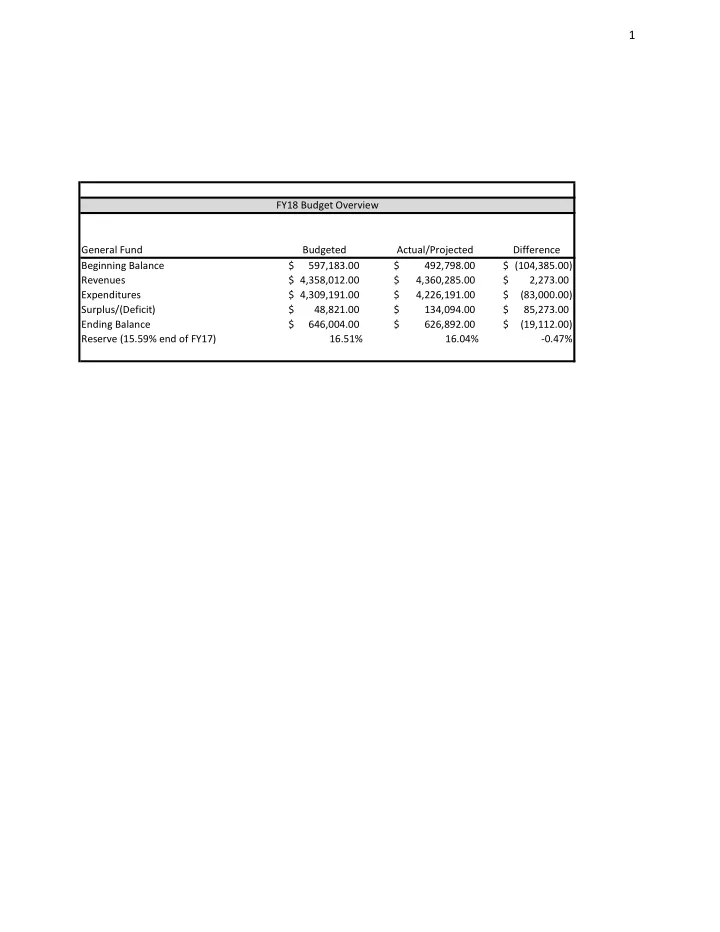

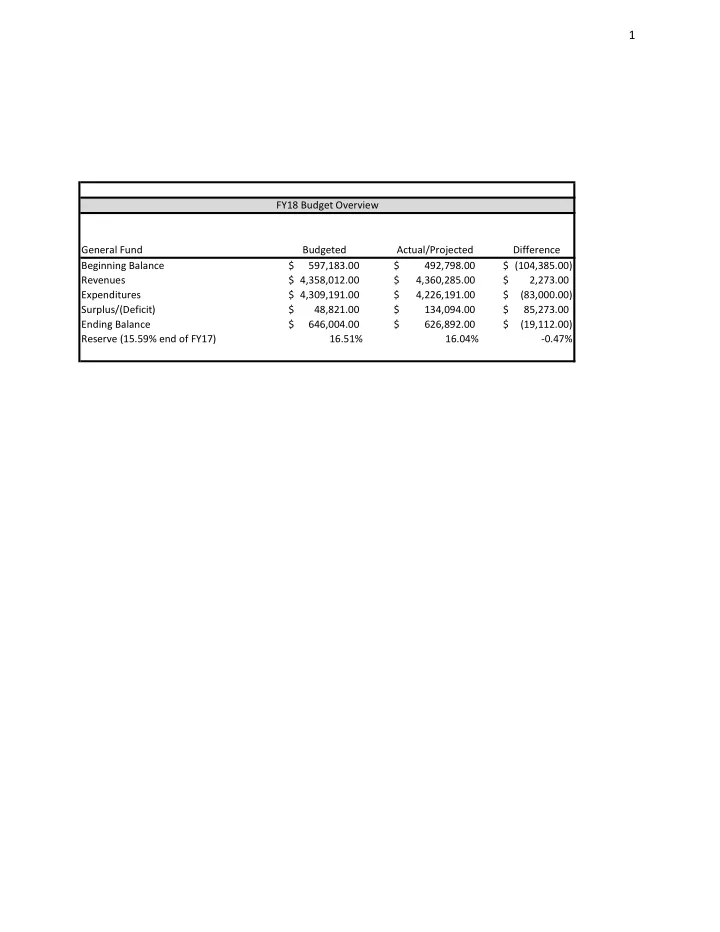

1 FY18 Budget Overview General Fund Budgeted Actual/Projected Difference Beginning Balance $ 597,183.00 $ 492,798.00 $ (104,385.00) Revenues $ 4,358,012.00 $ 4,360,285.00 $ 2,273.00 Expenditures $ 4,309,191.00 $ 4,226,191.00 $ (83,000.00) Surplus/(Deficit) $ 48,821.00 $ 134,094.00 $ 85,273.00 Ending Balance $ 646,004.00 $ 626,892.00 $ (19,112.00) Reserve (15.59% end of FY17) 16.51% 16.04% -0.47%

2 Determination of Tax Revenue and Mill Levy Limitations Section 15-10-420, MCA AGGREGATE OF ALL FUNDS /OR _______________ FUND FYE JUNE 30, 2019 - Preliminary Calculation ENTITY NAME_______________________________________________ Auto-Calculation (If completing manually Reference Enter amounts in enter amounts as Line yellow cells instructed) (1) Enter Ad valorem tax revenue ACTUALLY assessed in the prior year NEW- PLEASE READ INSTRUCTIONS BEFORE ENTERING. $ 2,204,888 $ 2,204,888 (2) Add: Current year inflation adjustment @ 0.82% $ 18,080 (3) Subtract: Ad valorem tax revenue ACTUALLY assessed in the prior year for Class 1 and 2 property, (net and gross proceeds) - (enter as negative) NEW- PLEASE READ INSTRUCTIONS BEFORE ENTERING. $ - $ - (4) Adjusted ad valorem tax revenue $ 2,222,968 = (1) + (2) + (3) ENTERING TAXABLE VALUES (5) Enter 'Total Taxable Value' - from Department of Revenue Certified Taxable Valuation $ 12,581,278 $ 12,581.278 Information form, line # 2 Subtract: 'Total Incremental Value' of all tax increment financing districts (TIF Districts) - from (6) Department of Revenue Certified Taxable Valuation Information form, line # 6 (enter as negative) $ (375,475) $ (375.475) (7) Taxable value per mill (after adjustment for removal of TIF per mill incremental district value) = (5) + (6) $ 12,205.803 Subtract: 'Total Value of Newly Taxable Property' - from Department of Revenue Certified (8) Taxable