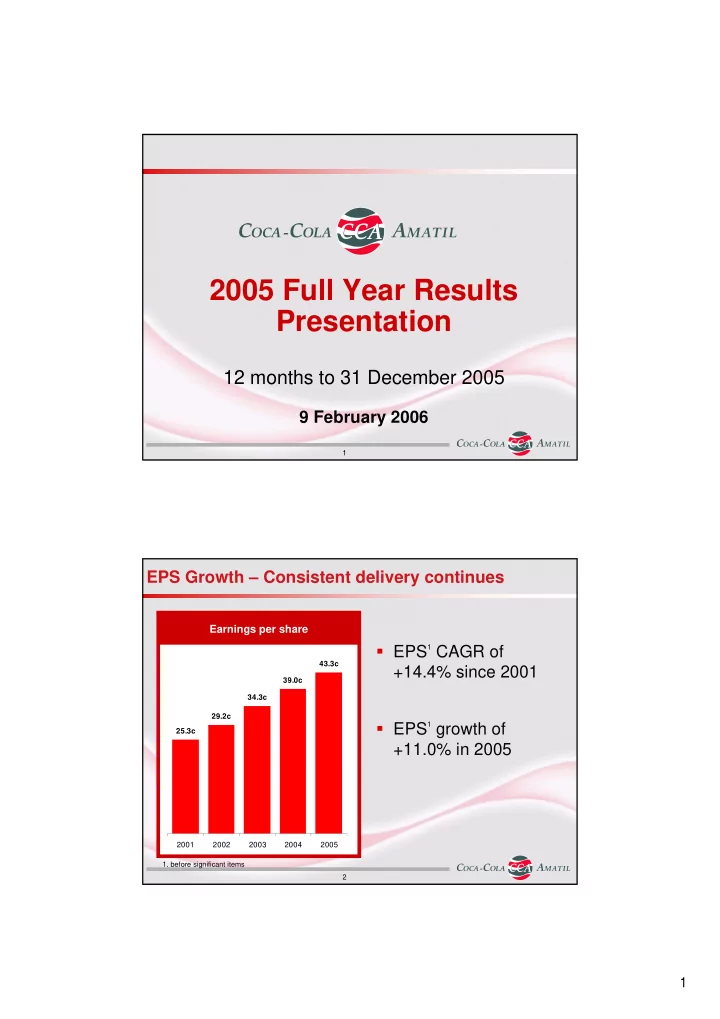

2005 Full Year Results Presentation 12 months to 31 December 2005 9 February 2006 1 EPS Growth – Consistent delivery continues Earnings per share 1 CAGR of � EPS 43.3c +14.4% since 2001 39.0c 34.3c 29.2c 1 growth of � EPS 25.3c +11.0% in 2005 2001 2002 2003 2004 2005 1. before significant items 2 1

Dividends have increased by 125% in last 4 years Dividends per share � DPS CAGR of 31.5c +22.5% since 2001 28.0c � DPS growth of 23.0c +12.5% in 2005 18.5c � Dividend payout ratio 14.0c increased to 73.5% � 100% franked 2001 2002 2003 2004 2005 3 5th consecutive year of double-digit earnings growth Net Profit 1 � 16.8% to $320.5m EBIT 1 � 10.1% to $570.6m EPS 1 � 11.0% to 43.3c ROCE 1 � 4.1 pts to 17.5% (due to the inclusion of SPCA) Operating � $54.2m to $435.2m Cash Flow 1. before significant items 4 2

Successful execution of the 5 core business drivers � Product & package innovation � Non-carbonated beverage and food expansion � Growing product availability through cold drink placements and outlet expansion � Delivering levels of customer service which cannot be profitably matched by our competitors � Backed by revenue management and cost discipline 5 Product Innovation continues to drive category growth Product launches 80 70 60 50 40 30 20 10 0 2001 2002 2003 2004 2005 74 new product launches in 2005 6 3

