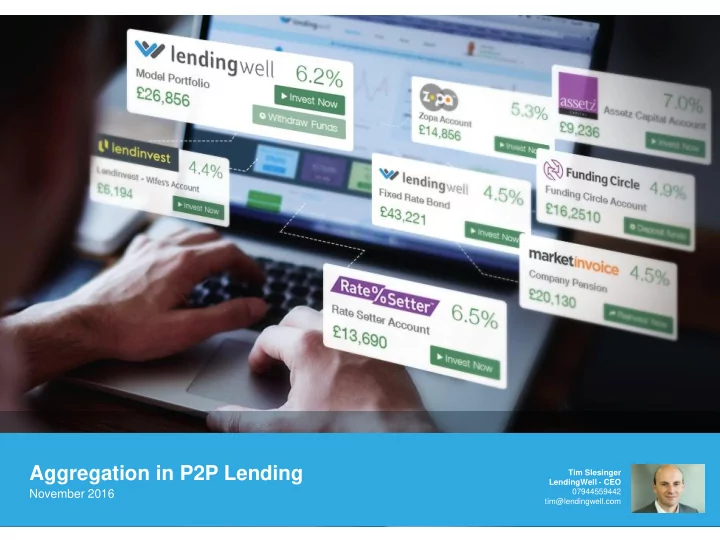

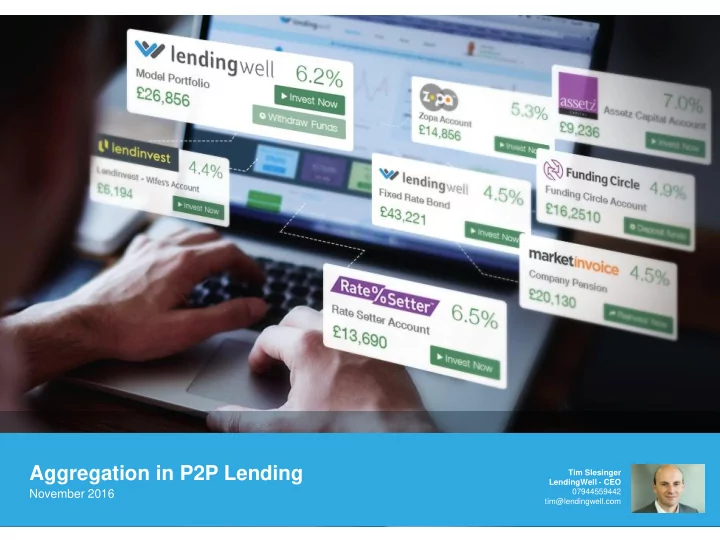

Aggregation in P2P Lending Tim Slesinger LendingWell - CEO November 2016 07944559442 tim@lendingwell.com 1

UK P2P LENDING MARKET £2.9BN £20BN £53m Expected CAGR 48% 2015-2020 2015 2020 2010 2

AN EVER MORE CHALLENGING LANDSCAPE FOR INVESTORS TO NAVIGATE 2010 2016 <10 P2P Platforms >100 P2P Platforms 0.1% 4.4% 12.4% 33.1% 30.8% 23.7% 95.5% Consumer lending Business lending Property lending Invoice financing 3

STILL AN EARLY ADOPTER MARKET… TOTAL AuM 78% GROWTH 2015 NUMBER ACCOUNTS 11% GROWTH 4

WAYS TO INVEST IN P2P LOANS INCLUDE… Description Examples 1 Investors (Institutional and Retail) invest in Zopa; Funding Circle; Lending Direct via platforms loans direct through a lending platform Club 2 P2PGI, Ranger Direct Lending, Investors buy shares in an investment trust Honeycomb, Funding Circle Listed Investment trusts listed on a stock exchange Trust, Victory Park Speciality Lending 3 Investors invest in an unlisted fund as a Unlisted GP/ LP funds & Colchis, Ranger Direct Lending, limited partner with fund being managed by Prospect Capital Mgmt. Managed accounts a general partner 4 Investors put money into a segregated client account with a custodian. The P2P NSR Invest, Goji, Bondmason, P2P aggregators aggregator enables the investors to directly LendingWell (plumbing solution) invest in fractional loan parts 5

