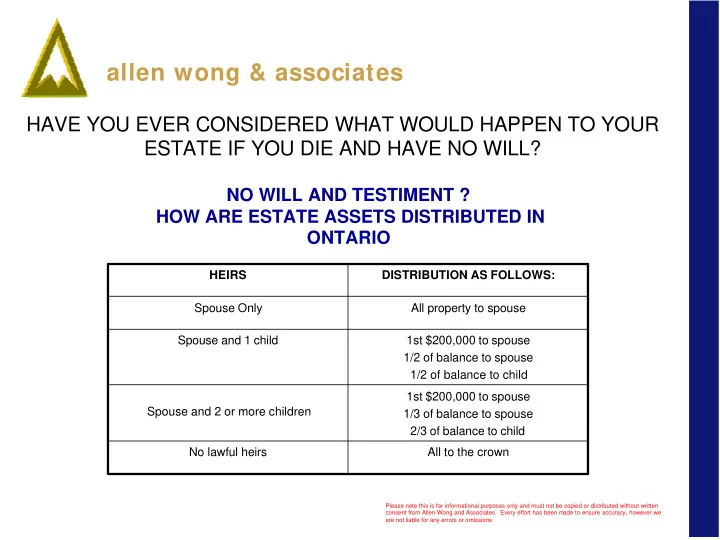

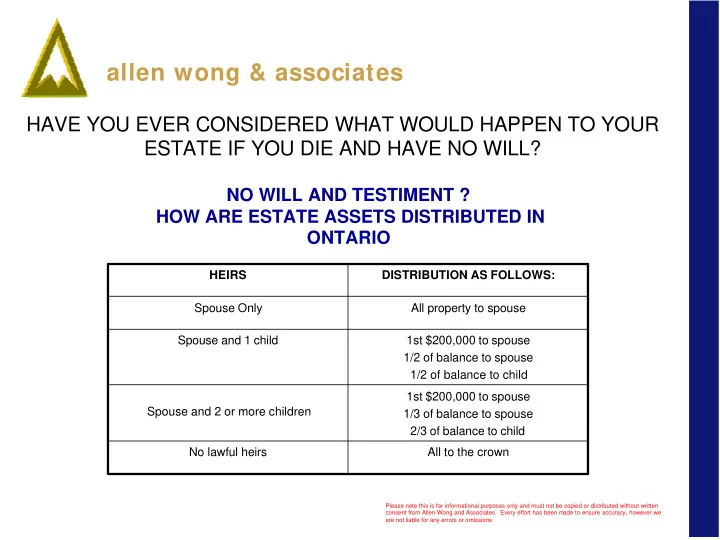

allen wong & associates HAVE YOU EVER CONSIDERED WHAT WOULD HAPPEN TO YOUR ESTATE IF YOU DIE AND HAVE NO WILL? NO WILL AND TESTIMENT ? HOW ARE ESTATE ASSETS DISTRIBUTED IN ONTARIO HEIRS DISTRIBUTION AS FOLLOWS: Spouse Only All property to spouse Spouse and 1 child 1st $200,000 to spouse 1/2 of balance to spouse 1/2 of balance to child 1st $200,000 to spouse Spouse and 2 or more children 1/3 of balance to spouse 2/3 of balance to child No lawful heirs All to the crown Please note this is for informational purposes only and must not be copied or distributed without written consent from Allen Wong and Associates. Every effort has been made to ensure accuracy, however we are not liable for any errors or omissions

allen wong & associates PROBATE FEES PROVINCE OF ONTARIO $5 PER $1000 FOR THE FIRST $50,000 $15 PER $1000 THERE AFTER NO CAP ON MAXIMUM CHARGED. Therefore an estate worth $1,000,000 would face total Probate Fees of $14,500 Please note this is for informational purposes only and must not be copied or distributed without written consent from Allen Wong and Associates. Every effort has been made to ensure accuracy, however we are not liable for any errors or omissions

allen wong & associates HOW MUCH CAN A $10,000 RRSP CONTRIBUTION SAVE YOU IN TAXES? Please note this is for informational purposes only and must not be copied or distributed without written consent from Allen Wong and Associates. Every effort has been made to ensure accuracy, however we are not liable for any errors or omissions

allen wong & associates CANADA PENSION PLAN (CPP) CPP rates are adjusted every January to take into account increases in the cost of living, as measured by the Consumer Price index Please note this is for informational purposes only and must not be copied or distributed without written Source: Social Development Canada consent from Allen Wong and Associates. Every effort has been made to ensure accuracy, however we are not liable for any errors or omissions

allen wong & associates TAXATION OF DIFFERENT INCOME TYPES Please note this is for informational purposes only and must not be copied or distributed without written consent from Allen Wong and Associates. Every effort has been made to ensure accuracy, however we are not liable for any errors or omissions

allen wong & associates THE POWER OF COMPOUND INTEREST Based on 5% Compound Annual Return Please note this is for informational purposes only and must not be copied or distributed without written consent from Allen Wong and Associates. Every effort has been made to ensure accuracy, however we are not liable for any errors or omissions

allen wong & associates REGISTERED EDUCATION SAVINGS PLANS HIGHLIGHTS (RESP) Please note this is for informational purposes only and must not be copied or distributed without written consent from Allen Wong and Associates. Every effort has been made to ensure accuracy, however we are not liable for any errors or omissions

