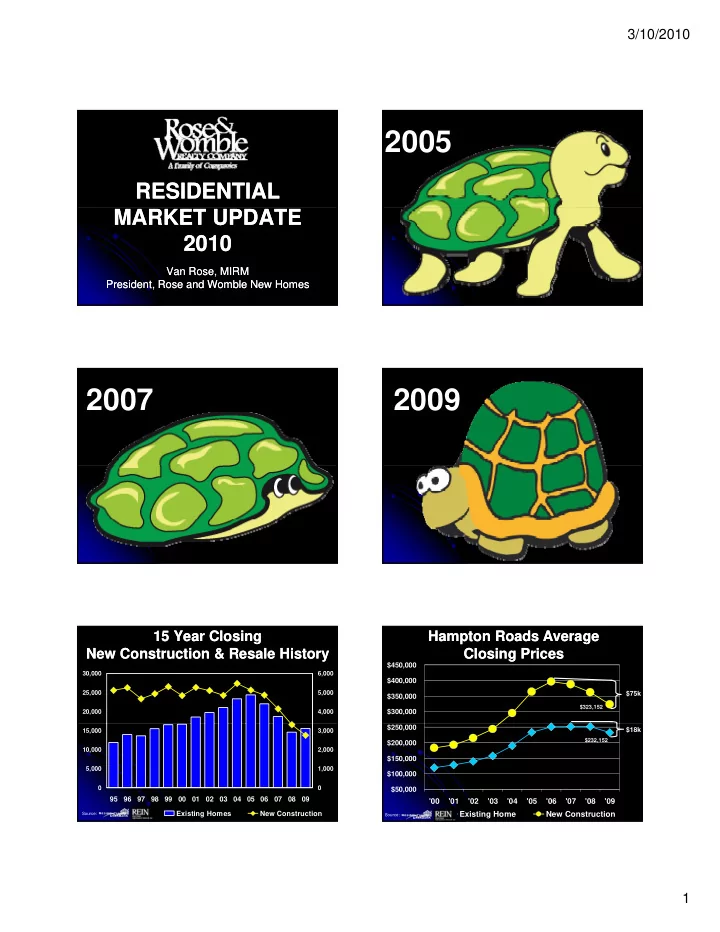

3/10/2010 2005 RESIDENTIAL RESIDENTIAL MARKET UPDATE MARKET UPDATE 2010 2010 Van Rose, MIRM Van Rose, MIRM President, Rose and President, Rose and Womble Womble New Homes New Homes 2007 2009 15 Year Closing 15 Year Closing Hampton Roads Average Hampton Roads Average New Construction & Resale History New Construction & Resale History Closing Prices Closing Prices $450,000 30,000 6,000 $400,000 25,000 5,000 $75k $350,000 $323,152 20,000 4,000 $300,000 $250,000 $18k 15,000 3,000 $232,152 $200,000 10,000 2,000 $150,000 5,000 1,000 $100,000 0 0 $50,000 95 96 97 98 99 00 01 02 03 04 05 06 07 08 09 '00 '01 '02 '03 '04 '05 '06 '07 '08 '09 Existing Homes New Construction Existing Home New Construction Source: Source: 1

3/10/2010 Market Share for Existing Homes Market Share for Existing Homes Market Share for New Construction Market Share for New Construction Detached Sales by Price Range Detached Sales by Price Range Detached Sales by Price Range Detached Sales by Price Range 100% 100% 1311 1258 191 12% 10% 12% $400,000+ 257 $500,000+ 17% 1690 14% 14% 227 1787 16% 75% 75% 281 18% $300K to $400K to 4485 $400K $400K $500K $500K 36% 566 34% 39% 4291 29% 50% 50% 441 $200K to $300K to $300K $400K 25% 25% 4868 40% 657 40% 556 36% 33% <$200,000 <$300,000 3712 0% 0% 2008 2009 2008 2009 Source: Source: Market Share for Existing Homes Market Share for Existing Homes Market Share for New Construction Market Share for New Construction Attached Sales by Price Range Attached Sales by Price Range Attached Sales by Price Range Attached Sales by Price Range 100% 100% 8% 209 5% 78 7% 62 6% 267 $300,000+ $400,000+ 148 12% 128 13% 869 24% 948 28% 75% 75% $200K to $300K to $300K $300K $400K $400K 525 53% 60% 730 50% 50% $100K to $200K to 2335 65% 61% 2090 $200K $300K 25% 25% <$100,000 <$200,000 270 28% 252 21% 3% 196 6% 98 0% 0% 2008 2009 2008 2009 Source: Source: New Construction Product Mix New Construction Product Mix Average Market Time Average Market Time 2009 Closings 2009 Closings Existing Homes Existing Homes 100 Single Family 90 87 84 Detached 80 77 76 78 80 72 69 69 25% Market 70 66 3% Multi-Story 61 60 Condo Condo Days on 48 50 46 57% 11% 2% 40 36 Multi-Plex 1% 28 30 27 Condo 20 7% 5% 10 Townhome/ Duplex 0 94 95 96 97 98 99 00 01 02 03 04 05 06 07 08 09 Source: Source: 2

