7.9% +5.7% Sicav A 103.11 +14.7% Sicav D 91.73 YTD 2015 +18.1% +7.9% Fund inception 1995 (annualised) +7.9% Sicav I 134.28 622.7. AUM (million) 67.9. *Sicav A

The strategy and the team CB European Quality Fund The team Overview - CB European Quality Fund Carl Bernadotte A long-only equity fund with a focus on European quality growth Portfolio manager & owner companies >25 years’ experience The strategy was launched in 1995 Born 1955 Owns shares in CB European Quality Fund Concentrated portfolio (20-33 holdings) and a long-term perspective Marcus Grimfors Benchmark: MSCI Europe Net Portfolio manager Objective: Lower standard deviation than benchmark 7 years’ experience Objective: Outperform benchmark over 12 months Born 1981 Owns shares in CB European Quality Fund Overview - CB Fonder Alexander Jansson Portfolio manager & CEO Company founded in 1994 7 years’ experience Family owned, acting under the supervision of the Swedish Born 1983 Owns shares in CB European Quality Fund Financial Supervisory Authority Erik Allenius Somnell Guidelines: active, ethical and long-term Business development An ethical and sustainable framework is applied in the portfolio 3 years’ experience management Born 1984 Owns shares in CB European Quality Fund The team is based in Stockholm, Sweden; all fund administration is performed in Luxembourg 2

Strategy: Investment criteria CB European Quality Fund Large/mid caps - Min. market cap EUR 1 bn - Mature industries Resilient profit growth Primary - Proven management - - In any econ. environment - Stable dividend yield Conservative valuation Internal recruiting Secondary - Not necessarily high - - History & peers - - Subject to tradition - 3

Strategy: Structural growth is more value CB European Quality Fund creating than cyclical growth - And less dependent of the economic cycle Structural vs. cyclical growth Structural growth is independent of the economic cycle Drivers: Strong multiple Structural growth Secular trends expansion relative component Leading business model to the market Technical leadership Stable profit growth Limited multiple Cyclical growth Purely driven by expansion relative to component macro factors Cyclical model Structural model the market Credit: Allianz GI 4 Design: CB Fonder

Strategy: High barriers to entry CB European Quality Fund protected growth Competetiveness: Porter’s 5 forces -model Negotiating power versus suppliers Barriers to entry • Fragmentation of suppliers Threat of new entrants • Cost, time, knowledge - monopoly to perfect competion • Economies of scale • Degree of specialisation • Technologies, patents etc. Competitive Bargaining power Bargaining power of rivalry among of suppliers incumbents customers (buyers) Customer/client relationship Barriers to substitution • • Degree of customer loyalty Brand recognition Threat of substitute • products or services • Switching costs Product complexity, patents etc. • Pricing power Source: Competitive Strategy: Techniques for Analyzing Industries and Competitors, 5 Michael E. Porter, 1980. Design: CB Fonder

Strategy: Stock selection according to a CB European Quality Fund bottom-up-strategy Fundamental analysis Quantitative analysis Technical analysis • • • Structural growth and barriers to Internally developed models for Momentum factors – is the short-term entry/moat – see p. 4 and 5. screening and ranking based on trend supportive of the sector/style? quantitative variables. • • Business idea – robust enough to deliver No target prices: ” let the trend be your • stable profit growth over an entire Valuation: in comparison to peers and friend ”. economic cycle? the company's own history and growth • rate. Timing for entry and exit levels; • Management – do they deliver as increasing and reducing portfolio • promised? Main multiples: P/E, P/B and PEG. positions. The fundamental and quantitative analysis forms the investment universe. The technical analysis plays a crucial role for the weighting of the portfolio. 6

