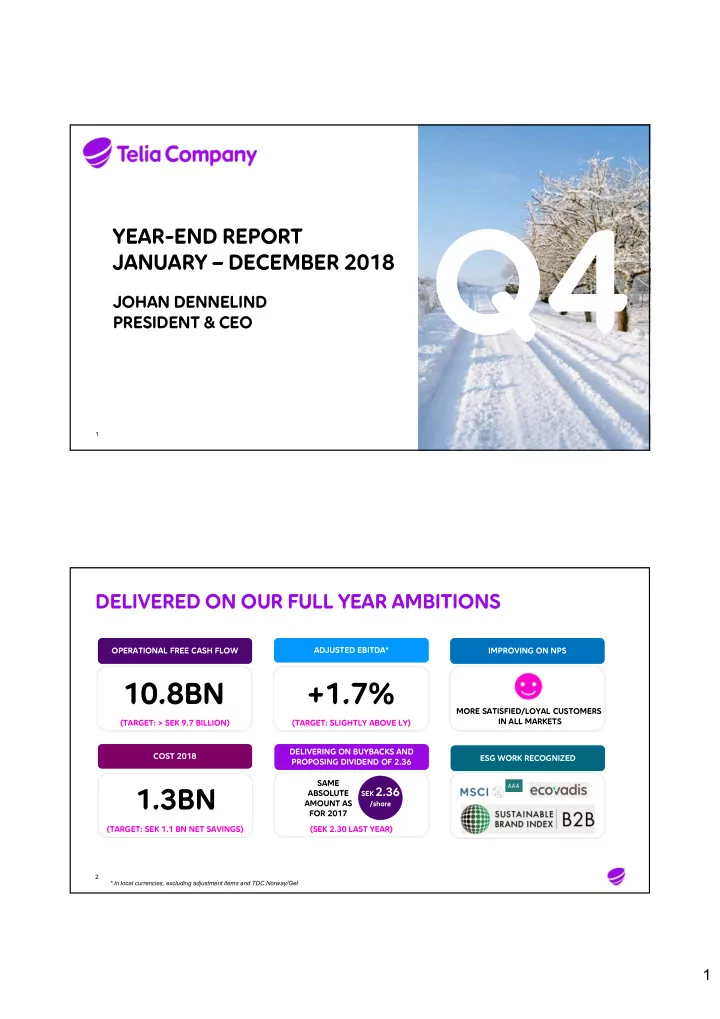

YEAR-END REPORT JANUARY – DECEMBER 2018 JOHAN DENNELIND PRESIDENT & CEO 1 DELIVERED ON OUR FULL YEAR AMBITIONS ADJUSTED EBITDA* ADJUSTED EBITDA* OPERATIONAL FREE CASH FLOW OPERATIONAL FREE CASH FLOW IMPROVING ON NPS IMPROVING ON NPS 10.8BN +1.7% MORE SATISFIED/LOYAL CUSTOMERS IN ALL MARKETS (TARGET: > SEK 9.7 BILLION) (TARGET: SLIGHTLY ABOVE LY) DELIVERING ON BUYBACKS AND DELIVERING ON BUYBACKS AND COST 2018 COST 2018 ESG WORK RECOGNIZED ESG WORK RECOGNIZED PROPOSING DIVIDEND OF 2.36 PROPOSING DIVIDEND OF 2.36 SAME 1.3BN SEK 2.36 ABSOLUTE AMOUNT AS /share FOR 2017 (TARGET: SEK 1.1 BN NET SAVINGS) (SEK 2.30 LAST YEAR) 2 * In local currencies, excluding adjustment items and TDC Norway/Get 1

2018 M&A TAKING US TO WANTED LEADING CONVERGED POSITION IN THE NORDICS ACQUISITIONS DIVESTMENTS Signed or closed 2018 All closed 2018 * Norway INTENSE M&A HAS TAKEN TELIA COMPANY EURASIA IN ALL MATERIAL ASPECTS EXITED TO THE WANTED POSITION 3 * Expected to be closed H2 2019 A QUARTER WITH SEVERAL HIGHS BUT LOWER EBITDA ENDING THE YEAR WITH ENDING THE YEAR WITH FIRST NEGATIVE ORGANIC FIRST NEGATIVE ORGANIC STRONG CASH FLOW STRONG CASH FLOW EBITDA QUARTER IN 2018 EBITDA QUARTER IN 2018 +76% -5.5% B2B & ICT B2B & ICT STRONG B2B PIPELINE IN CORE MARKETS & ICT JOURNEY VS. Q4 2017 VS. Q4 2017 UNDER WAY ICT TDC NORWAY/GET TRADING TDC NORWAY/GET TRADING CUSTOMER FOCUS YIELDING CUSTOMER FOCUS YIELDING ACCORDING TO PLAN ACCORDING TO PLAN GOOD NPS MOMENTUM IN KEY MARKETS +7 +1 +4 Norway 4 2