Valuation Information form, line # 3 (enter as negative) $ (380,348) $ (380.348) Subtract: 'Taxable Value of Net and Gross Proceeds, (Class 1 & 2 properties)' - from Department (9) of Revenue Certified Taxable Valuation Information form, line # 5 (enter as negative) $ - $ - (10) Adjusted Taxable value per mill = (7) + (8) + (9) $ 11,825.455 (11) CURRENT YEAR calculated mill levy 187.98 =(4) / (10) (12) CURRENT YEAR calculated ad valorem tax revenue $ 2,294,447 = (7) x (11) CURRENT YEAR AUTHORIZED LEVY/ASSESSMENT Enter total number of carry forward mills from prior year (13) FOR FY18 BUDGETS, PLEASE ENTER ONLY THE # OF MILLS LEFT BEHIND FROM FY17. NEW- PLEASE READ THE INSTRUCTIONS BEFORE ENTERING. 0.00 0.00 (14) Total current year authorized mill levy, including Prior Years' carry forward mills 187.98 =(11) + (13) (15) Total current year authorized ad valorem tax revenue assessment $ 2,294,447 =(7) x (14) CURRENT YEAR ACTUALLY LEVIED/ASSESSED Enter number of mills actually levied in current year (16) (Number should equal total non-voted mills, which includes the number of carry forward mills, actually imposed per the final approved current year budget document. Do Not include voted or 187.98 187.98 permissve mills imposed in the current year.) (17) Total ad valorem tax revenue actually assessed in current year $ 2,294,447 =(7) x (16) RECAPITULATION OF ACTUAL: (18) Ad valorem tax revenue actually assessed '=(10) x (16) $ 2,222,949 (19) Ad valorem tax revenue actually assessed for newly taxable property $ 71,498 (20) Ad valorem tax revenue actually assessed for Class 1 & 2 properties (net-gross proceeds) $ - (21) =(18) + (19) + (20) Total ad valorem tax revenue actually assessed in current year $ 2,294,447 (22) Total carry forward mills that may be levied in a subsequent year =(14) - (16) (Number should be equal to or greater than zero. A (negative) number indicates an over levy.) 0.00

