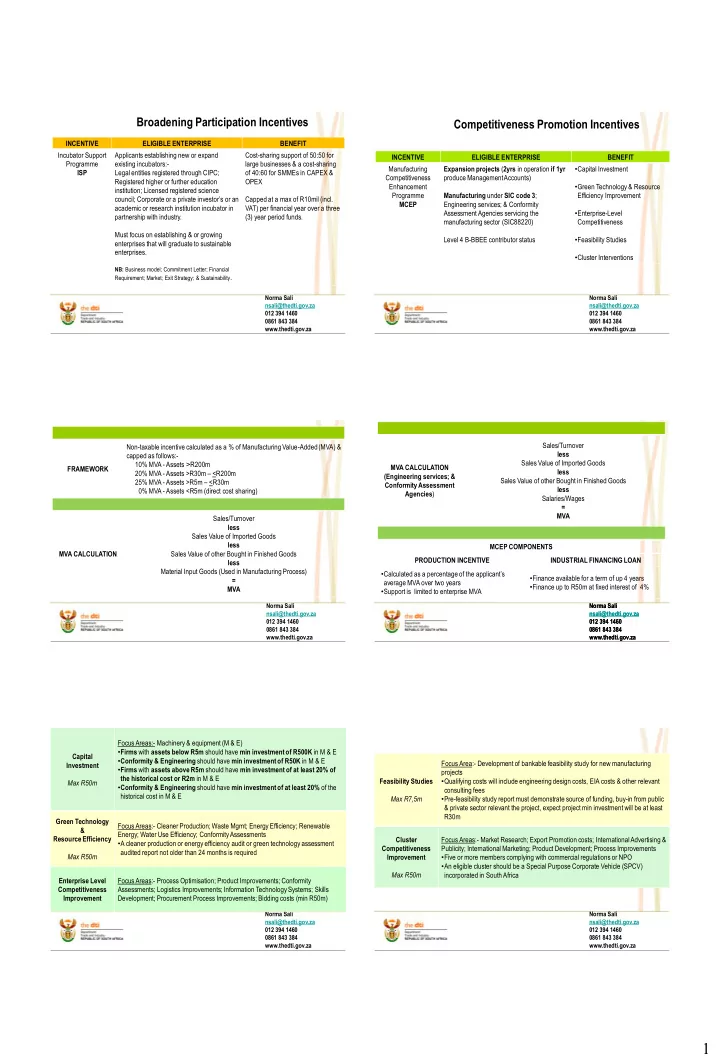

Broadening Participation Incentives Competitiveness Promotion Incentives INCENTIVE ELIGIBLE ENTERPRISE BENEFIT Incubator Support Applicants establishing new or expand Cost-sharing support of 50:50 for INCENTIVE ELIGIBLE ENTERPRISE BENEFIT Programme existing incubators:- large businesses & a cost-sharing Manufacturing Expansion projects ( 2yrs in operation if 1yr • Capital Investment ISP Legal entities registered through CIPC; of 40:60 for SMMEs in CAPEX & Competitiveness produce Management Accounts) Registered higher or further education OPEX Enhancement • Green Technology & Resource institution; Licensed registered science Programme Manufacturing under SIC code 3 ; Efficiency Improvement council; Corporate or a private investor’s or an Capped at a max of R10mil (incl. MCEP Engineering services; & Conformity academic or research institution incubator in VAT) per financial year over a three Assessment Agencies servicing the • Enterprise-Level partnership with industry. (3) year period funds. manufacturing sector (SIC88220) Competitiveness Must focus on establishing & or growing Level 4 B-BBEE contributor status • Feasibility Studies enterprises that will graduate to sustainable enterprises. • Cluster Interventions NB: Business model; Commitment Letter; Financial Requirement; Market; Exit Strategy; & Sustainability . Norma Sali Norma Sali nsali@thedti.gov.za nsali@thedti.gov.za 012 394 1460 012 394 1460 0861 843 384 0861 843 384 www.thedti.gov.za www.thedti.gov.za Sales/Turnover Non-taxable incentive calculated as a % of Manufacturing Value-Added (MVA) & less capped as follows:- Sales Value of Imported Goods 10% MVA - Assets ˃ R200m MVA CALCULATION FRAMEWORK less 20% MVA - Assets >R30m – <R200m (Engineering services; & Sales Value of other Bought in Finished Goods 25% MVA - Assets >R5m – <R30m Conformity Assessment less 0% MVA - Assets <R5m (direct cost sharing) Agencies ) Salaries/Wages = MVA Sales/Turnover less Sales Value of Imported Goods less MCEP COMPONENTS MVA CALCULATION Sales Value of other Bought in Finished Goods PRODUCTION INCENTIVE INDUSTRIAL FINANCING LOAN less Material Input Goods (Used in Manufacturing Process) • Calculated as a percentage of the applicant’s • Finance available for a term of up 4 years = average MVA over two years • Finance up to R50m at fixed interest of 4% MVA • Support is limited to enterprise MVA Norma Sali Norma Sali Norma Sali nsali@thedti.gov.za nsali@thedti.gov.za nsali@thedti.gov.za 012 394 1460 012 394 1460 012 394 1460 0861 843 384 0861 843 384 0861 843 384 www.thedti.gov.za www.thedti.gov.za www.thedti.gov.za Focus Areas:- Machinery & equipment (M & E) • Firms with assets below R5m should have min investment of R500K in M & E Capital • Conformity & Engineering should have min investment of R50K in M & E Focus Area:- Development of bankable feasibility study for new manufacturing Investment • Firms with assets above R5m should have min investment of at least 20% of projects the historical cost or R2m in M & E Feasibility Studies • Qualifying costs will include engineering design costs, EIA costs & other relevant Max R50m • Conformity & Engineering should have min investment of at least 20% of the consulting fees historical cost in M & E Max R7,5m • Pre-feasibility study report must demonstrate source of funding, buy-in from public & private sector relevant the project, expect project min investment will be at least R30m Green Technology Focus Areas:- Cleaner Production; Waste Mgmt; Energy Efficiency; Renewable & Energy; Water Use Efficiency; Conformity Assessments Resource Efficiency Cluster Focus Areas:- Market Research; Export Promotion costs; International Advertising & • A cleaner production or energy efficiency audit or green technology assessment Competitiveness Publicity; International Marketing; Product Development; Process Improvements audited report not older than 24 months is required Max R50m Improvement • Five or more members complying with commercial regulations or NPO • An eligible cluster should be a Special Purpose Corporate Vehicle (SPCV) Max R50m incorporated in South Africa Enterprise Level Focus Areas:- Process Optimisation; Product Improvements; Conformity Competitiveness Assessments; Logistics Improvements; Information Technology Systems; Skills Improvement Development; Procurement Process Improvements; Bidding costs (min R50m) Norma Sali Norma Sali nsali@thedti.gov.za nsali@thedti.gov.za 012 394 1460 012 394 1460 0861 843 384 0861 843 384 www.thedti.gov.za www.thedti.gov.za 1