AS PREDICTED A CHALLENGING REVENUE/EBITDA Q SERVICE REVENUE DEVELOPMENT EBITDA DEVELOPMENT Reported in absolute & organic growth, excl. adj. items Organic growth, external service revenues Service revenue growth EBITDA EBITDA growth, yoy Service revenue growth excl. Telia Carrier 4.2% 3.9% 3.8% 8,000 1.8% 4.0% 7,000 2.0% 6,000 0.0% -2.0% 5,000 -1.4% -1.4% 6,977 6,590 6,735 -4.0% 6,495 6,443 4,000 -5.5% -6.0% -2.5% -2.5% 3,000 -8.0% 2,000 -10.0% Q4 17 Q1 18 Q2 18 Q3 18 Q4 18 Q4 17 Q1 18 Q2 18 Q3 18 Q4 18 • Telia Carrier again a material part of the decline • First negative EBITDA quarter in 2018 • Sweden pressured by fixed telephony • Sweden main driver - legacy pressure, credit losses, marketing and higher sales-related costs • Mobile revenue growth in 6 of 7 markets • Finland neutral and Norway strong 5 DELIVERED ON COST 2018 – BUT NOT THE DESIRED MIX COST AGENDA 2019 RESOURCE COST 2018 COST REDUCTION 2018 SEK in billions Change in cost, organic 1.5 NEW OPERATING MODEL TO NEW OPERATING MODEL TO SUPPORT SUPPORT 1.0 Employees Consultants Total CONTINUED RESOURCE CONTINUED RESOURCE 0.5 OPTIMIZATION ACROSS GROUP OPTIMIZATION ACROSS GROUP -4% -6% 0.0 -3% NET AMBITION ON SWEDISH -3% NET AMBITION ON SWEDISH Outcome Outcome by type OPEX OPEX OPEX COGS -17% • All countries contribute • Target SEK 1.1 billion • Structural cost reductions are ahead of us • Majority from Sweden • Material part of cost reduction from less low margin revenues • Organic OPEX down by 2 percent 6 3

STABLE MOBILE REVENUE DEVELOPMENT MOBILE SERVICE REVENUE GROWTH MOBILE ARPU GROWTH Q4 In local currency, pre & post-paid, y-o-y Organic growth SWEDEN SWEDEN NORWAY NORWAY 2% +1.6% +1.6% +1.3% +1.3% +0.9% +0.9% 1% FINLAND FINLAND +1.2% +1.2% LIT EST DEN +10% -2.7% +1.3% 0% Q4 17 Q1 18 Q2 18 Q3 18 Q4 18 • Mobile revenue growth in 6 of 7 markets • ARPU growth still in majority of markets • Low single-digit growth in B2C Sweden • Continued ARPA/ARPU uplift in scope for 2019 • Lithuania improved growth sequentially by 2 p.p. to 16 percent 7 SWEDEN GROWING EXCLUDING LEGACY PRESSURE REVENUE BREAKDOWN LEGACY HEADWIND BY Q FIBER OTC DEVELOPMENT Service revenues (SR), y-o-y in % SR, SEK in millions, y-o-y in absolute SR, SEK in millions, y-o-y in absolute 100 Reported growth Growth ex legacy* 0 2 0 0 -100 -100 -2 -200 -200 Fiber installation revenue change -4 Legacy revenue change -6 -300 -300 Q4 17 Q1 18 Q2 18 Q3 18 Q4 18 Q4 17 Q1 18 Q2 18 Q3 18 Q4 18 Q4 17 Q1 18 Q2 18 Q3 18 Q4 18 • Legacy reducing growth by 2-3 p.p. • Price increases from 2017 no • Fiber installation revenues down per quarter longer impacting 14 percent full year • *Legacy revenues comprise fixed • Similar stock reduction as in • Slower roll-out as we have telephony and other copper based previous quarters entered the tail services excluding DSL • 1.8 million homes passed plus 0.9 million through OCN 8 4

STABLE Q4 TRADING FOR GET Q4 TRADING PERFORMANCE – GET Revenues, EBITDA & ARPU y-o-y, subscriptions q-o-q • Stable revenues and EBITDA development with slightly improving KPI’s REVENUES EBITDA • Positive impact on EBITDA from broadband +1% +1% partly offset by lower TV gross profit • A somewhat tough year ending with good momentum on the customer side CUSTOMERS ARPU • Churn managed lower in all segments and STABLE STABLE products • NPS improved H2 vs. H1 2018 CUSTOMERS ARPU +2,000 +2% BROADBAND 9 SUSTAINABILITY BECOMING A CORE PART OF OUR DNA EURSIA EXIT MAKING IN A RESPONSIBLE WAY YOUNITE EMPLOYEE ENGAGEMENT FOR SOCIAL IMPACT NORDIC COALITION IMPORTANT FIRST CROSS INDUSTRY STEP TAKEN IMPACT NEW CLIMATE GOALS DARING AMBITIONS TO BE IN THE FOREFRONT 5

