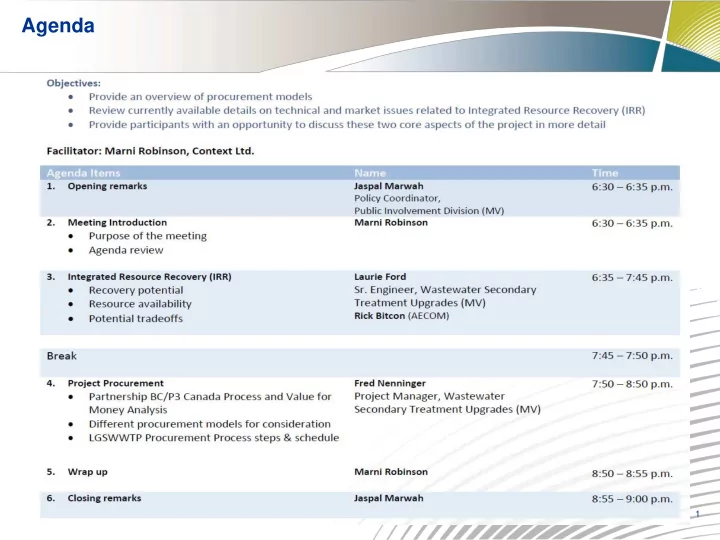

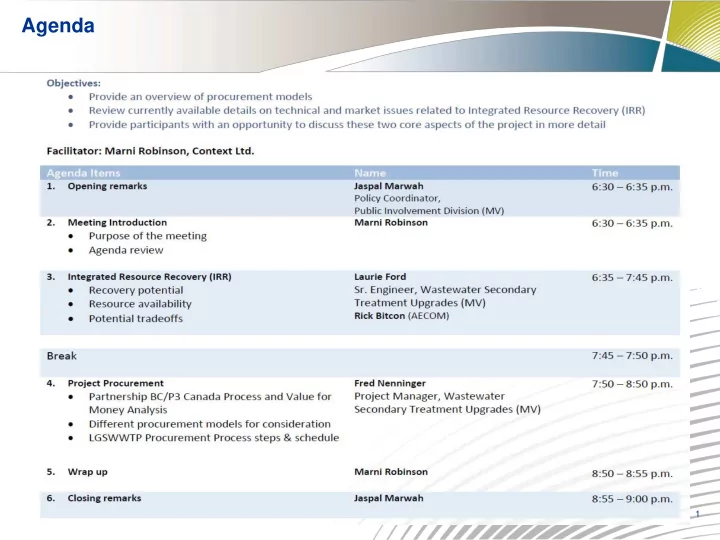

Agenda 1

Part 1 Integrated Resource Recovery

Integrated Resource Recovery Potential Potential Inputs Products 3

4

Feedstock: Food Waste & Yard Waste Food Waste Increased energy generation potential Yard Waste Cellulosic material doesn’t break down in digestion Limited quantity used for structure • More solids generated for compost or other end use 5

Potential Off-Site Energy Centre 6

High Solids Digestion 7 7

High Solids Digestion (Dry) 8 8

Pictures from Harvest Power, Richmond BC 9 9

10 10 10

11 11 11

12 12 12

Low Solids Digestion (Wet) 13 13 13

BTA Pulper and Grit Removal System 14 14 14

Toronto Source Separated Organics Facility 15 15 15

Biogas Generation Potential Fuel, electricity and heat potential Wastewater solids: 270 GJ/d North Shore Food waste/Yard waste: Up to 200 GJ/d 16

Electricity and Heat from Biogas Electricity and high grade heat potential Wastewater solids: 108 GJ/d, 1.3 MW Food waste/yard waste: 80 GJ/d, 0.9 MW Estimated plant electricity demand: ~180 GJ/d Estimated plant heat demand: ~180 GJ/d 17

Biomethane Potential Remove carbon dioxide, H2O, H2S, siloxanes from biogas Sell as biomethane to natural gas grid Plant electricity, some plant heat purchased Wastewater solids: 270 GJ/d North Shore Food waste/Yard waste: Up to 200 GJ/d Total equivalent to natural gas heat for 2,140 homes 18

Effluent Heat Potential Low Grade Heat Use electrical heat pumps to extract heat Wastewater effluent: 2,350 GH/d, 27 MW Existing District Energy System demand: 1-2 MW Potential demand: 3 to 27 MW 27MW would provide heat and hot water for 10,700 homes 19

Reclaimed Water Potential Reclaimed Water Advanced treatment required for non-potable use Secondary conveyance system required Potential supply: 100 ML/d High industrial water user demand: 3-6 ML/d Estuary enhancement potential Future development potential 20

Nutrient Generation Potential Liquid stream Biosolids 21

Nutrients from Liquid Stream Nitrogen, Phosphorus Struvite crystals - Magnesium ammonium phosphate - Nuisance formation in piping, digester - Extract in special reactors - Sell as slow release fertilizer Potential generation: up to 230 T/y P Demand: unlimited 22

Nutrients in Solids Stream Biosolids land application High nitrogen and phosphorus Other micronutrients • Generation: ~3500 dry T/y • Demand: limited 23

Energy from Solids Stream Organic matter in biosolids has energy value Dried biosolids has ~ 2/3 energy value of low grade coal Evaporation of water requires energy input Drying Thermal reduction 70-80% water 24

Energy from Biosolids Heat Water 75% 10% water water 75% water Potential energy available: 500 GJ/d (before digestion) Net energy available after water evaporated: up to 25% 25

Questions?