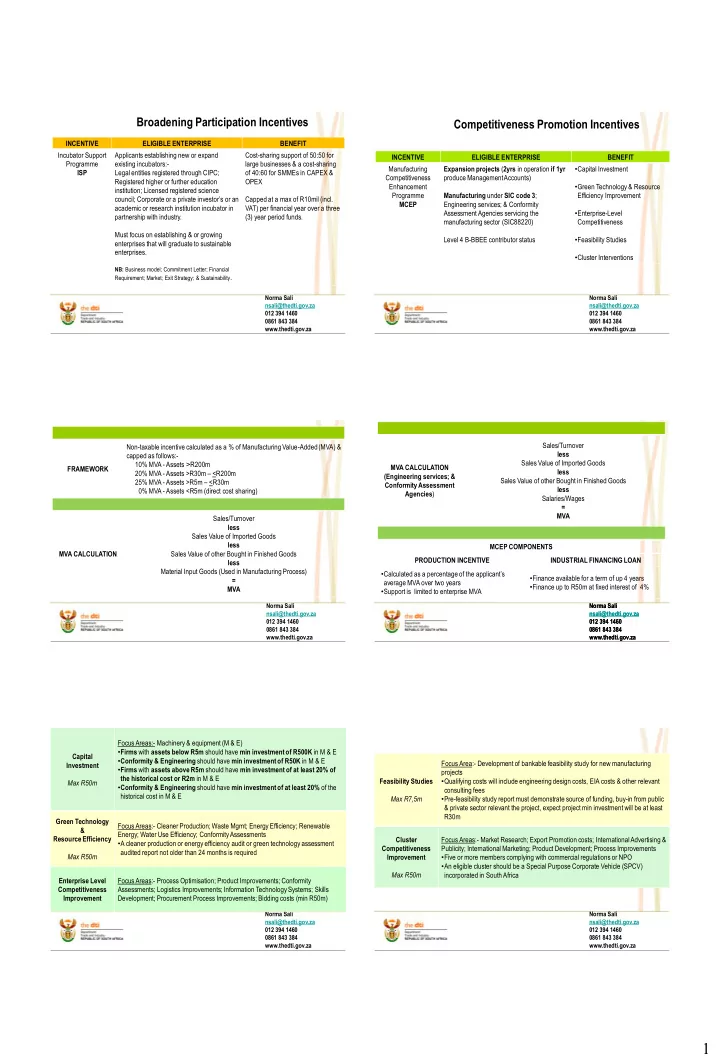

PRODUCTION INCENTIVE MAXIMUM ENTERPRISE COST 10% Competitiveness Promotion Incentives COMPONENTS SUPPORT ASSETS SHARING BONUS < R5m 50% N/A >R5m- <R30m 40% >10 Capital R50m >R30m-<R200m 30% >20 Investment IMPORTANT NOTICE ˃ R200m 30% >25 • Projects should complete online applications 60 calendar days prior to commencement date of < R5m 50% N/A operations Green Technology & >R5m- <R30m 40% >10 • Should the dti not respond within the 60 calendar days after submission of a complete online R50m >R30m-<R200m 30% >20 Resource Efficiency application, the applicant should notify the dti in writing of its intention to commission the ˃ R200m 30% >25 qualifying assets for commercial use or undertake implementation of business development activities before approval < R5m 70% Enterprise Level • The assets or activities will not be disqualified on the basis of having been in commercial use or being >R5m- <R200m 60% Competitiveness Improvement N/A N/A undertaken before approval >R200m 50% • An automotives manufacturer with less than 25% of its base-year turnover earned as part of motor < R30m 70% manufacturers’ vehicle (light, medium or heavy) supply chain (including after -market supply) locally & or Feasibility Studies R7.5m N/A >R30m->R200m 50% internationally may be considered for eligibility under MCEP Cluster Competitiveness R50m N/A 80% N/A Improvement Norma Sali Norma Sali nsali@thedti.gov.za nsali@thedti.gov.za 012 394 1460 012 394 1460 0861 843 384 0861 843 384 www.thedti.gov.za www.thedti.gov.za Manufacturing Incentives Manufacturing Incentives Section 12i Tax Allowance The allowance is deductible from taxable income in the same way as • Innovation (Max 1 points) 12i depreciation & other expenses. • Improved Energy Efficiency (Cleaner Production Technology) (Max 2 points) It reduces the amount of taxable income & eventually the amount of tax payable. • Business Linkages (Max 1) SCORING • SMME Procurement (Max 1) The level of allowance is determined by a point scoring system:- • Direct Employment Creation (Max 2) A minimum of 5 points out of 10 must be scored. • Skills Development (Training of Employees) (Max 2) To achieve