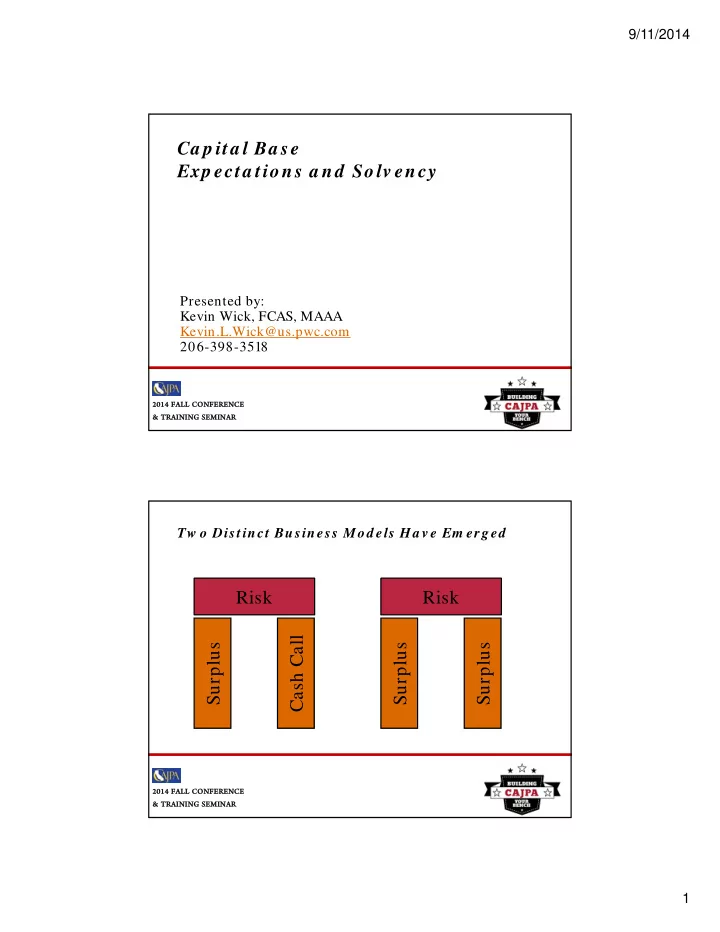

9/11/2014 Ca p ita l Ba se Exp ecta tions a nd Solv ency Presented by: Kevin Wick, FCAS, MAAA Kevin.L.Wick@us.pwc.com 206-398-3518 2014 FALL CONFERENCE 2014 FALL CONFERENCE & TRAINING SEMINAR & TRAINING SEMINAR Tw o Distinct Business Mod els Ha v e Em erged Risk Risk Cash Call Surplus Surplus Surplus 2014 FALL CONFERENCE 2014 FALL CONFERENCE & TRAINING SEMINAR & TRAINING SEMINAR 1

9/11/2014 Pools a re a t Different Sta ges Have not recognized • Minimal effort in assessing capital needs business model has • Same measurement tools that were used 25 years ago • “It has worked so why change?” resistant to change attitude changed Recognized change • Common pitfall is using the wrong measure but are struggling to • “90% confidence level” is not conservative upgrade financial • Universal set of “financial benchmark ratios” does not exist • “Risk based capital” is not a target measures Understands capital • Defined appropriate surplus targets requirements and • Leverage off recent advances in capital measures pool operation is • Consider impact on surplus needs of key financial decisions. consistent with goals 2014 FALL CONFERENCE 2014 FALL CONFERENCE & TRAINING & TRAINING SEMINAR SEMINAR Com m on Pool Solv ency Mea sures The “Confid ence Lev el” • Incomplete measurement of program risk - Unpaid claims only • Misleading - Percentage scale - Generally misunderstood by stakeholders • Not used in broader insurance marketplace • Made sense in the context of pooling when use started 2014 FALL CONFERENCE 2014 FALL CONFERENCE & TRAINING SEMINAR & TRAINING SEMINAR 2

9/11/2014 Com m on Pool Solv ency Mea sures Benchm a rk Fina ncia l Ra tios • Dependent on benchmark Exam ples values • Reserve to Surplus • Are pools comparable to the • Premium to Surplus insurance industry? • Net Retention to • Value of comparing to mostly Surplus unregulated and unrated industry? • Individual pools are unique A “ one size fits all” set of pool financial ratios to determ ine optim al capital targets does not and cannot exist 2014 FALL CONFERENCE 2014 FALL CONFERENCE & TRAINING & TRAINING SEMINAR SEMINAR Com m on Pool Solv ency Mea sures “Risk Ba sed Ca p ita l” form ula • RBC is a Regulatory Tool – Developed for a specific context – Having sufficient resources left in a troubled company to rehabilitate or liquidate – Not capital you should hold based on your risk “… w ill not com pute the precise am ount of capital an insurer needs to m aintain in a com petitive, dynam ic and uncertain m arketplace.” 2014 FALL CONFERENCE 2014 FALL CONFERENCE & TRAINING SEMINAR & TRAINING SEMINAR 3

9/11/2014 Are Pools Different tha n Insura nce Com p a nies? • Goal is not to make money for investors • Oversight is done by Board of Directors made up of members • Members have voting privileges • Policies and business practices are focused on serving the members • Lower cost structure How different is the underlying business model and need for capital? 2014 FALL CONFERENCE 2014 FALL CONFERENCE & TRAINING & TRAINING SEMINAR SEMINAR Determ ining Ca p ita l Ta rgets using Ca p ita l Mod eling Risk Measurement Capital Requirements Financial Goals (Risk Appetite) 2014 FALL CONFERENCE 2014 FALL CONFERENCE & TRAINING SEMINAR & TRAINING SEMINAR 4