Performance: The fund and the index CB European Quality Fund The fund gained +8% in the forth quarter and during the last 12 months the fund has gained +18%. The fund outperformed MSCI Europe Net during all four quarters. Our quality growth strategy outperformed in both a rising market in Q1 and Q4 2015 (+0.5% and +2.4% outperformance respectively) as well as in a falling market in Q2 and Q3 2015 (+0.8% and +5.1% outperformance respectively). The fund and the benchmark index, 1 year (EUR) The fund and the benchmark index, Q4 2015 (EUR) 115 130 125 110 120 +7.9% +18.1% 115 105 +5.3% 110 +8.2% 105 100 100 CB European Quality Fund Sicav A CB European Quality Fund Sicav A 95 MSCI Europe Net MSCI Europe Net 90 95 Dec-14 Mar-15 Jun-15 Sep-15 Dec-15 Sep-15 Oct-15 Nov-15 Dec-15 12% 4% CB European Quality Fund Sicav A 10% CB European Quality Fund Sicav A vs MSCI Europe Net +9.1% vs MSCI Europe Net +2.4% 8% 2% 6% 4% 0% 2% 0% -2% -2% Dec-14 Mar-15 Jun-15 Sep-15 Dec-15 -4% Sep-15 Oct-15 Nov-15 Dec-15 Source: MSCI, CB Fonder 7

Performance: The fund and the index CB European Quality Fund The fund (EQF) and the benchmark index, 10 years (EUR) 200 175 MSCI Europe Net (EUR) CB European Quality Fund Sicav A (EUR) 150 125 100 75 50 Dec-05 Dec-06 Dec-07 Dec-08 Dec-09 Dec-10 Dec-11 Dec-12 Dec-13 Dec-14 Dec-15 Key ratios (10 years)* EQF Index +51.2 Performance, % +59.0 The fund has outperformed the benchmark index, and has Standard deviation, % 13.02 15.26 due to its lower risk (beta: Sharpe (0%) +0.36 +0.28 0.70) generated a significant -54.10 Max drawdown, % -45.78 positive alpha. The fund’s Beta against MSCI Europe +0.70 risk-adjusted return, Sharpe, Alpha against MSCI Europe, % p.a. +1.79 is higher than that of the index. Consistency with MSCI Europe, % 52.5 Tracking error, % 8.73 Information ratio +0.06 Source: MSCI, CB Fonder 8 *Data as of 31 December 2015

The Portfolio: Contributors and detractors CB European Quality Fund Top three quarterly contributors and detractors, Q4 2015 (EUR) -0,2% 0,0% 0,2% 0,4% 0,6% 0,8% 1,0% Company Contr./Detr. % Avg. weight*, % Performance, % Continental +0.83 +18.1 4.8 AAK +0.81 +18.1 4.8 Assa Abloy +0.77 +21.4 3.9 Intrum Justitia -0.05 0.9 -1.1 Next Plc -0.10 5.2 -2.8 Handelsbanken -0.14 2.2 -3.7 *Average values in Q4 2015. Source: Bloomberg, CB Fonder • German Continental – mostly know for their tires but also a leading player in powertrain systems and through that also leading in development of e.g. electric and driverless cars – held their capital markets day (CMD) in Q4 at which the company confirmed its medium-term goals, e.g. that the Powertrain division should generate a € 10 billion turnover with a 10% operating margin by 2019. The company is positioned to gain from several structural growth trends: safety, fuel efficiency and ”internet of cars” . The stock gained 18% during the quarter, in EUR. • The vegetable oil refiner, AAK (previously AarhusKarlshamn), painted a positive picture of the company’s growth opportunities going forward at their CMD. An exciting area that was highlighted was TROPICAO, a solution chocolate producers can use to avoid heat-related bloom issues. The stock gained 18% during the quarter, in EUR. • Assa Abloy – global market leader that installs every tenth lock in the world – repeated its goal at the CMD of 5% annual organic growth as well as 5% growth through acquisitions; a growth rate matched by few in todays’ economic climate. A structural growth trend that the company is exposed to is digital locks, where a big advantage is that installations already made by Assa (installed base) generates 75% of sales. The stock gained 21% during the quarter, in EUR. • The Swedish debt collection firm Intrum Justitia announced during the quarter that they had sacked their successful CEO Lars Wollung. The firm was very vague in their communication of the decision, but stated that it had to do with different views on the future of the company. We sold our entire position after the announcement. The stock lost 1% during the quarter, in EUR. . • The Brittish clothing retailer Next was pressured (as was the whole industry) by warm weather in Q4 which caused a slow start of winter collection sales. Our take: temporary setback. The stock lost 3% during the quarter, in EUR. • In Q4, Svenska Handelsbanken made something for them very unusual: they missed expectations quite significantly in their Q3-report. We perceive this as a warning signal and a possible symptom of a harsher business climate. The stock lost 4% during the quarter, in EUR. 9

Recommend

More recommend