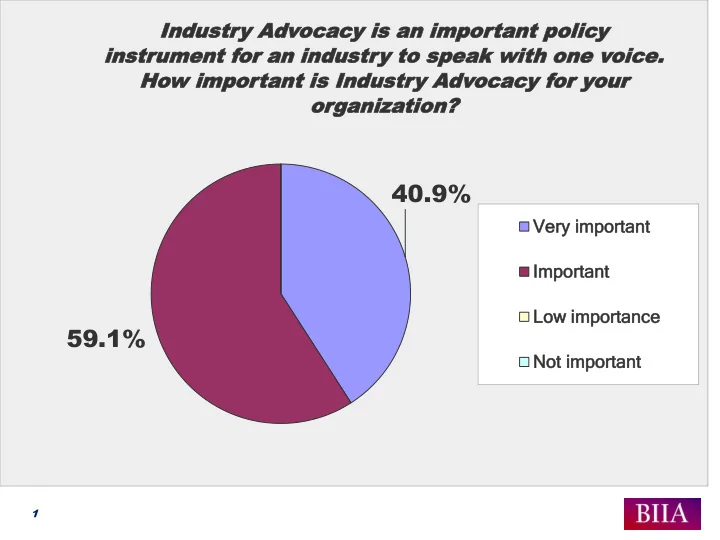

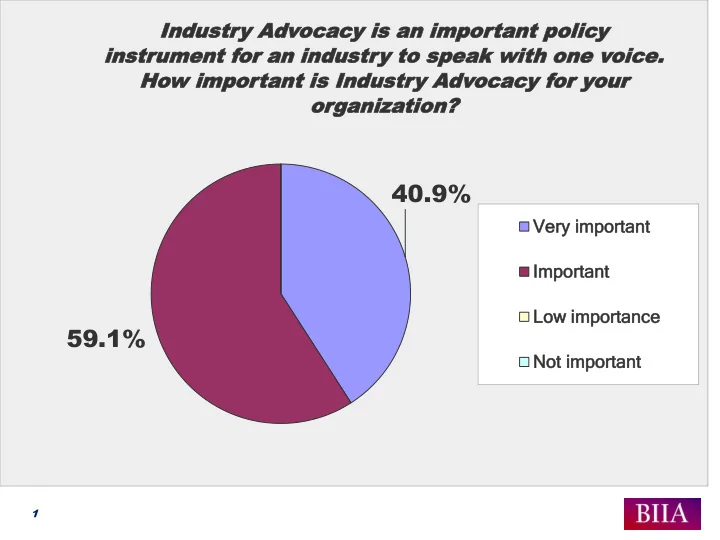

In Industr stry y Ad Advocacy is y is an i imp mporta tant po t poli licy y instr instrume ument nt for or an an i ind ndust ustry y to to spea speak wi k with th on one v e voice oice. . How impo Ho w importa tant nt is In is Indu dustr stry y Adv Advoc ocac acy f y for or y you our r or orga ganiza nization tion? 40.9% Ve Very imp ry importa ortant Impo Importan rtant Low ow i importanc mportance 59.1% Not Not imp importan rtant 1

Wha hat t t type ype of of Ind Indust ustry y Adv Advocac ocacy as y assis sistance tance would y ould you ou expect fr xpect from an om an indust industry y ass associa ociation? tion? 80.0% 70.0% 60.0% 50.0% 40.0% 30.0% 20.0% 10.0% 0.0% Information on Develop principles Organise Assist in country- Develop a existing policies and guidelines workshops with specific situations common code of and practices regulators conduct 2

Ne Netw twor orking king: : Sha Sharing ring be best d st demo emonstr nstrated ted pr prac actices tices in in the the r region gion was s as said aid to to be be i impo mportan tant! t! It w It was s as sug ugge gested sted to co to cond nduc uct t resea esearch h abo bout ut be best d st demo emonstr nstrated ted pr prac actices tices an and spec d specific ific is issues sues in in the the r region gion – ho how impor importan tant t is is this n this nee eed f d for y or you our r or orga ganiza nization tion? 13.6% Very important Important Low importance Not important 40.9% 45.5% 3

Open Ended Question 4: If your organization feels this is important, what specific issues should be researched? Data 26% Products & Services 18% Technology and Operations 16% Legal Framework 16% Consumer Education 11% Cross Border Data Transfer 5% Dispute Resolution 5% Credit Bureau Cooperation 3% Per ercent cent of of Comment Comments 4

Open Ended Question 4: If your organization feels this is important, what specific issues should be researched? • Data Quality Management - Dispute Handling - Co-operation Between Bureaus - Consumer Education Strategies • Data Quality Management • Data Cross Border Information Sharing Practice And Guidelines – Fraud Prevention • It would be useful to have a comprehensive overview of regulations and the role of regulators in key Asian markets such as China and India • Data collection and quality control - how to collect information in the most cost-effective way from a number of microfinance institutions; - collect SME information from various channels; - public information accessibility; - data quality management mechanism; • Database technologies on - data match; - data mining and analysis; - data security; - a more effective and flexible database structure to support product development; - etc. • Products and Service - Internet and mobile based services; - consumer and SME reports for multiple purposes; - consumer and SME scores; - data analysis for financial regulation; - efficient dispute process and consumer services; - etc. • Legal framework and compliance of credit bureaus - Consumer and data protection legislation • Agreements, requirements, guides, etc. between credit bureau and data providers and users • Cross Border Flow of Data • (Research) The needs for consumers • Development and promotion of new products and services - have a uniform structure for all data providers to follow and learn with • Country Legal Frameworks for Data Sharing • Collecting positive information Services for utility companies New services for financial and nonfinancial companies • Consumer & SME Education Compliance with Data Privacy & Security regulations Industry Advocacy • Financial literacy 5