CONFUSING! 6

AN EVER MORE CHALLENGING LANDSCAPE FOR INVESTORS TO NAVIGATE DIVERSIFICATION IS NOT STRAIGHT FORWARD INVESTOR/ ADVISER Loan 1 Loan 2 Loan 3 Loan 4 Loan 5 Loan 6 Inefficient Complex Time Consuming 7

P2P LENDING: ASSET CLASS, RETURNS AND DEPLOYMENT CAPABILITIES • Increasing number of UK P2P platforms – 100+ • Landscape is evolving fast, with now 5 UK platforms each lending c £50m per month • Understanding the wide range of products offered on these platforms (secured, unsecured etc.) and underlying loans (property, businesses, car fleets etc.) makes the selection difficult Which P2P lending platform is right for you? 12% 1200 Net Return - LHS Volume (£m) - RHS 11.0% 10% 1000 9.0% 8% 800 7.5% 7.2% 6.9% 6% 600 5.6% 5.5% 4.8% 4% 400 3.8% 2% 200 0% 0 Funding Market Assetz Lendinvest Funding Lending Ratesetter Wellesley & Zopa Secure Invoice Circle Works Co Source: platforms websites, Altfi Data, World Economic Forum report: “The future of fintech” 8

UNLEVERED NET RETURNS IN UK CURRENTLY: 5.4% • 8.0% Average UK P2P returns to investors net of all losses and fees is relatively stable in the 5-6% 7.0% range. 6.0% 5.0% 4.0% 3.0% 2.0% 1.0% 0.0% Jul-15 Sep-15 Nov-15 Jan-16 Mar-16 May-16 Jul-16 Market Invoice Zopa RateSetter Funding Circle Overall Sector Return Source: AltFi Data 9

IF ISA OPEN TO P2P LENDING TOTAL ISA MARKET Potential P2P Lending into IF ISA (£bn) HEADING TEXT £8BN £116bn P2P lending opportunity £79bn p.a. by 2020 Stock Stock £44bn Cash Cash 2010 2015 2020e 10

THE OPPORTUNITY: THE UNTAPPED FINANCIAL ADVISER MARKET FINANCIAL ADVISERS Whole of Market AND ISAS £65BN Independent Research & Reports Training IN 2015 GROWING 8% YOY Assets under influence 11

NEW ACCESS CHANNEL: EFFICIENCY OF P2P AGGREGATOR Revenue model- EFFICIENT / LOWCOST Multiple P2P Aggregators emerging in US & UK Total 0.40-0.85% Expense Of AuM p.a. Ratio Simple and transparent thin layer of fees charged to lenders only Aggregator “omnibus” account mgmt: EFFICIENT/FLEXIBLE Aggregators empowered by a ROBUST ECO-SYSTEM Lenders P2P lending platforms Managed by Aggregator Lender 1 Plumbing mechanics; use Aggregator segregated Lender Burrows chart client A/C 2 Lender • 3 Straight through loan part ownership • No Pooling • Client money fully segregated 12

PLATFORM RISK • Internal controls OPERATIONAL • Cash handling RISK • Business model • Underwriting capabilities • Probability of default CREDIT RISK • Recoverability of losses • Loan concentration to any one borrower • INVESTMENT RISK Loan diversification strategy for lenders 13

DIVERSIFICATION IS KEY 14

PLATFORM DATA SHEETS 15

DATA-RICH ANALYSIS OF PORTFOLIO 16

A THIRD PARTY VIEW ON AGGREGATORS 17

THE OPPORTUNITY: INSTITUTIONAL MARKET Next key investment innovation Online Lending? ETN Open Ended Fund... would potentially unlock the Wealth £1TN+ Manager/ IFA market ETN • ETN – a DRAFT Work in Progress… Manager • Individual Liquidity: as good / or better than a GP/LP fund structure Investor 1 • Listed with daily or bi-weekly valuation ETN market • Always trades at / close to NAV (NAV gets maker 1 written down or up depending on market P2P conditions) Individual Aggregator • ETN Investor 2 Scalable (initial size possibly only £20m) SPV • Low fees (0.5-0.7% pa total expense ETN market ratio) maker 2 etc • Passive investment -tracks an Individual independent index e.g. LARI (AltFi data Investor 3 index) • Worst case can recover 40% of cash within 12 months and 100% within 3 years (ETN targets 10% cash equivalents at all Independent Individual times) Index provider Investor 4 • Available initially only for sophisticated e.g. AltFi Data investors and later for retail - LARI • ISA-able / SIPP-able 18

Recommend

More recommend