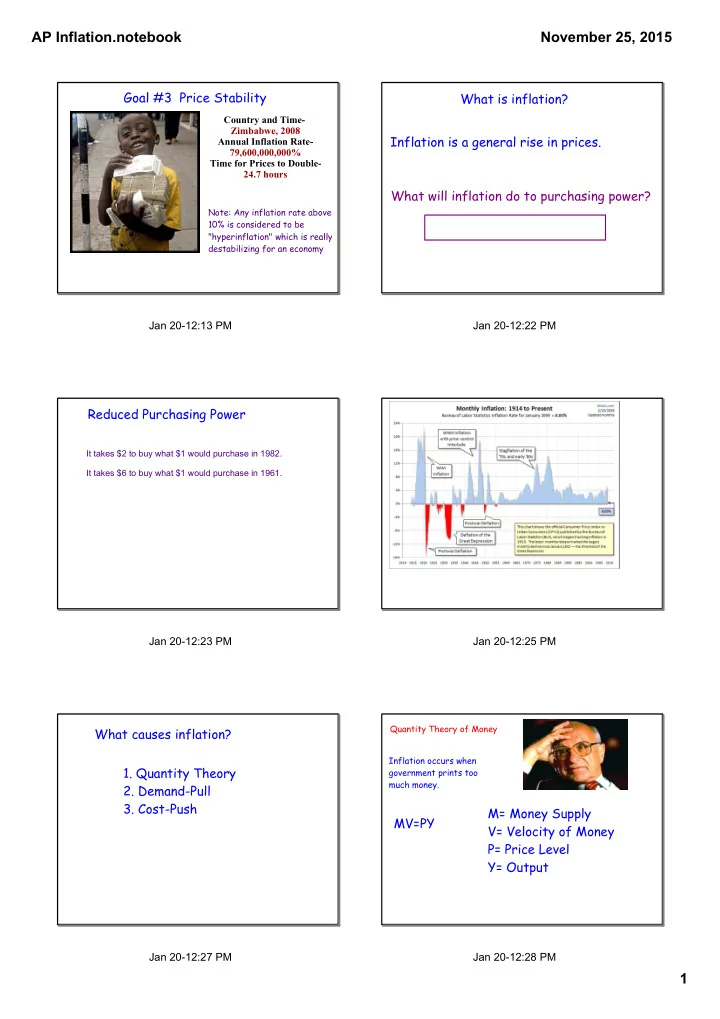

AP Inflation.notebook November 25, 2015 Goal #3 Price Stability What is inflation? Country and Time Zimbabwe, 2008 Inflation is a general rise in prices. Annual Inflation Rate 79,600,000,000% Time for Prices to Double 24.7 hours What will inflation do to purchasing power? Note: Any inflation rate above Purchasing Power will fall! 10% is considered to be "hyperinflation" which is really destabilizing for an economy Jan 2012:13 PM Jan 2012:22 PM Reduced Purchasing Power It takes $2 to buy what $1 would purchase in 1982. It takes $6 to buy what $1 would purchase in 1961. Jan 2012:23 PM Jan 2012:25 PM Quantity Theory of Money What causes inflation? Inflation occurs when 1. Quantity Theory government prints too much money. 2. Demand-Pull 3. Cost-Push M= Money Supply MV=PY V= Velocity of Money P= Price Level Y= Output Jan 2012:27 PM Jan 2012:28 PM 1

AP Inflation.notebook November 25, 2015 Demand-Pull Inflation Cost-Push Inflation -Higher production costs increase prices "Too many dollars chasing too few goods." -Usually due to a negative supply shock EX: Hurricane Katrina destroyed oil refineries Essentially, higher demand for products leads decreasing the supply of oil and gas. Companies that to temporary shortages that drive up prices. needed to use gasoline had to raise their prices to cover fuel costs. Can lead to STAGFLATION - rising prices coupled with FALLING real GDP. Jan 2012:32 PM Jan 2012:34 PM The Wage Price Spiral A Perpetual Process: 1.Workers demand raises 2.Owners increase prices to pay for raises 3. High prices cause workers to demand higher raises 4. Owners increase prices to pay for higher raises 5. High prices cause workers to demand higher raises 6. Owners increase prices to pay for higher raises Jan 2012:36 PM Jan 2012:26 PM Nominal Interest Rate v. Real Interest Rate Interest Rates and Inflation What is the difference? Jan 2012:41 PM Jan 2012:42 PM 2

AP Inflation.notebook November 25, 2015 Practice: Real Interest Rates The percentage increase in purchasing power that a 1. Nominal interest rate is 15%; Rate of inflation is 10%. borrower pays. (adjusted for inflation) What is the real interest rate? Real = nominal interest rate expected inflation Nominal Interest Rates 2. Nominal interest rate is 6%. The rate of inflation rises the percentage increase in money that the borrower unexpectedly to 8%. What is the real interest rate? pays not adjusting for inflation. Nominal = Real interest rate + expected inflation 3. The nominal interest rate is 10%. The real interest rate is 6%. What is the rate of inflation? Fisher Principal - nominal rate of interest will adjust so that it is equal to real interest rate plus inflation 4. Assume you have a loan on a used car at 4%. Determine your real interest rate. Jan 2012:44 PM Jan 2012:45 PM Closing: How do we measure inflation? Socrative Exit Ticket 1) Consumer Price Index 2) GDP Deflator Jan 265:01 AM Jan 2012:50 PM Consumer Price Index To see recent CPI data go to: - most common measurement of inflation - Government tracks the same goods and services over a period of time ("market basket") www.bls.gov - % change in prices from year to year is the inflation rate -prices are also usually compared to a base year (usually 1982) Jan 201:05 PM Jan 262:46 PM 3

AP Inflation.notebook November 25, 2015 Practice: price of market basket CPI = X 100 price of market basket 1. CPI 2002: 100 in a base year CPI 2003: 104 2. CPI 2005: 98 CPI 2006: 100 See figuring CPI sheet to see an example of how CPIs are 3. CPI 2007: 120 determined. CPI 2015: 135 Jan 201:35 PM Jan 201:45 PM Problems with CPI: Problems with CPI 2. New Products - the basket may not 1. Substitution Bias - as prices rise, include the newest products people are people substitute for items not in the buying market basket 3. Quality - CPI ignores improvements or declines in quality of products Jan 201:48 PM Jan 201:48 PM GDP Deflator Consumer Price GDP Deflator Index measures measures Nominal GDP Year 1 prices of a X 100 GDP Deflator = prices of ALL Real GDP Year 1 specific set goods and provides a of goods services measure of and produced inflation services domestically people Nominal GDP = (Deflator) X (Real GDP) typically 100 purchase Jan 201:50 PM Jan 201:52 PM 4

AP Inflation.notebook November 25, 2015 Practice: 1. In an economy, Real GDP (base year 1996) is $100 billion. Nominal GDP is $150 billion. Calculate the GDP Deflator. 2. In an economy Real GDP (base year 1996) is $125 billion. Nominal GDP is $150 billion. Calculate the GDP Deflator. 3. In an economy Real GDP (base year 1996) is $200 billion and the GDP Deflator is 120. Calculate nominal GDP. Jan 201:56 PM Jan 262:37 PM 5

Recommend

More recommend