SHAREHOLDER REMUNERATION FIRST SHARE BUYBACK YEAR ON TRACK DIVIDEND FOR 2018 SHARES BOUGHT UNTIL 31 DECEMBER 99.3M SAME ABSOLUTE SAME ABSOLUTE AMOUNT AS IN 2017 AMOUNT AS IN 2017 GROSS VALUE SEK 2.36 IN TWO SEK 2.36 IN TWO SEK 4.1BN SEPARATE TRANCHES SEPARATE TRANCHES AVERAGE PRICE COMMITTED TO 3-YEAR SHARE BUYBACK SEK 41.6 AMBITION OF SEK 5 BILLION PER YEAR 11 IMPROVING CASH FLOW AND STABLE DIVIDEND FREE CASH FLOW AND PAY-OUT RATIOS SEK billion PROPOSED DIVIDEND EQUALS AN AMOUNT OF SEK 9.9 BILLION – PAY-OUT 115% 115% 115% 80% 80% 80% 84% 84% 84% UNCHANGED VS. 2017 RATIO 12.4 11.7 +3% 0.9 2.7 2.36 2.30 2.00 7.5 2.0 10.8 9.7 5.5 2016 2017 2018 2016 2017 2018 (PROPOSED) Dividend from associated companies Operational free cash flow 12 6

LOOKING AHEAD AT 2019 CORE CORE COST FOCUS COST FOCUS M&A M&A REVENUE REVENUE LEGACY LEGACY AND CAPEX AND CAPEX SUPPORTS SUPPORTS THE 2019 THE 2019 GROWTH – GROWTH – HEADWIND HEADWIND DISCIPLINE DISCIPLINE EARNINGS/ EARNINGS/ FUNDAMENTALS... FUNDAMENTALS... FOCUS ON FOCUS ON UNCHANGED UNCHANGED TO TO CASH FLOW CASH FLOW ARPA/ARPU ARPA/ARPU CONTINUE CONTINUE GROWTH GROWTH … LEADS TO … LEADS TO GROWTH IN OPERATIONAL FREE CASH FLOW GROWTH IN OPERATIONAL FREE CASH FLOW 13 OUTLOOK FOR 2019 AND RATING OPERATI O NAL FREE Operational free cash flow to be between SEK 12.0-12.5 billion CA SH FL OW (SEK 10.8 billion 2018) Telia Company shall continue to target a solid investment grade long-term RATING credit rating of A- to BBB+ 14 7

YEAR-END REPORT JANUARY – DECEMBER 2018 CHRISTIAN LUIGA EXECUTIVE VICE PRESIDENT & CFO 15 PRESSURE ON REVENUES AND EBITDA AS EXPECTED SERVICE REVENUE DEVELOPMENT EBITDA DEVELOPMENT Organic growth, external service revenues Organic growth, excluding adjustment items -2.5% -5.5% Q4 SWE FIN NOR DEN LIT EST LAT Telia Other Q4 Q4 SWE FIN NOR DEN LIT EST LAT Other Q4 Carrier 17 18 17 18 • Sweden down mainly due to fixed telephony • Mixed picture on EBITDA development • Telia Carrier continued according to strategy to • Sweden burdened by fixed telephony erosion and take down low-margin revenues – a more neutral higher costs development expected 2019 • Norway benefiting from Phonero synergies 16 8

GROWTH IN CORE OFFSET BY LEGACY PRESSURE IN SWEDEN MOBILE SUBS. – B2C SERVICE REVENUES MOBILE – B2C Organic growth, external revenues Postpaid subscriptions in thousands In local currency Mobile B2C postpaid ARPU B2C incl. fiber installation revenues 2,300 Mobile B2C revenue growth B2C excl. fiber installation revenues 256 2,199 -1.0% -1.0% B2C -1.5% -1.5% B2B -3.2% -3.2% +1.3% +1.3% Q4 17 Q1 18 Q2 18 Q3 18 Q4 18 Jan 17 Dec 18 Q4 17 Q1 18 Q2 18 Q3 18 Q4 18 • Slower mobile growth and higher • Slightly lower ARPU due to • Net addition growth Q4 telephony drop pace in B2C lapsing effect from invoice fees • Only negative for three months • Flat trend in B2B • Subscription revenues grew by over the last two years 1.6 percent Q4 • Most satisfied TV customers again 17 STABLE QUARTER IN FINLAND SERVICE REVENUES* & EBITDA** MOBILE SUBSCRIPTIONS AND ARPU SEK million, reported currency & organic growth Total subscription base in 000’, ARPU in local currency -0.2% -0.2% 3,400 20 Subscriptions ARPU 3,324 +1% +1% 19 3,087 3,300 18 -1.0% -1.0% 3,200 17 1,137 1,191 3,100 16 3,000 15 Q4 17 Q4 18 Q4 17 Q4 18 Q4 17 Q1 18 Q2 18 Q3 18 Q4 18 Service revenues EBITDA • Flat mobile revenue development in both B2C and B2B • Flat subscription base as growth in B2B from the acquisition of AinaCom was offset by loss in B2C • Neutral cost base development • AinaCom to be EBITDA accretive from 2019 • OPEX down despite higher marketing spend 18 = ARPU growth y-o-y = Organic growth * External service revenues ** Excluding adjustment items 9

Recommend

More recommend