allen wong & associates WITHHOLDING TAXES ON RRSP Amount Withdrawn In All Provinces Except Quebec Excess Of Minimum Quebec Up to $5,000 10% 21% $5,001 to $15,000 20% 26% Over $ 15,000 30% 31% Please note this is for informational purposes only and must not be copied or distributed without written consent from Allen Wong and Associates. Every effort has been made to ensure accuracy, however we are not liable for any errors or omissions

allen wong & associates LARGER DOWNPAYMENT OR BUY THAT CAR ? HOW DOWNPAYMENTS EFFECT MORTGAGES � House: $350,000 Scenario 1 Scenario 2 � Mortgage Rate 5.79% Down Payment Down Payment � Amortization: 25 years House Price $ 350,000 $ 350,000 Down Payment $ 200,000 $ 150,000 Total Mortgage $ 150,000 $ 200,000 Monthly Mortgage $923.50 $1,165.00 Payment Total Payment $277,050 $ 349,500 25 Years ***** AN ADDITIONAL $50,000 DOWN CAN SAVE YOU OVER $72,000 IN INTEREST PAYMENT OVER THE LIFE OF YOUR MORTGAGE Please note this is for informational purposes only and must not be copied or distributed without written consent from Allen Wong and Associates. Every effort has been made to ensure accuracy, however we are not liable for any errors or omissions

allen wong & associates MORTGAGES MONTHLY VS. BI-WEEKLY The effect of biweekly mortgage payments can be dramatic. For example, if you currently have a $150,000 mortgage loan at 9 percent fixed interest , you will have paid approximately $372,000 at the end of 25 years . That’s a $222,500 in interest! However, if you use a biweekly payment system , you will pay $313,000 and have it completely paid off in UNDER 20 years. You save a staggering $69,000 and you pay the loan off 5 years earlier! Please note this is for informational purposes only and must not be copied or distributed without written consent from Allen Wong and Associates. Every effort has been made to ensure accuracy, however we are not liable for any errors or omissions

allen wong & associates WHAT HAPPENS IF YOUR LIFE INSURANCE COMPANY GOES BANKRUPT? How Does Assuris Protect Your Clients? If your life insurance company fails, your policies will be transferred to a solvent company. Assuris guarantees that you will retain at least 85% of the insurance benefits you were promised. Insurance benefits include Death, Health Expense, Monthly Income and Cash Value. Your deposit type products will also be transferred to a solvent company. For these products, Assuris guarantees that you will retain 100% of your Accumulated Value up to $100,000. Deposit type products include accumulation annuities, universal life overflow accounts, premium deposit accounts and dividend deposit accounts. What Products Are Protected By Assuris? Life Insurance, Critical Illness, Health Insurance, Disability Insurance, Long Term Care Insurance, Annuities, Segregated Funds and Group Insurance Also Accumulation Annuities and Group Retirement Products. Example of Some Carriers Covered By Assuris? AIG Assumption Life AXA Blue Cross Life Insurance Canada Life Cumis Life Desjardins Empire Life Equitable Life Industrial Alliance Pacific Manulife Pencorp Life RBC Insurance Standard Life Sun Life Transamerica Life Unity Life UL Mutual Please note this is for informational purposes only and must not be copied or distributed without written consent from Allen Wong and Associates. Every effort has been made to ensure accuracy, however we are not liable for any errors or omissions

allen wong & associates THE RULE OF 72? HOW LONG WILL IT TAKE FOR YOUR SAVINGS TO DOUBLE? Example $10,000 invested at 12% will double every 6 years Initial Years Invested/ Rate of Return Value of Deposit/Starting Investment Doubles Investment $10,000 6 12% $20,000 $20,000 12 12% $40,000 $40,000 18 12% $80,000 $80,000 24 12% $160,000 $160,000 30 12% $320,000 $320,000 36 12% $640,000 $640,000 42 12% $1,280,000 Therefore $10,000 invested at 12% will double every 6 years and total $1,280,000 in 42 years Please note this is for informational purposes only and must not be copied or distributed without written consent from Allen Wong and Associates. Every effort has been made to ensure accuracy, however we are not liable for any errors or omissions

allen wong & associates THE RULE OF 114 or 144? Most of us have heard of the rule of 72, which can explain how long it takes for our investments to double based on our expected rate of return. But have you ever wondered how long it would take your investments to triple or quadruple (4Times)? Let me introduce you to the Rule of 114 or 144 The Rule of 114 The Rule of 144 Rate of Return Years to Triple Rate of Return Years to Quadruple 2% 57 years 72 Years 2% 4% 28.5 years 36 Years 4% 24 years 6% 6% 19 years 18 Years 8% 8% 14 years 12 Years 12% 12% 9.5 years Simply take the either the rule of 114 or 144 and divide by the rate of return to get the estimated number of years to tripe or Quadruple for example at 8% ( 114/8=14 Years or 144/8 equals 18 years) Please note this is for informational purposes only and must not be copied or distributed without written consent from Allen Wong and Associates. Every effort has been made to ensure accuracy, however we are not liable for any errors or omissions

allen wong & associates EARLY BIRD GETS THE WORM! RRSP INVESTING, THE EARLIER THE BETTER! Please note this is for informational purposes only and must not be copied or distributed without written consent from Allen Wong and Associates. Every effort has been made to ensure accuracy, however we are not liable for any errors or omissions

Recommend

More recommend