Qualifying Status : 5, 6 or 7 out of 10 must be scored To achieve Preferred Status : 8, 9 or 10 out of 10 must be scored • Located in an Industrial Development Zone (IDZ) (Max 1 point) Norma Sali Norma Sali nsali@thedti.gov.za nsali@thedti.gov.za 012 394 1460 012 394 1460 0861 843 384 0861 843 384 www.thedti.gov.za www.thedti.gov.za Manufacturing Incentives Investment Allowance Calculation INCENTIVE ELIGIBLE ENTERPRISE BENEFIT INCENTIVE INVESTMENT ALLOWANCE CALCULATION Section 12i Tax New project investing R1.7bn in Qualifying Assets Section 12i Tax Greenfield project (R50mil qualifying Greenfield project Allowance assets: building, plant & machinery) Preferred Status Allowance Preferred status achieved (8, 9 or 10 points out of 10) 12i 12i 55% Max R900mil Brownfield project (R30mil qualifying Qualifying Status • Formula: Lesser of 55% of QA or a maximum of R900m assets: building, plant & machinery) 35% Max R550mil • Calculation: Lesser of 55% x R1.7bn = R935m or maximum of R900m Skill development, 2% of wage bill Brownfield project • Final Investment Allowance applicable = R900m Preferred Status The allowance of R900m equates to a tax saving of R900m x 28% 55% Max R550mil = R252k (28% is the prevailing companies’ tax rate). Qualifying Status 35% Max R350mil The full allowance will be deductible in the year of assessment (but within the The lesser of actual total own training 4 year limit) when at least 50% of the manufacturing assets are brought into costs or R36 000 per employee use. Norma Sali Norma Sali nsali@thedti.gov.za nsali@thedti.gov.za 012 394 1460 0123945323/5833 0861 843 384 0861 843 384 www.thedti.gov.za www.thedti.gov.za 2

Training Allowance Calculation INCENTIVE TRAINING ALLOWANCE CALCULATION Section 12i Tax Calculation based on the lesser of the actual expenditure on training or the Allowance average number of Employees x R36k 12i • Average number of Employees: 100 • Maximum allowance per Employee over 6 years: R36k •Actual training costs: R3m •Calculated Training Allowance: 100 x R36k = R3,6m •Final Training Allowance applicable: R3m Norma Sali nsali@thedti.gov.za 0123945323/5833 0861 843 384 www.thedti.gov.za 3

Recommend

More recommend