9/11/2014 Fina ncia l Risk Ca tegories • Actual unpaid claims may be higher than current Reserving estimates Underwriting • Next year’s losses may come in higher than projected • Interest rates may go up which results in bond Asset/Credit holdings decreasing in value • Excess carrier may default Operational • Next year’s administrative budget may be exceeded due to an unforeseen event 2014 FALL CONFERENCE 2014 FALL CONFERENCE & TRAINING SEMINAR & TRAINING SEMINAR Risk Mea surem ent (Ca p ita l Mod eling) Process Step 3: In a similar Step 2: The individual manner, the total risks are aggregated funding need is into four broad determined through a categories considering risk aggregation interdependencies. process. Total Funding Need Underwriting Reserving Asset & Credit Operational Counter Int. GL AL GL - party People AL rate System Equity PR External PR APD APD WC WC Step 1: The uncertainty associated with each of this risk elements is measured. 2014 FALL CONFERENCE 2014 FALL CONFERENCE Slide 10 & TRAINING SEMINAR & TRAINING SEMINAR 5

9/11/2014 Exa m p le of Mod eling Outp ut 2014 FALL 2014 FALL CONFERENCE CONFERENCE & TRAINING & TRAINING SEMINAR SEMINAR Determ ining Ca p ita l Ta rgets Risk Measurement Capital Requirements Financial Goals (Risk Appetite) 2014 FALL CONFERENCE 2014 FALL CONFERENCE & TRAINING SEMINAR & TRAINING SEMINAR 6

9/11/2014 Context for Determ ining Risk Ap p etite/ Fina ncia l Goa ls “Pooling” Perspective versus from Other “Insurance” Pool’s Differences Other Insurance Financial Industry Demands of Pool Standards Members Financial Goals 2014 FALL CONFERENCE 2014 FALL CONFERENCE & TRAINING SEMINAR & TRAINING SEMINAR Exa m p le of Outcom e/ Fina ncia l Ta rgets In this example, the The board consensus minimum target funding was that funding level is a 1-in-100 year which exceeded what event. The board felt is necessary to cover members are expecting at a 1-in-500 year event a minimum that level of is excessive. protection. The current funding level is below the target. 2014 FALL CONFERENCE 2014 FALL CONFERENCE & TRAINING SEMINAR & TRAINING SEMINAR 7

9/11/2014 Mod eling a lso Prov id es Und ersta nd ing on the Source of the Ca p ita l Need s Modeling showed a large source of risk and thus capital need was from the long bond duration. Reducing the bond duration reduced risk and thus fund need. The current funding level is below the target. 2014 FALL CONFERENCE 2014 FALL CONFERENCE & TRAINING SEMINAR & TRAINING SEMINAR Decision Fra m ew ork Representative common “pooling” measures 2014 FALL 2014 FALL CONFERENCE CONFERENCE & TRAINING & TRAINING SEMINAR SEMINAR 8

9/11/2014 Observ a tions from Stud ies Com p leted • Common solvency measures being used by pools provide a false sense of security • Comparing to insurance industry problematic • smaller, concentrated exposure, higher retentions • Pool structures and risk profiles are unique • Clarity on funding adequacy is valuable to the stakeholders • Greater risk awareness leads to better financial decisions 2014 FALL CONFERENCE 2014 FALL CONFERENCE & TRAINING & TRAINING SEMINAR SEMINAR Key Milestones Transition from a “cash call” to a “risk transfer” business model •Business model has matured Recognition •Surplus is important •Common pool solvency measures developed in a “cash call” context Understand Capital •Consideration of all financial risks Requirements •Extreme enough events measured Financial Goals •Members/owners make this decision Defined •Context provided by management and consultants Ongoing Financial •Understanding of how financial decisions impact risk and funding adequacy Discipline •Surplus is used efficiently – proper financial controls and framework 2014 FALL 2014 FALL CONFERENCE CONFERENCE & TRAINING SEMINAR & TRAINING SEMINAR 9

9/11/2014 Reca p of Session Objectiv es 1. Provide clarity on the “appropriate pool surplus” question 2. Critique the common measures used by many pools to evaluate funding adequacy 3. Present at a high level an alternative approach to develop target surplus levels 4. Relate how the results of a capital modeling study can be used to answer common pool financial questions 5. Outline key milestones for making the transition from a “cash call” to a “risk transfer” business model 2014 FALL CONFERENCE 2014 FALL CONFERENCE & TRAINING & TRAINING SEMINAR SEMINAR Questions a nd Com m ents For further discussion regarding pool solvency measures and framework, please contact: Kevin L. Wick, FCAS, MAAA Hyeji Kang, FCAS, MAAA Craig J. Scukas, FCAS, MAAA Managing Director Director Director +1 (206) 398 3518 +1 (312) 298 4167 +1 (206) 398 3585 Kevin.L.Wick@us.pwc.com Hyeji.Kang@us.pwc.com Craig.J.Scukas@us.pwc.com 2014 FALL 2014 FALL CONFERENCE CONFERENCE & TRAINING SEMINAR & TRAINING SEMINAR 10

Recommend

More recommend