Wha hat net t networ orking pla king platf tfor orm m would be a ould be appr ppropria opriate? te? 5.3% 15.8% 42.1% Conferences Workshops Virtual Webinars Newsletters 36.8% 6

Cr Cross ss-border r tr transf sfer r of da data ta: H : How w impo importa tant is t t is this is issue issue for or y you our r or orga ganiza nization tion? 4.5% 36.4% 27.3% Very important Important Low importance Not important 31.8% 7

Open Ended Question 7: What are the key issues for your organization regarding cross-border transfer of data? Legal Framework 45% Demand Issue? 15% Products & Services 10% Technology and Operations 10% Data 10% Best Demonstrated Practices 10% Per ercent cent of of Comment Comments 8

Open Ended Question 7: What are the key issues for your organization regarding cross-border transfer of data? • Ensuring that appropriate legislation is in place to allow for data sharing cross border • Best Practice Pros and Cons Effect of cross-border of data • Not NB to my organization • The real demand for cross-border dataflow in the region • Data protection legislation in the region regarding cross-border transfer of data • Approval from central banks, data standards • We are a global organization and this is key to our corporate value proposition • Consumer authorization • It does not matter a lot as there is no active demand for cross border data transfer. However governing law provides adequate and sufficient provisions for cross border data sharing and furnishing • For product development For data processing • Legal Constrains • low needs of cross-border data for individuals • Unclear regulations • Quality & reliability of information • Central Bank Support • Regulatory 9

Man any y cr cred edit b it bur urea eaus us in the in the region gions s ar are e rela elativ tivel ely y ne new – the the req equir uireme ement nt of of s skill kill de develop elopmen ments ts for or cr cred edit b it bur urea eaus us an and user d users s was r as raised aised in a in a pr previ viou ous s mee meeting. ting. Ho How i impo mportan tant t is is this this is issue sue for y or you our r or orga ganiza nization? tion? 4.5% Very important 22.7% 36.4% Important Low importance Not important 36.4% 10

Wha hat t t type ype of of skills skills do y do you thin ou think shou k should be ld be de develop eloped f ed for or your our or organiz ganization? tion? 80.0% 70.0% 60.0% 50.0% 40.0% 30.0% 20.0% 10.0% 0.0% Regulatory IT Data Other 11

Consumer onsumer Financ Financial ial Inc Inclus lusion/ ion/ Educa Educati tion/ Financial on/ Financial Liter Literac acy y (h (http://ww ttp://www.a .apc pccis. cis.or org) g) ha has s be beco come r me rele elevant vant in in co coun untries w tries whe here e cred cr edit it bu burea eaus us ha have be e been en intr introd oduc uced ed rec ecen entl tly 4.5% 9.1% Very important Important 22.7% Low importance 63.6% Not important 12

Open Ended Question 11: Financial Inclusion etc.: If your organization feels this issue is important, what are the perceived needs and their potential solutions? Programs to promote bureaus as a positive force in the economy and a credit file as an enabler of • financial freedom SME Financial inclusion guideline and practice Consumer financial inclusion guideline and • practice Financial Literacy for Consumer and SME Needs: -understand the roles and concrete tasks credit bureau can function in consumer • Education/ Financial Literacy. Solution: - learn the current industry practices in the world and organize related communication activities among credit bureaus in the region. On going education, sustained efforts • Education empowers the consumer Education relaxes regulators Education makes banks and • financial institutions and other credit grantors to act responsibly Creating positive public opinion about the credit bureau and role it plays is vitally important. • Negative perception that had been created over a long period has cost a lot in terms of bureau development particular in introducing new products and services for its users. Lenders use credit bureau as a tool in credit and recovery management which set ground for general public to have adverse perception about it. Local market oriented community focused awareness and public outreach strategy (something similar to Schufa has presented) would be of use to overcome this situation. I think the key is to establish a comprehensive and holistic consumer education plan and also • how to deliver the plan to the market. It will be a journey and investment. Awareness campaigns. • More educational marketing • Consumers & SMEs need to be educated in managing credit and the importance of developing & • maintaining a good credit rating. Members support in relation to benefit analysis and passing on information to borrowers. • Promote industry standards and values Help consumers to manage finances • 13

Ho How w should a pot should a potential ential pr prog ogram am be implemented? be implemented? 80.0% 70.0% 60.0% 50.0% 40.0% 30.0% 20.0% 10.0% 0.0% Conduct research Communicate Work though APEC Work through IFC on best through APCCIS World Bank Group demonstrated website: practices www.apccis.org 14

Recommend

More recommend