3 CITY OF LIVINGSTON ANALYSIS OF CITY MILL VALUES & LEVIES FISCAL YEARS 2010 TO 2019 Fiscal Year MILL VALUES 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 Mill Value Including TIF's $ 10,514 $ 10,901 $ 11,037 $ 11,201 $ 11,564 $ 11,394 $ 10,916 $ 11,214 $ 12,254 $ 12,581 Percentage Increase 3.8% 3.7% 1.2% 1.5% 3.2% -1.47% -4.20% 2.73% 9.28% 2.67% Mill Value Excluding TIF's $ 10,149 $ 10,488 $ 10,577 $ 10,712 $ 11,030 $ 10,978 $ 10,562 $ 10,878 $ 11,886 $ 12,206 Percentage Increase 2.7% 3.3% 0.8% 1.3% 3.0% -0.5% -3.8% 2.99% 9.27% 2.69% MILL LEVIES SUBJECT TO LIMIT: GENERAL 118.79 111.14 109.87 114.21 141.24 141.12 153.01 157.24 145.20 143.48 COMP. LIAB INSURANCE 7.41 12.31 9.00 14.62 4.00 2.00 3.50 1.00 2.00 11.00 PERS 2.87 5.98 4.50 4.67 4.50 4.50 5.50 6.15 5.55 6.00 POLICE PENSION 8.08 8.00 10.70 8.29 7.25 7.25 6.75 8.55 7.90 9.50 FIRE PENSION 8.93 5.56 8.51 6.47 7.00 7.00 5.00 7.10 7.90 7.50 LIBRARY 9.23 9.23 9.23 7.00 7.00 7.00 7.00 7.00 7.00 5.50 LIBRARY CAPITAL FUNDING - - - 1.77 0.46 1.00 1.00 1.00 - - SANITARIAN 2.72 2.72 3.00 3.00 - - - - - - AMBULANCE 1.36 1.36 1.36 1.36 0.36 1.00 - - - - AGGREGATE HEALTH INS 11.88 13.59 9.93 15.80 11.00 11.00 10.00 9.00 9.95 5.00 TOTAL MILL LEVIES ______ ______ ______ ______ ______ ______ ______ ______ ______ ______ SUBJECT TO LIMIT 171.27 169.89 166.10 177.19 182.81 181.87 191.76 197.04 185.50 187.98 MILL LEVIES NOT SUBJECT TO MILL LEVY LIMIT PERMISSIVE HEALTH INSURANCE 18.42 21.55 23.07 23.51 21.54 23.58 29.29 31.02 31.76 31.85 VOTED MILL LEVIES: FIRE TRUCK GOB 2.43 2.46 2.46 - - - - - - - 2000 FIRE TRUCK 3.64 3.68 4.18 3.18 3.18 3.00 2.75 3.25 2.80 3.00 2016 FIRE TRUCK - - - - - - - 4.50 4.80 4.80 AMBULANCE 2.00 2.00 2.00 2.00 2.00 2.00 2.00 2.00 2.00 2.00 RR CROSSING 11.25 11.25 11.25 11.25 - - - - - - ______ ______ ______ ______ ______ ______ ______ ______ ______ ______ TOTAL VOTED LEVY 19.32 19.39 19.89 16.43 5.18 5.00 4.75 9.75 9.60 9.80 _______ _______ _______ _______ _______ _______ _______ _______ _______ _______ TOTAL MILLS 209.01 210.83 209.06 217.13 209.53 210.45 225.80 237.81 226.86 229.63 5.50% 0.87% -0.84% 3.86% -3.50% 0.44% 7.29% 5.32% -4.60% 1.22% Percentage increase in mill levy 1.2% Percentage increase in Property Taxes Levied 3.9% Maximum mill levy subject to limit 187.98 Recommended levy subject to limit 187.98 ________ Allowable Mills not Levied 0.00 Actual value of mill 12,581 _________ Allowable property taxes not levied $ -