Part 2 Introduction to Procurement Models

Introduction and Objectives Background • Lion’s Gate Secondary Wastewater Treatment Plant (LGWWTP) • $400 m + • Currently in Project Definition Phase • Business plan anticipated (Fall 2013) and Procurement in 2014 • Wastewater treatment plants in Metro Vancouver have been traditionally undertaken by traditional delivery models • Metro Vancouver interested in exploring alternate procurement models Objective • To establish a base understanding of potential procurement models available to deliver LGWWTP 28

Partnerships BC – Information Why will Partnerships BC be involved? • Any capital project valued > $50 million with Provincial Contribution P3 business case to be undertaken • Business case required for provincial funding Mandate & Information • Mission is to structure and implement partnership solutions for infrastructure projects in the public’s interest • Standalone provincial crown corporation • 26 projects procured or under construction, 9 announced or under procurement • Standardized business case processes and procurement document templates Value for Money Assessment core part of Procurement Model Selection 29

Partnerships BC – Process A business case needs to be developed to support the development and approval of the process for Provincial Funding. Business Case components include : • Project Justification (Definition of future requirements) • Procurement Delivery Options • Procurement Model Analysis including Multi-Criteria Analysis • Risk assessment & quantification • Value for Money Assessment Value for Money assesses the value for risk transferred under each procurement model. Quantification of risk is fundamental to Partnerships BC process Final procurement model selected must: 1) Best serve project requirements 2) Demonstrate Value for Money 30

Partnerships BC – Value for Money Value for Money (“VFM”) Process Short-Listed Procurement Models Risk Assessment Process Public Sector Comparator Shadow Bid Financial Model (“DBB”) Financial Model (“P3”) Risk Adjusted Annual Cash Risk Adjusted Annual Cash Flows to the Public Sector Flows to the Public Sector (Including efficiencies) Value for Capital, operating, lifecycle and Capital, operating, lifecycle Money financing Assessment 31

PPP Canada – Information PPP Canada involvement • PPP Canada is Federal Crown Corporation to improve delivery of public infrastructure by achieving better value, timelines and accountability through P3s • Manages $1.2 billion P3 Canada Fund; 4 funding rounds to date • Eligible applicants include: Province, Territory, Municipal or Regional Government, First Nations, Not-for-Profit • Eligible infrastructure categories include*: Water and Wastewater , Public Transit, National Highway, Green Energy, Disaster Mitigation, Solid Waste Mgt • Access to P3 Canada funding of potentially up to 25% of eligible costs of project if delivered through P3. • Business case with Value for Money assessment must be submitted as part of funding process 20% of funding in P3 Canada Round Three for water & wastewater projects: 1) Sudbury Biosolids 2) Kananaskis Wastewater (Evan Thomas) 3) Capital Regional District – Biosolids Energy Centre 32

Part 2 Procurement Models

Procurement Models Procurement models include: Traditional Design-Bid-Build (“DBB”) 1) Construction Management at Risk (“CM@R”) 2) 3) Design-Build (“DB”) ■ Progressive ■ Prescriptive Alternative ■ Performance Delivery (“AD”) ■ Design-Build- Finance (“DBF”) Models 4) Design-Build-Operate/Maintain (“DBO/M”) 5) Design-Build-Financial-Operate/Maintain (“DBFO/M”)* *Only those with a “Finance” component are generally given priority to P3 Canada Funding 34

Procurement Models Increasing Risk T ransfer and Private Sector Involvement • Progressive DB • • • • • CM CM@ R Prescriptive DB DBO DBFO • • • • • DBB Alliance Performance DB DBM DBFOM • DBF Value for Money is achieved when the risks are allocated to the party best able to manage the risks 35

Traditional Delivery Model – DBB Design-Bid-Build Model Separate contracts for design and construction Metro Vancouver Design Construction Contract Contract Revenue Design Operations Maintenance Construction Collection Sub - contractors and suppliers • Separate Contracts for design, construction, and operations • Fully financed by Metro Vancouver – progress payments made to each of the contractors 36

Traditional Delivery Model Design-Bid-Build Model Pros Cons • • Public Sector retains all risks of project Control and Oversight over entire Project • Accepted Model in which MV has • Separate procurement processes may take experience longer • Cost overruns and schedule risks due to design flaws • Contractor has no on-going responsibility for operations or asset performance • Schedule risk due to potential lack of contractor financial incentive 37

Design-Build Metro Vancouver DB Contract Revenue DB Consortium Operations Maintenance Collection Design Construction Sub - contractors and Suppliers • Single contract for design-build under a fixed price • MV is responsible for operations after substantial completion • Fully financed by MV – progress payments made to contractor 38

Design-Build Pros Cons • DB Contractor assumes design risk • Schedule risk borne by MV • Schedule can be accelerated – • Asset performance risk in operations construction can commence before retained by MV design is complete • Better certainty on price • Price subject to competition 39

Design-Build-Operate/Maintain Metro Vancouver DBO/ M Contract DBO/ M Consortium Maintenance Revenue Collection Construction Operations Design Sub - contractors and suppliers • Single contract for design-build-operate/maintain • Fully financed by MV • Progress payments during construction fixed construction price • Monthly performance-based operating payments fixed operating payments 40

Recommend

More recommend