3/10/2010 Hampton Roads Residential Inventory Hampton Roads Residential Inventory Inventory 2007 to 2009 2007 to 2009 15,000 Resale 14,000 11,091 units 13,000 9.4 months supply 12,000 11,000 10,000 New Homes 9,000 1,289 units 8,000 7.1 months supply Jan Feb Mar April May June July Aug Sept Oct Nov Dec 2007 2008 2009 2010 Source: Source: *Inventory on 03/03/10. Based on sales pace of last 6 months Hampton Roads Residential Inventory by Price Range LET’S 100% $500,000+ 1,231 11% 254 20% JUST 632 6% 12% $400K to 1,401 75% 199 15% $500K TALK TALK 28% 3,091 $300K to 308 24% 50% $400K ABOUT $200K to 366 25% 28% 43% $300K 4,736 IT…. <$200,000 13% 162 0% Existing Homes New Construction Source: 11 MILLION 11 MILLION HOMEOWNERS ARE HOMEOWNERS ARE UNDERWATER!! UNDERWATER!! Source: CNN Money 3

3/10/2010 1.35 YEARS TO 1.35 YEARS TO 7 MILLION 7 MILLION SELL CURRENT SELL CURRENT FORECLOSURES FORECLOSURES FORECLOSURE FORECLOSURE STILL TO COME!! STILL TO COME!! INVENTORY INVENTORY Source: Amherst Securities Group Source: Amherst Securities Group Hampton Roads Short Sale/Foreclosure Market Share 400 35% 375 356 350 342 30% 326 325 318 305 294 300 248 285 285 25% 261 250 20% 20% 198 160 200 160 163 166 15% 141 176 150 133 134 119 10% 99 96 100 71 63 59 50 44 5% 50 36 32 0 0% Jul-07 Oct Jan-08 Apr Jul Oct Jan-09 Apr Jul Oct Jan-10 Source: Total Short Sale/ Foreclosure Closings % Total Closings Foreclosures by City/County Chesapeake 9% 14% Hampton Newport News 10% 21% Norfolk Portsmouth 13% 6% Suffolk Virginia Beach 11% 16% All Other Areas Source: 4

3/10/2010 Existing Home Average Closing Prices Existing Home Average Closing Prices New Construction Average Closing Prices New Construction Average Closing Prices Versus Standard Appreciation Versus Standard Appreciation Versus Standard Appreciation Versus Standard Appreciation $275,000 $450,000 $250,000 $400,000 $225,000 $350,000 $200,000 $300,000 $175,000 $250,000 $150,000 $200,000 $125,000 $100,000 $150,000 '00 '01 '02 '03 '04 '05 '06 '07 '08 '09 '10 '11 '12 '00 '01 '02 '03 '04 '05 '06 '07 '08 '09 '10 '11 Existing Home Average Price 4% Appreciation New Construction Average Price 4% Appreciation Hampton Roads Hampton Roads Interest Rates will Rise Interest Rates will Rise Employment to Permit Ratio Employment to Permit Ratio 18% 20,000 3.0 16% 15,000 2.0 14% 10,000 1.0 12% 5,000 5 000 0 0 0.0 10% 0 -1.0 8% 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 -5,000 -2.0 6% -10,000 -3.0 4% -15,000 -4.0 72 75 78 81 84 87 90 93 96 99 02 05 08 Change in Employment Permits Issued E/P Ratio 30-Yr Fixed Avg Source: Freddie Mac Data Sources: Bureau of Economic Analysis, Bureau of Labor Statistics U.S. Census Bureau (Permits)- 2009 #'s are Preliminary IF YOU IF YOU BUILD IT… BUILD IT… THEY WILL THEY WILL COME COME 33 $368,048 5

3/10/2010 # 5 # 4 Riverwalk Townes 46 45 $252,617 $237,438 # 3 # 2 62 83 $382,456 $180,506 # 1 Hampton Roads Top 5 Builders AND THE AND THE WINNERS WINNERS ARE…….. ARE…….. 92 $208,695 Source: 6

3/10/2010 # 4 # 5 98 93 # 3 # 2 133 154 # 1 233 7

Recommend

More recommend