4 CITY OF LIVINGSTON ANALYSIS OF CITY MILL VALUES & LEVIES FISCAL YEARS 2010 TO 2019 Fiscal Year MILL VALUES 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 Mill Value Including TIF's $ 10,514 $ 10,901 $ 11,037 $ 11,201 $ 11,564 $ 11,394 $ 10,916 $ 11,214 $ 12,254 $ 12,581 Percentage Increase 3.8% 3.7% 1.2% 1.5% 3.2% -1.47% -4.20% 2.73% 9.28% 2.67% Mill Value Excluding TIF's $ 10,149 $ 10,488 $ 10,577 $ 10,712 $ 11,030 $ 10,978 $ 10,562 $ 10,878 $ 11,886 $ 12,206 Percentage Increase 2.7% 3.3% 0.8% 1.3% 3.0% -0.5% -3.8% 2.99% 9.27% 2.69% MILL LEVIES SUBJECT TO LIMIT: GENERAL 1,205,600 1,165,636 1,162,095 1,223,418 1,557,864 1,549,215 1,616,123 1,710,386 1,725,899 1,751,317 COMP. LIAB INSURANCE 75,204 129,107 95,193 156,609 44,120 21,956 36,968 10,878 23,772 134,266 PERS 29,128 62,718 47,597 50,025 49,635 49,401 58,092 66,897 65,916 73,236 POLICE PENSION 82,004 83,904 113,174 88,802 79,967 79,591 71,295 93,003 93,899 115,957 FIRE PENSION 90,631 58,313 90,010 69,307 77,209 76,846 52,811 77,231 93,899 91,545 LIBRARY 93,675 96,804 97,626 74,984 77,209 76,846 73,935 76,143 83,202 67,133 LIBRARY CAPITAL FUNDING - - - 18,960 5,074 10,978 10,562 10,878 - - SANITARIAN 27,605 28,527 31,731 32,136 - - - - - - AMBULANCE 13,803 14,264 14,385 14,568 3,971 10,978 - - - - AGGREGATE HEALTH INS 120,570 142,532 105,030 169,250 121,329 120,758 105,622 97,898 118,266 61,030 TOTAL MILL LEVIES SUBJECT TO LIMIT 1,738,219 1,781,806 1,756,840 1,898,059 2,016,377 1,996,569 2,025,409 2,143,312 2,204,853 2,294,484 MILL LEVIES NOT SUBJECT TO MILL LEVY LIMIT PERMISSIVE HEALTH INSURANCE 186,945 226,016 244,011 251,839 237,584 258,861 309,367 337,422 389,197 400,714 VOTED MILL LEVIES: FIRE TRUCK GOB 24,662 25,800 26,019 - - - - - - - 2000 FIRE TRUCK 36,942 38,596 44,212 34,064 35,075 32,934 29,046 35,352 33,281 36,618 2016 FIRE TRUCK - - - - - - - 48,949 57,053 58,589 AMBULANCE 20,298 20,976 21,154 21,424 22,060 21,956 21,124 21,755 23,772 24,412 RR CROSSING 114,176 117,990 118,991 120,510 - - - - - - TOTAL VOTED LEVY 196,079 203,362 210,377 175,998 57,135 54,890 50,170 106,056 114,106 119,619 TOTAL MILLS 2,121,242 2,211,185 2,211,228 2,325,897 2,311,096 2,310,320 2,384,947 2,586,790 2,708,155 2,814,816

Recommend

More recommend