New customers and cold drink equipment driving product availability 15% increase in active Active customers 700,000 customers in 2005 600,000 500,000 400,000 300,000 200,000 100,000 0 2001 2002 2003 2004 2005 Cold drink coolers 350,000 300,000 250,000 200,000 150,000 100,000 50,000 19% increase in cold 0 drink coolers in 2005 2001 2002 2003 2004 2005 7 Solid group performance continues 1 � 10.1% to $570.6m Group EBIT Beverage EBIT margin a healthy 15.5% Food EBIT margin 13.0% (10 months) EBIT margin maintained in a competitive � 5.3% to $455.5m Australia market Competitive trading conditions in New � 12.1% to $72.0m Pacific Zealand lead to under-recovery of COGS South Result better than expectations with strong EBIT loss of $6.6m Korea 1 local currency revenue growth in H2 of 10.2% Indonesia Standout result from Indonesia with 49.6% � 32.4% to $42.9m & PNG 1 local currency EBIT growth SPC Solid earnings result despite an intensifying $45.7m (10 months) Ardmona competitive environment 1. before significant items 8 4

Australia – Solid EBIT growth & margin performance in a more competitive market A$m 2005 2004 % Chg Sales revenue 2,125.1 2,041.6 4.1% Sales revenue / case $6.60 $6.32 4.4% Volume (million unit cases) 322.0 322.9 -0.3% EBIT 455.5 432.5 5.3% EBIT Margin 21.4% 21.2% 0.2pts Capital Expenditure / Sales Revenue 7.8% 6.3% 9 Australia – Growing category leadership capability through product and package innovation KEY DRIVERS � Maintaining category leadership to provide a sustainable platform for profitably growing our customer and consumer relationships � New products including Sprite Zero, Coke with Lime, Fruitopia J, Fruitopia Classic, Fruitopia Alive and multi-pack water � Continued growth in diet CSD revenue with diet Coke up 8% and Sprite Zero growing the Sprite category by 10% � Both Mt Franklin and Pump grew revenues around 15% � Revenue from non-carbonated soft drinks accounts for 20% of Australian revenue 10 5

Pacific – Competitive trading conditions in NZ lead to under-recovery of COGS A$m 2005 2004 % Chg Sales revenue 451.9 427.2 5.8% Sales revenue / case $6.73 $6.31 6.7% Volume (million unit cases) 67.1 67.7 -0.9% EBIT 72.0 81.9 -12.1% EBIT Margin 15.9% 19.2% -3.3pts Capital Expenditure / Sales Revenue 5.8% 5.4% 11 Pacific KEY DRIVERS � Continuing focus on product innovation, cold drink placement, new outlet expansion and customer service enhancement to maintain category leadership � Low calorie CSDs continued to grow strongly with diet Coke revenue up 10% � Water and sports categories continuing to grow revenue above 20% led by Pump, Kiwi Blue and Powerade � Juice category returned to profits in last quarter following the introduction of the Keri 3 Litre Easy Grip pack and price rises in September 12 6

South Korea – Growing volumes and sales the first priority A$m 2005 2004 % Chg Sales revenue 630.7 561.5 12.3% Sales revenue / case $5.01 $4.58 9.4% Volume (million unit cases) 126.0 122.7 2.7% EBIT 1 -6.6 4.6 n/a EBIT Margin -1.0% 0.8% -1.8pts Capital Expenditure / Sales Revenue 6.7% 6.2% 1. before significant items 13 South Korea – Successful launch of Minute Maid underpinned H2 sales growth KEY DRIVERS � Expanding the beverage portfolio to strengthen the revenue base � Continuing focus on developing sales force capabilities � Significantly up-weighting marketing spending � Successful launch of Minute Maid, achieving 17% share of the 100% juice category in a little over 6 months � Increased marketing spend by TCCC � Growing product availability with a 32% increase in cold drink coolers � Increasing sales force capability leading to improved merchandising and shelf space gains 14 7

