Notice: If the taxes are not paid within sixty days from the date they are certified delinquent, the property is subject to foreclosure for tax delinquency (O.R.C. 323.131 (A)(3)(a). O.R.C. 323.131 Form and contents of tax bill: (A)(3)(a) “Notice : If the taxes are not paid within sixty days from the date they are certified delinquent, the property is subject to foreclosure for tax delinquency. ” Failure to provide such notice has no effect upon the validity of any tax foreclosure to which a property is subjected. This amendment changes and makes consistent with existing law, the required language to be found in the statutory notice of tax delinquency. The notice shall now read “Notice : If the taxes are not paid within sixty days from the date they are certified delinquent, the property is subject to foreclosure for tax delinquency. ” This notice is now consistent with existing RC section 323.25 which permits foreclosure 60 days after a property is certified delinquent. Amended by 130 th General Assembly File No. TBD, SB 172, § 1, effective 9/4/2014.

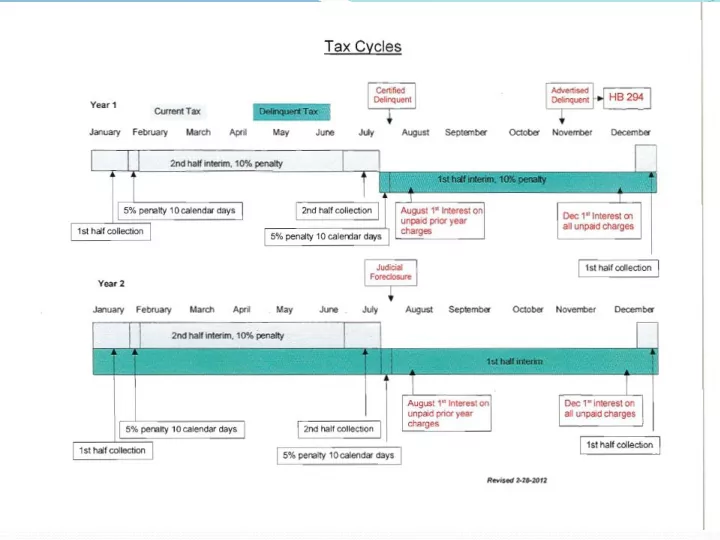

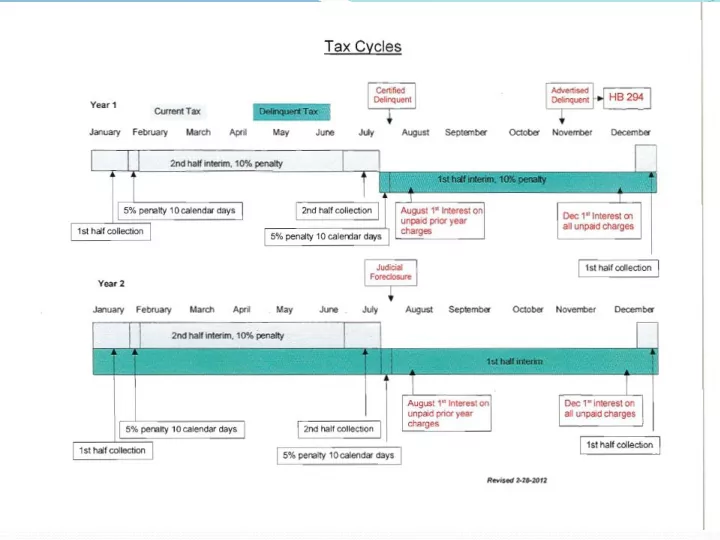

Tax Cycles Certified Advertised Foreclosure Delinquent Delinquent Year 1 Current Tax Delinquent Tax January February March April May June July September October November December August 2nd half interim, 10% penalty 1st half interim, 10% penalty 5% penalty 10 calendar days 2nd half collection Dec 1 st Interest on all unpaid charges (4%) 1st half collection 5% penalty 10 calendar days 1st half collection Year 2 January February March April May June July August September October November December 2nd half interim, 10% penalty 1st half interim August 1 st Interest Dec 1 st interest on 1st half collection on unpaid prior year all unpaid charges charges (8%) (4%) 5% penalty 10 calendar days 2nd half collection 1st half collection 5% penalty 10 calendar days Revised 2-29-2016

Recommend

More recommend