South Korea – Initiatives to lower cost of doing business MAJOR INITIATIVES � Redeployment of 200 employees from distribution into merchandising roles � Early retirement plan (ERP) offer to employees Key Benefits: � > 20% increase in the size of the sales force – a significant strengthening � Reduction in distribution costs with a shift to outsourcing � Reduction in the FTE employee base by at least 6% (150 employees) � Cost recovery will flow through progressively from the second half of 2006 15 Indonesia & PNG – Highest ever local currency sales and EBIT for Indonesia 2005 2004 A$m % Chg Sales revenue 427.9 419.8 1.9% Sales revenue / case $3.45 $3.71 -7.0% Volume (million unit cases) 124.0 113.1 9.6% EBIT 1 42.9 32.4 32.4% EBIT Margin 10.0% 7.7% 2.3pts Capital Expenditure / Sales Revenue 9.0% 6.1% 1. before significant items 16 8

Indonesia & PNG – Strong result in a challenging environment KEY DRIVERS � Building a stronger soft drink culture � Strengthening sales execution through increased resources and training � Expanding availability through cold drink cooler placement and outlet expansion � Significant increase in the size of the sales force supported by training and development programs � Product and package innovation focused around CSD package and flavour extensions as well as sports and tea categories � Customer base grew 26% driven by modern and traditional foodservice channels � Electric cold drink coolers grew over 20% and 60,000 ice chest placed (up 60%) 17 First 10 months on target 10 months 2005 2004 % Chg A$m Sales revenue 351.9 n/a n/a EBIT 45.7 n/a n/a EBIT Margin 13.0% n/a n/a Capital Expenditure / Sales Revenue 6.2% n/a 18 9

SPCA – Transitioning to a modern customer service focused organisation KEY DRIVERS � Product and package innovation � Developing new channel opportunities � Strengthening key account management skills � Improving supply chain capacity and efficiency � Extended the resealable Fridge Pack range with Beetroot, Pink Lady Apple and Pineapple offerings � Successfully trialled its Goulburn Valley snack pack range in the convenience and petroleum channel � Commencement of supply chain improvements with $15 million warehouse consolidation 19 2005 Full Year Results Presentation John Wartig, CFO 9 February 2006 20 10

Financial Scorecard – Key metrics remain strong Performance 2005 2004 Change � 0.5 pts EBIT margin – Beverages 15.5% 16.0% EBIT margin – Food 13.0% n/a n/a � 10.1% EBIT 1 $570.6m $518.3m NPAT 1 growth � 16.8% $320.5m $274.3m EPS 1 growth � 11.0% 43.3c 39.0c Returns ROCE 1 � 4.1 pts 17.5% 21.6% Dividend payout ratio 73.5% 72.2% Financial Health Interest cover 4.1x 4.7x Cash Flow � 1.3 pts Capex / sales 7.4% 6.1% � 0.8 pts Working capital / sales – Beverages 12.2% 13.0% Working capital / sales – Food 67.0% n/a 1. before significant items 21 EBIT driven by volume and price/mix recovery of higher COGS + inclusion of SPCA 113.3 (99.3) (40.7) 45.7 570.6 33.4 518.3 EBIT FY04 Volume Price & Mix COGS Indirect SPCA EBIT FY05 costs & other 22 11

Impact on balance sheet of acquisitions and increased capex A$m 2005 2004 $ chg Working capital 728.6 494.6 234.0 Property, plant & equipment 1,512.5 1,221.7 290.8 IBAs & intangible assets 1,998.4 1,445.6 552.8 Deferred income tax liability (341.9) (359.8) 17.9 Other net assets (340.1) (332.8) (7.3) Capital Employed 3,557.5 2,469.3 1,088.2 23 Working capital improvements continue � Total working capital Working capital increased due to inclusion Group working capital of SPCA $728.6m � Beverages improvement a $494.6m result of better inventory and debtor management � Food working capital has 2004 2005 reduced from its peak of Beverages Food Non-trading ~90% of sales in June to Working capital / sales 67% 2005 2004 Chg � 0.8 pts Beverages 12.2% 13.0% Food 67.0% - n/a 24 12

Recommend

More recommend